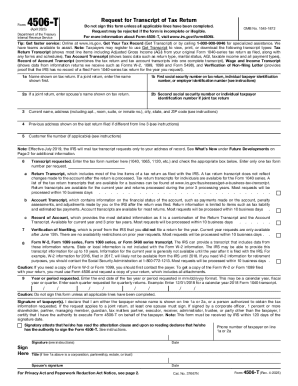

IRS 4506-T 2013 free printable template

Instructions and Help about IRS 4506-T

How to edit IRS 4506-T

How to fill out IRS 4506-T

About IRS 4506-T 2013 previous version

What is IRS 4506-T?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 4506-T

What should I do if I realize there is an error on my submitted irs form 4506 t?

If you discover an error after filing your irs form 4506 t, you can submit a corrected version. Ensure that any amendments are clearly marked and provide a brief explanation of the correction in the remarks section. It's also advisable to keep a copy for your records when submitting the corrected form.

How can I verify whether my irs form 4506 t has been received and is being processed?

To check the status of your irs form 4506 t, you can contact the IRS directly or use their online tools designed for tracking form submissions. Keep in mind that processing may take some time, so allow adequate time before inquiring. Having your submission details on hand will help expedite the process.

What considerations should I keep in mind regarding data privacy when filing the irs form 4506 t?

When submitting your irs form 4506 t, it's essential to consider data privacy. Ensure that you are using secure methods of submission, such as e-filing through IRS-approved systems. Remember to be cautious of sharing sensitive personal information and keep records of your submissions safely stored.

Can an authorized representative file an irs form 4506 t on my behalf?

Yes, an authorized representative can file an irs form 4506 t on your behalf, provided they have a power of attorney (POA) document that grants them such authority. Ensure that the POA is properly completed and submitted along with the form to avoid any processing issues.

What common mistakes should I avoid when filing my irs form 4506 t?

One common mistake when filing the irs form 4506 t is providing incorrect personal information such as your Social Security number or filing status. Verify all entries for accuracy, and double-check that you've included all necessary signatures to prevent delays in processing.

See what our users say