IRS 433-D 2015 free printable template

Show details

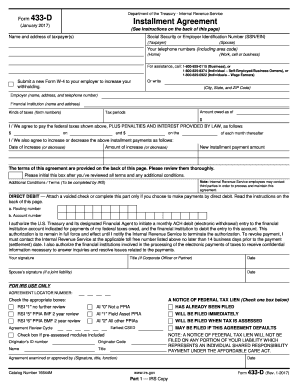

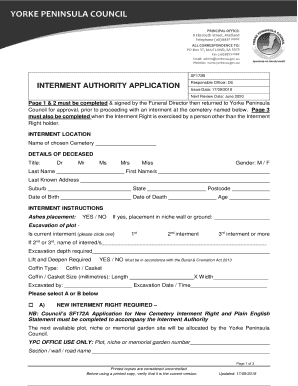

Form Department of the Treasury - Internal Revenue Service 433-D Installment Agreement Rev. January 2015 See Instructions on the back of this page Name and address of taxpayer s Social Security or Employer Identification Number SSN/EIN Taxpayer Spouse Your telephone numbers including area code Home Work cell or business For assistance call 1-800-829-0115 Business or 1-800-829-8374 Individual Self-Employed/Business Owners or 1-800-829-0922 Individuals Wage Earners Or write Submit a new Form W-4...to your employer to increase your withholding. Originator Code Name Title Agreement examined or approved by Signature title function Catalog Number 16644M MAY BE FILED IF THIS AGREEMENT DEFAULTS www.irs.gov Part 1 IRS Copy Form 433-D Rev. 1-2015 Part 2 Taxpayer s Copy INSTRUCTIONS TO TAXPAYER If not already completed by an IRS employee please fill in the information in the spaces provided on the front of this form for Your name include spouse s name if a joint return and current address Your...social security number and/or employer identification number whichever applies to your tax liability Your home and work cell or business telephone numbers The complete name address and phone number of your employer and your financial institution The amount you can pay now as a partial payment The date you prefer to make this payment This must be the same day for each month from the 1st to the 28th. City State and ZIP Code Employer Name address and telephone number Financial Institution Name and...address Amount owed as of Tax periods Kinds of taxes Form numbers I / We agree to pay the federal taxes shown above PLUS PENALTIES AND INTEREST PROVIDED BY LAW as follows on and on the of each month thereafter I / We also agree to increase or decrease the above installment payments as follows Date of increase or decrease Amount of increase or decrease New installment payment amount The terms of this agreement are provided on the back of this page. Please review them thoroughly. Please initial...this box after you ve reviewed all terms and any additional conditions. Note Internal Revenue Service employees may contact third parties in order to process and maintain this agreement. Additional Conditions / Terms To be completed by IRS DIRECT DEBIT Attach a voided check or complete this part only if you choose to make payments by direct debit. Read the instructions on the back of this page. a* Routing number b. Account number I authorize the U*S* Treasury and its designated Financial Agent...to initiate a monthly ACH debit electronic withdrawal entry to the financial institution account indicated for payments of my federal taxes owed and the financial institution to debit the entry to this account. This authorization is to remain in full force and effect until I notify the Internal Revenue Service to terminate the authorization* To revoke payment I must contact the Internal Revenue Service at the applicable toll free number listed above no later than 14 business days prior to the...payment settlement date.

pdfFiller is not affiliated with IRS

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Very easy to use!

EASY TO USE

Very easy to use without restriction.Thank you

See what our users say