Business Loan Application Form Sample Pdf

What is Business loan application form sample pdf?

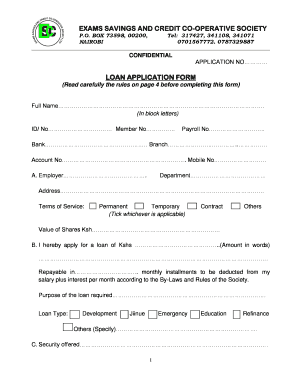

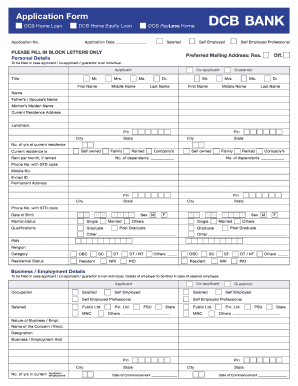

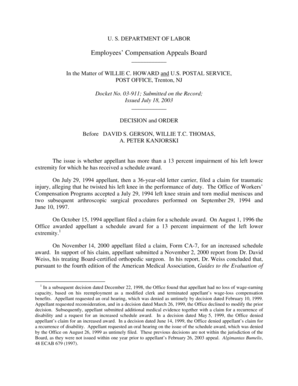

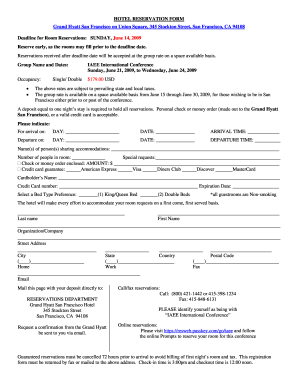

A Business loan application form sample PDF is a document that business owners or individuals seeking a loan fill out to apply for a business loan. This form collects important information about the applicant, the business, and the requested loan amount.

What are the types of Business loan application form sample pdf?

There are several types of Business loan application form sample PDFs, including:

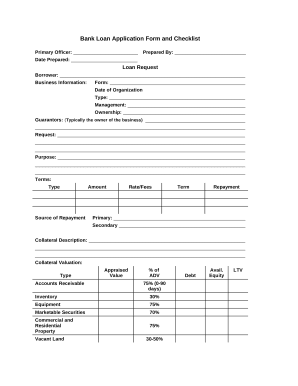

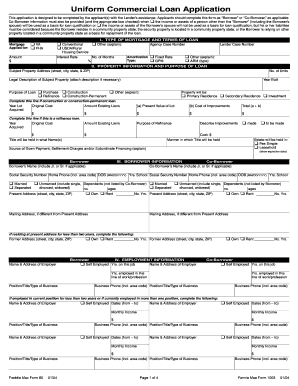

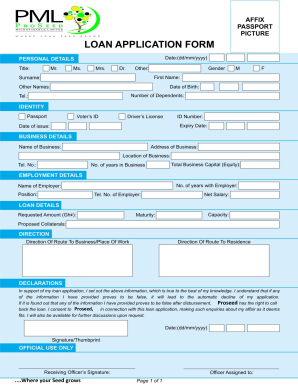

Basic Business loan application form sample PDF

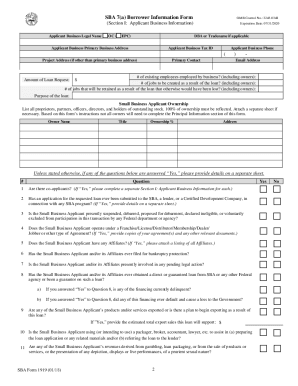

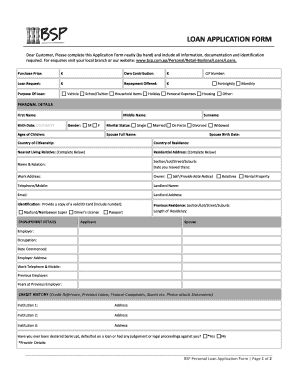

Detailed Business loan application form sample PDF

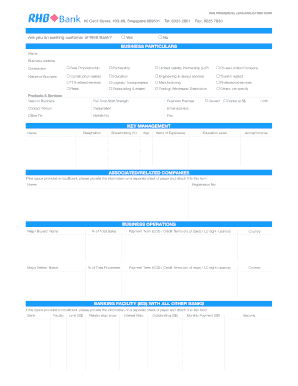

Online Business loan application form sample PDF

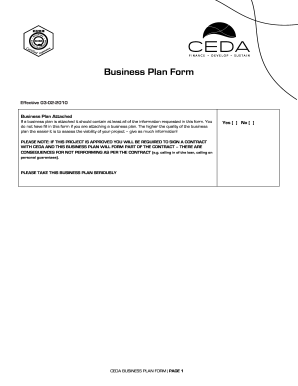

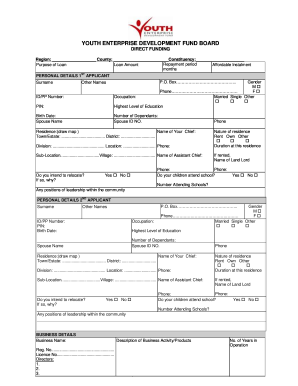

How to complete Business loan application form sample pdf

Completing a Business loan application form sample PDF is a crucial step in applying for a loan. Here are some tips to help you complete the form accurately:

01

Fill in all required fields with accurate information about yourself and your business.

02

Double-check all information before submitting the form to ensure accuracy.

03

Attach any necessary documents requested by the lender to support your application.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Business loan application form sample pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How to write a loan application form?

Include the following information: Your name. Your address. Your business name. Your business address. Name of loan agent or lender. Contact information of lender or loan agent. Subject line with the requested loan amount.

How do you write a loan approval letter?

How to write this approval letter: Inform the reader that the loan has been approved. Discuss repayment terms. Offer assistance or a friendly comment, if you wish.

How do you write a loan format?

What should a Loan Agreement cover? The relevant personal details of the parties such as full name, residential addresses and ages of the parties to the agreement, Reasons for the loan, Amount paid and the method of payment, Duration or the term of the loan, Security that is required to be given (if applicable),

What do I need to say when applying for a small business loan?

A small business loan request letter is a letter to a bank that supports your business loan application. It should include the amount of money you want to borrow and explain why you merit the loan, how you expect to use the loan, and how you plan to pay the bank back.

How to write a letter to a bank requesting a loan to start a business?

How to Write a Bank Loan Request Letter Start your bank loan request by briefly explaining what your business does. Include essential business information. Specify how much money you would like to borrow and what type of loan you are seeking. Explain how you will use the loan proceeds to attain specific business goals.

How to write a loan proposal for small business?

You need to clearly itemize why you need business financing, what amount you're requesting (both current and prospective for the next five years), and what you will use the amounts for. Tip: Describe how funding will contribute to the overall success of your company (and its strategic plan).