How to fill out taxforms online

pdfFiller allows you to complete digital tax forms and file them directly with the IRS in minutes.

Check out the step-by-step guide below to learn how pdfFiller makes completing and filing tax paperwork hassle-free.

Get started

This page is for informative purposes only and does not constitute tax or legal advice

pdfFiller benefits for tax reporting

Completing tax forms can be stressful and time-consuming. But it doesn’t have to be. With pdfFiller,

taxpayers and accountants save time by filling out forms online, e-signing, and submitting them to the IRS in one click.

Fillable forms

The pdfFiller library features every of tax form under one roof, so you don’t have to search elsewhere.

Easy form completion

Select your tax form and start entering information into fillable fields straight away.

You can even complete forms on the go from a mobile device.

Improved accuracy

Unlike handwriting, typing data into neatly organized fields allows you to avoid

errors and make timely corrections.

Time efficiency

Forget about retyping data again and again. Just create a reusable template that already contains

the information you need.

Simple e-signing

Add your own e-signature to tax forms, or send documents to colleagues for signing.

You will be notified once everything is signed.

Instant e-filing

No need to print, scan, or mail tax reports the old way. Submit your W-2, 1099-MISC/NEC, and 941

forms directly to the IRS in one click.

Online notary

Avoid in-person notary visits. With pdfFiller, you can notarize documents online without leaving

your home or office.

Enhanced document management

Collaborate on tax documents with your colleagues, host fillable forms on your website, and complete

forms in bulk for multiple employees at once.

Secure storage

Keep your tax records safe and organized in the cloud so that you can access them anytime and anywhere

