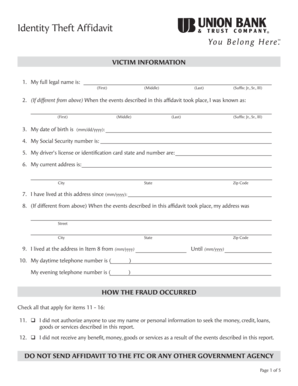

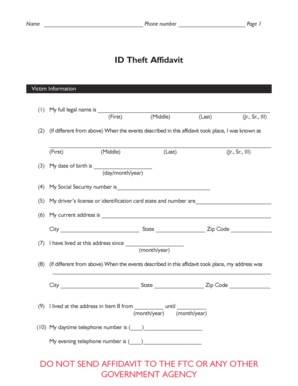

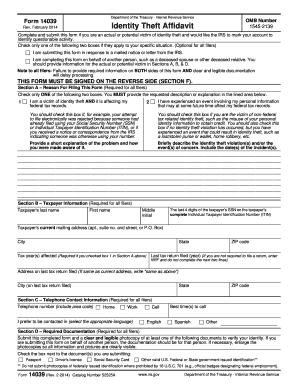

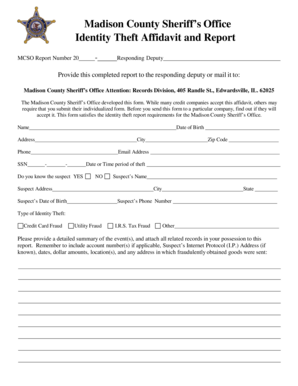

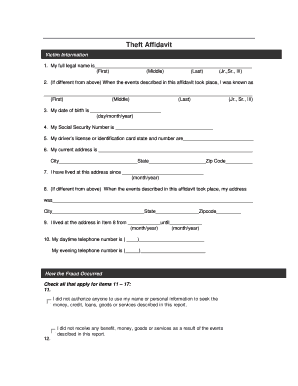

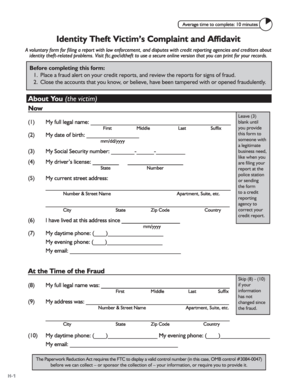

Identity Theft Affidavit

What is Identity Theft Affidavit?

Identity Theft Affidavit is a formal document used to report identity theft to the authorities and provide necessary information to assist in the investigation of fraudulent activities. It helps victims of identity theft to establish their innocence and restore their credit.

What are the types of Identity Theft Affidavit?

There are two main types of Identity Theft Affidavit: the IRS Identity Theft Affidavit and the Federal Trade Commission (FTC) Identity Theft Affidavit.

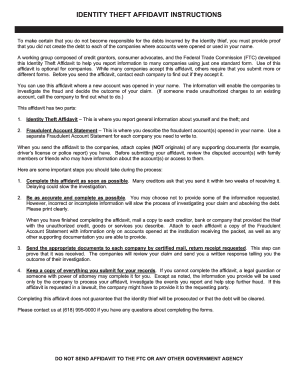

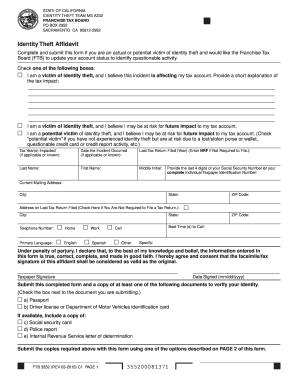

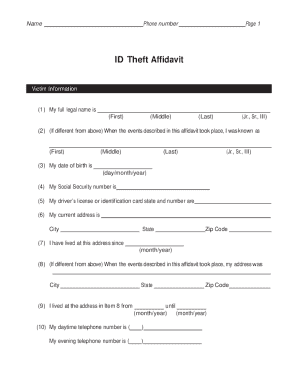

How to complete Identity Theft Affidavit?

Completing an Identity Theft Affidavit requires gathering all relevant information related to the identity theft incident and filling out the form accurately. Here are the steps to complete an Identity Theft Affidavit:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.