Payroll Tax Withholding Calculator

What is a payroll tax withholding calculator?

A payroll tax withholding calculator is a tool used to calculate the amount of taxes that should be withheld from an employee's paycheck. It takes into account factors such as the employee's filing status, number of dependents, and income level to determine the correct amount of tax withholdings.

What are the types of payroll tax withholding calculators?

There are several types of payroll tax withholding calculators available. Some common types include:

Federal payroll tax withholding calculator

State payroll tax withholding calculator

Social Security and Medicare tax withholding calculator

How to complete a payroll tax withholding calculator

Completing a payroll tax withholding calculator is a straightforward process. Here are the steps to follow:

01

Gather the necessary information. This includes the employee's filing status, number of dependents, and income.

02

Input the information into the payroll tax withholding calculator.

03

Review the results to ensure accuracy.

04

Make any necessary adjustments to the employee's tax withholdings.

05

Update the employee's payroll records with the new tax withholding information.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out payroll tax withholding calculator

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I calculate withholding in Excel?

Calculate income tax with SUMPRODUCT function in Excel In the tax table, right click the first data row and select Insert from the context menu to add a blank row. Select the cell you will place the calculated result at, enter the formula =SUMPRODUCT(C6:C12-C5:C11,C1-A6:A12,N(C1>A6:A12)), and press the Enter key.

How do I manually calculate payroll taxes?

Determine the employee's gross pay. Multiply the number of withholding allowances the employee has claimed on his W4 form by the amount of one allowance for his filing status and the length of the pay period. Calculate federal income tax to be withheld. Figure any state or local income tax to be withheld.

How do you calculate payroll manually?

Your manual payroll calculations are based on the pay frequency and their hourly wage. So, for someone who is full time making $11 an hour on a biweekly pay schedule, the calculation would look like this: 40 hours x 2 weeks = 80 hours x $11/hour = $880 (gross regular pay).

How do I calculate payroll taxes for a budget?

Let's say you have an employee who earns $2,000 biweekly: $2,000 X 6.2% = $124. The employer cost of payroll tax is $124. $1,000 X 6.2% = $62. $250,000 X 1.45% = $3,625. $50,000 X 0.9% = $450. $3,625 + $450 = $4,075. $1,000 X 1.45% = $14.50. $100,000 X 12.4% = $12,400. $100,000 X 2.9% = $2,900.

How do I manually pay payroll taxes?

How do you do manual payroll? To do payroll manually, you need to calculate each of your employees' gross pay for the pay period, and then determine the dollar amount of all taxes/benefits that must be deducted. Once you have done this, you can find their net pay and pay them via check or direct deposit.

How do I calculate payroll taxes?

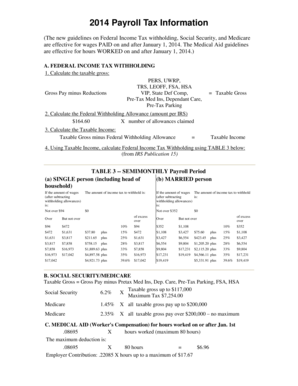

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Combined, the FICA tax rate is 15.3% of the employee's wages.

Related templates