A step-by-step guide to filling out tax forms online

01

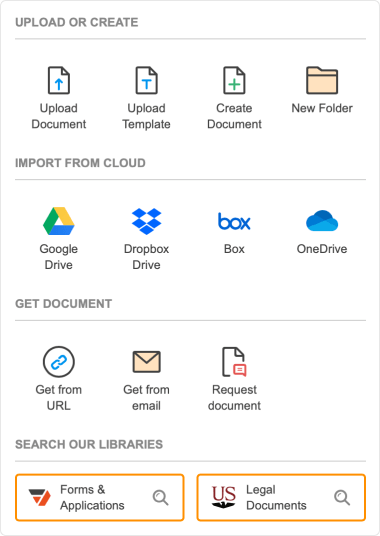

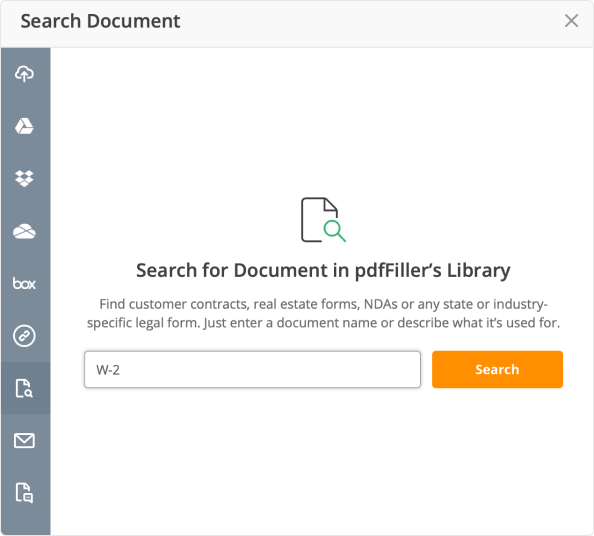

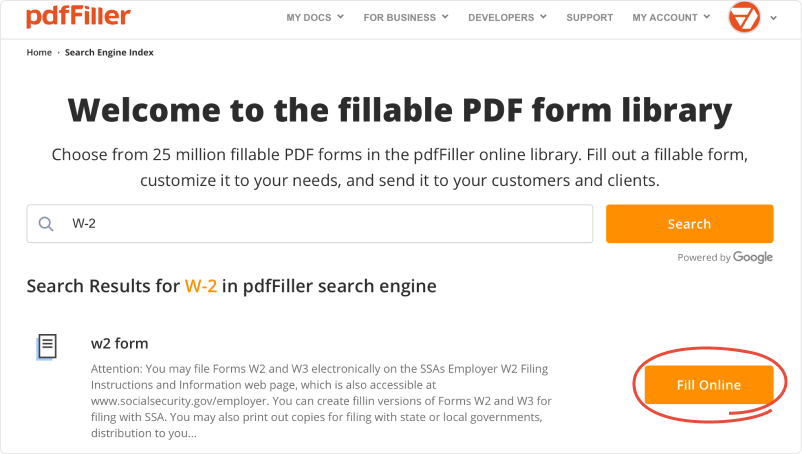

Find the tax form you need in the pdfFiller online library. Hover over the Add new button and then click Forms and Applications.

Enter the name of a form in the search bar and click Search.

Select the form you need from the search results and click Fill Online.

02

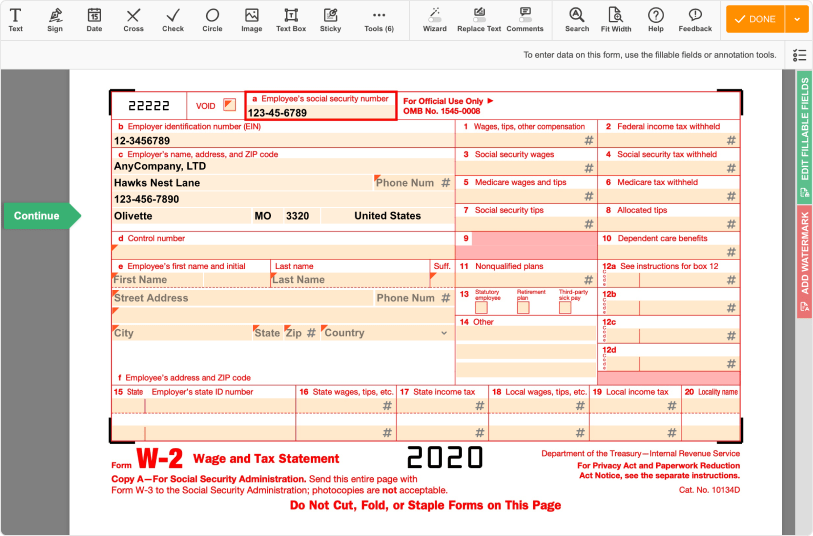

Add information to the fillable fields by following the wizard’s tips. The data you enter will automatically populate similar fields in all the document copies found below copy A. When finished, click Done.

03

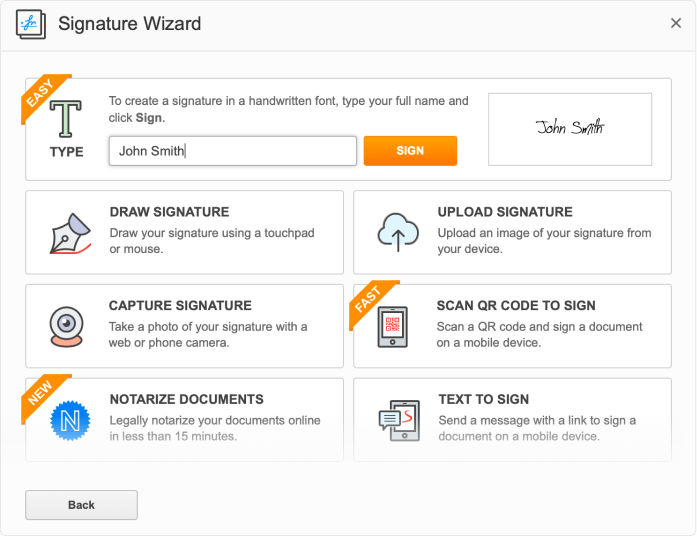

Some tax forms require signing. To e-sign a form, click on a signature field. Then, create your personal e-signature. You can simply type your name, draw your signature, upload it as an image, or capture a handwritten signature with your web or phone camera.

