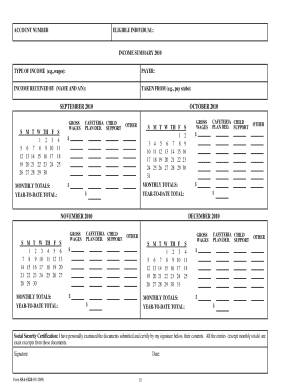

What is Payslip?

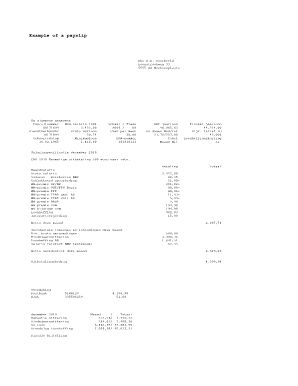

A payslip is a document that employees receive from their employers, usually on a monthly basis. It provides a breakdown of their salary, including any deductions and taxes. The payslip also includes important information such as the employee's name, employee number, and the pay period covered. It is an essential document for both employers and employees to keep track of earnings and ensure accurate payment.

What are the types of Payslip?

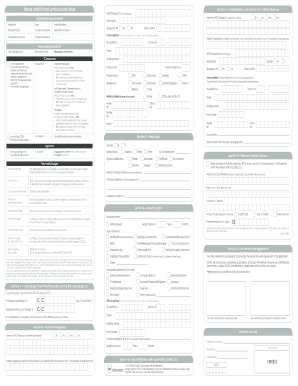

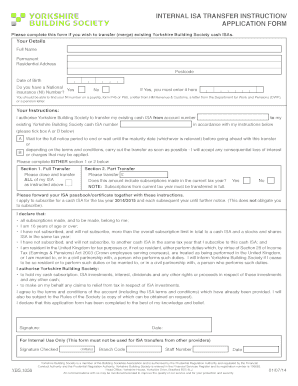

There are various types of payslips that employers may use depending on their preferences and the country's regulations. Some common types of payslips include:

Traditional Paper Payslip: This is a printed payslip that is physically handed out to employees.

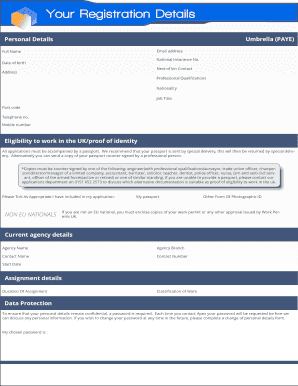

Digital Payslip: With the advancement in technology, many employers now provide payslips in digital format, which can be accessed online through a secure portal.

Emailed Payslip: Some employers choose to email the payslip directly to the employee's designated email address.

Self-Service Payslip: This type of payslip allows employees to access and download their payslip themselves through an online self-service platform.

Mobile App Payslip: Some companies have mobile apps that employees can use to view and manage their payslips on their smartphones.

How to complete Payslip

Completing a payslip accurately is crucial for ensuring that employees are paid correctly and that all necessary information is recorded. Here's a step-by-step guide on how to complete a payslip:

01

Enter the employee's name and employee number.

02

Specify the pay period covered by the payslip.

03

Record the employee's basic salary before any deductions or taxes.

04

Deduct any applicable taxes, such as income tax, national insurance, or social security contributions.

05

Subtract any other deductions, such as pension contributions or healthcare premiums.

06

Calculate the employee's net pay by subtracting the total deductions from the basic salary.

07

Include any additional information required by local regulations or company policies.

08

Review the payslip for accuracy, ensuring all figures are correct and all necessary information is included.

09

Provide the completed payslip to the employee in their preferred format, whether it's a printed copy, digital copy, or through an online self-service platform.

Empowering users to create, edit, and share documents online, pdfFiller offers unlimited fillable templates and powerful editing tools. With pdfFiller, users have everything they need to efficiently manage their documents, including payslips. Whether you prefer traditional paper payslips or digital options, pdfFiller has it all.