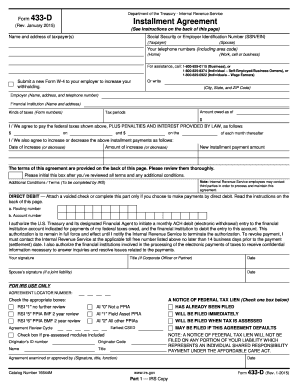

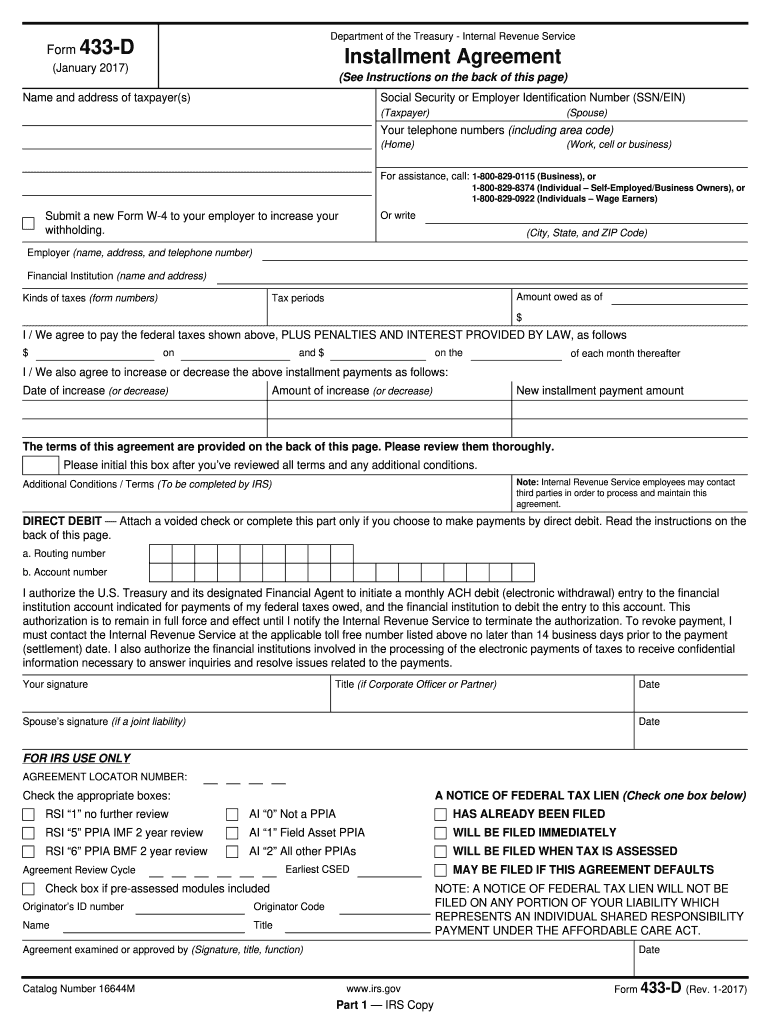

IRS 433-D 2017 free printable template

Instructions and Help about IRS 433-D

How to edit IRS 433-D

How to fill out IRS 433-D

About IRS 433-D 2017 previous version

What is IRS 433-D?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 433-D

What should I do if I realize I've made a mistake after submitting the 433 d 2017 form?

If you discover an error after submitting your 433 d 2017 form, you should file an amended return. This involves completing a new form indicating the corrections along with a brief explanation of the changes. Ensure that you clearly mark the submission as an amendment to avoid any confusion during processing.

How can I track the status of my 433 d 2017 form once it's submitted?

To check the status of your submitted 433 d 2017 form, you can use the online tracking tool provided by the filing agency or contact their customer service. Keep your submission details handy, such as the date of filing and the method used, to facilitate the tracking process.

Are there any special considerations for nonresidents when filing the 433 d 2017 form?

Yes, nonresidents have unique filing rules for the 433 d 2017 form. They must ensure they comply with applicable international tax treaties and reporting requirements, which may differ based on their residency status and type of income received. It's advisable for nonresidents to consult a tax professional for tailored guidance.

What common errors should I be aware of when filing the 433 d 2017 form?

Common errors when filing the 433 d 2017 form include incorrect personal information, missing signatures, and failure to report all required income. To avoid these mistakes, double-check all entries and ensure that you have the necessary documentation before submission.

See what our users say