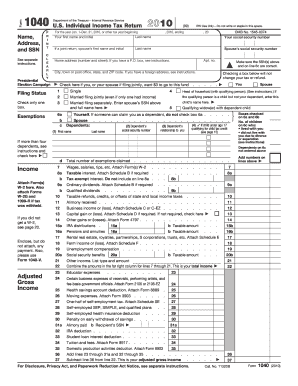

1040 Form

What is 1040 Form?

The 1040 Form, also known as the U.S. Individual Income Tax Return, is the standard form used by taxpayers to file their annual income tax returns with the Internal Revenue Service (IRS). It is a crucial document for reporting and calculating the amount of federal income tax owed by an individual or a married couple who file jointly.

What are the types of 1040 Form?

There are several types of 1040 Forms depending on the taxpayer's specific situation: 1. 1040: This is the most common form used by taxpayers with straightforward tax situations. 2. 1040A: This form is for taxpayers who do not itemize deductions and have a taxable income under $100,000. 3. 1040EZ: This is the simplest form, designed for taxpayers with no dependents, no itemized deductions, and a taxable income under $100,000. These different forms cater to different tax scenarios and allow individuals to accurately report their income and claim any applicable deductions and credits.

How to complete 1040 Form

Completing the 1040 Form may seem daunting, but with the right guidance, it can be done easily. Follow these steps to complete your 1040 Form:

By following these steps, you can confidently complete your 1040 Form and fulfill your tax obligations. Remember to review your completed form for accuracy before submission. If you encounter any difficulties or need further assistance, pdfFiller is here to help. With its user-friendly interface and powerful editing tools, pdfFiller empowers users to easily create, edit, and share documents online, including the 1040 Form. Take advantage of its unlimited fillable templates and simplify your tax preparation process.