04

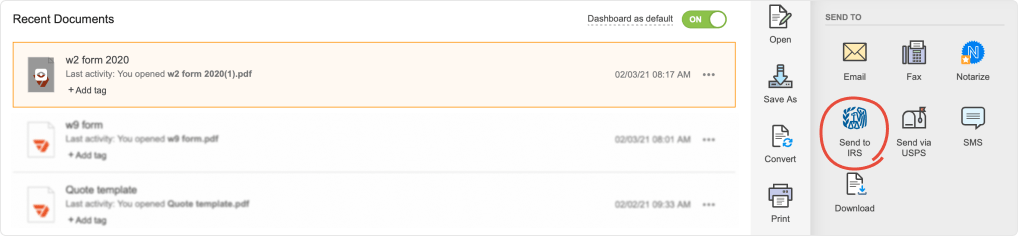

File your form directly with the IRS by clicking the Send to IRS button in the right-hand sidebar.

05

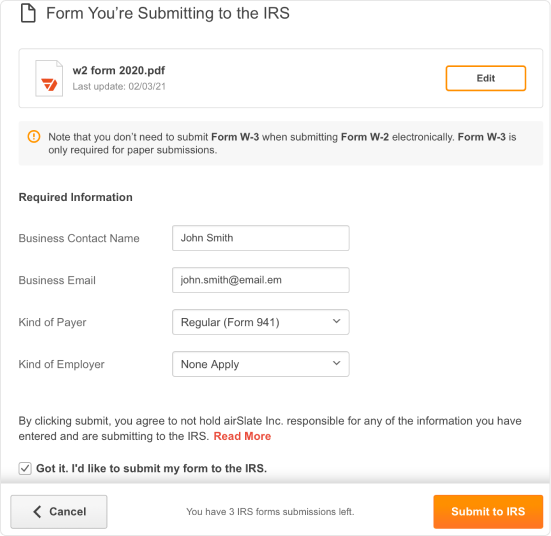

Enter your name and email address, then specify what kind of payer/employer you are by using the dropdowns. Finally, check the Got it box and click Submit to IRS. Once your form is submitted and approved, you’ll get a notification via email.

Please note: You can only directly e-file forms W-2, 1099-MISC/NEC , and 941. For other tax forms, you’ll need to send

their printed versions to the IRS by mail. However, you can use other tax forms in pdfFiller for your

internal records and for providing information to local governments, employees, etc.

Streamline your tax reporting workflow with pdfFiller’s add-value features

Save time with templates

Convert your filled out tax forms into reusable templates so that you don’t have to retype information again and again.

Fill out forms faster

Pre-fill up to 1,000 tax forms at a time by adding information from your database or CRM to a table.

Send documents for signing

Email tax forms for e-signing to your colleagues or employees and get notified once the job is done.

Share documents in seconds

Enable your colleagues or employees to easily access and complete fillable tax forms via shareable links or QR-codes.

Welcome to the pdfFiller forms catalog

Browse Versions and Schedules for All Relevant Forms

IRS Forms with Versions and Schedules

Edit professional templates, download them in any text format or send via pdfFiller’s advanced sharing tools. See also Top Forms by user votes.

1099-MISC form

Miscellaneous Income

W2 form

Wage and Tax Statement is used to report wages paid to employees and the taxes withheld from them

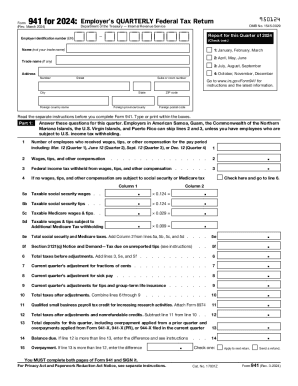

941 form

Don't use Form 941-V to make federal tax deposits. Use Form 941-V when making any payment with...

How to fill out other forms

Find the form you need, fill it out, and sign faster than ever before.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.