Real Estate Escrow Agreement Form

What is real estate escrow agreement form?

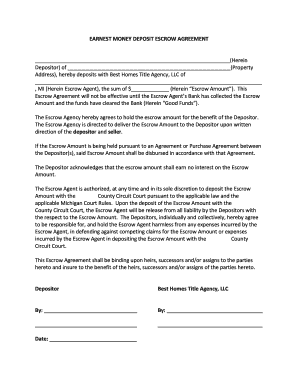

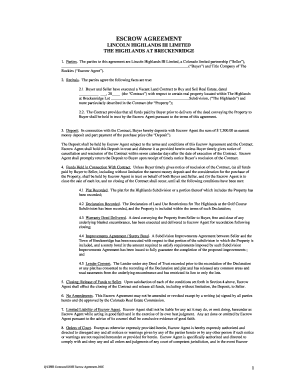

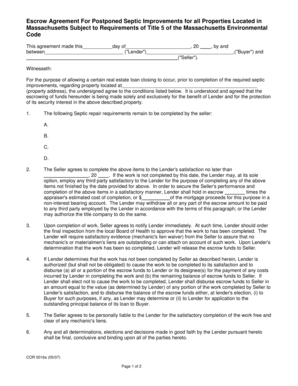

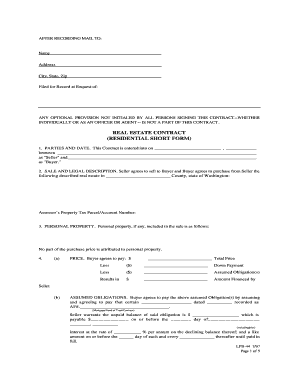

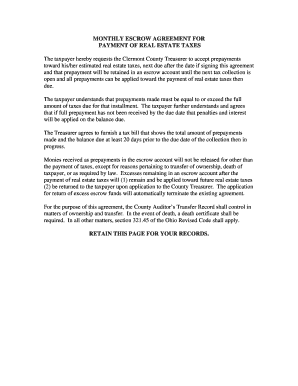

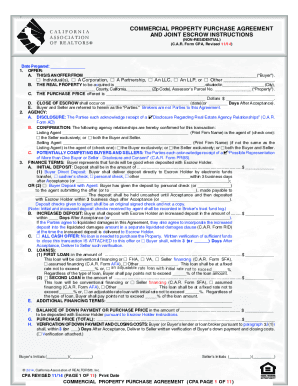

A real estate escrow agreement form is a legal document that outlines the terms and conditions of an escrow agreement for a real estate transaction. It serves as a binding agreement between the buyer, seller, and escrow agent, ensuring that all parties fulfill their obligations in the transaction. The escrow agreement form protects the interests of both the buyer and seller, ensuring a smooth and secure transaction.

What are the types of real estate escrow agreement form?

There are several types of real estate escrow agreement forms, depending on the nature of the transaction and the parties involved. The most common types include: 1. Purchase and Sale Agreement Escrow: Used when buying or selling a property. 2. Lease Agreement Escrow: Used when leasing or renting a property. 3. Mortgage Escrow: Used when obtaining financing for a real estate transaction. 4. Construction Escrow: Used to hold funds for construction projects. Each type of escrow agreement form serves a specific purpose and contains unique terms and conditions tailored to the nature of the transaction.

How to complete real estate escrow agreement form

Completing a real estate escrow agreement form can be a straightforward process if you follow these steps: 1. Obtain the form: You can find real estate escrow agreement forms online or through a real estate attorney. 2. Read the instructions: Familiarize yourself with the form's instructions and requirements. 3. Fill in the details: Provide accurate information about the buyer, seller, property, and escrow agent. 4. Include relevant terms: Specify the terms of the escrow agreement, including the deposit amount, deadlines, and contingencies. 5. Review and sign: Carefully review the completed form, ensuring all parties sign and date it. 6. Distribute copies: Provide copies of the signed agreement to all parties involved in the transaction.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.