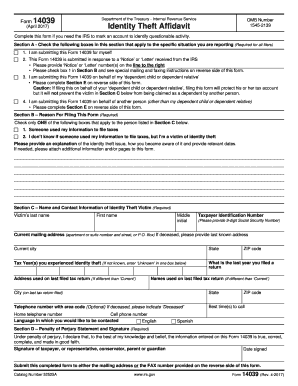

IRS 14039 2014 free printable template

Show details

Sep 30, 2016 ... MR Group PC145 Culver RD #160 Rochester NY. 14620. 7/31/2016 7/3/2008 ... 17112 Valley Glen Rd Pflugerville. 78660 ...... 1003 Mountain View DriveHarker Heights TX. 76548.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 14039

How to edit IRS 14039

How to fill out IRS 14039

Instructions and Help about IRS 14039

How to edit IRS 14039

To edit IRS 14039, you can use pdfFiller, which offers user-friendly tools for modifying printed forms. Simply upload the form to the platform, where you can make necessary changes, add your information, or correct any errors. Once edits are complete, you can save the updated form for submission or storage.

How to fill out IRS 14039

Filling out IRS 14039 is straightforward. First, gather all necessary information such as your name, Social Security Number (SSN), and any supporting identification. Then, ensure that you clearly indicate your reason for filing the form in the designated sections. Pay close attention to accuracy, as mistakes may delay the processing of your request.

Consider reviewing the completed form carefully before submission. This includes checking that all fields are properly filled out and all information is correct. Utilizing resources like pdfFiller can help facilitate this process by allowing you to complete, sign, and store documents electronically.

About IRS 14 previous version

What is IRS 14039?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 14 previous version

What is IRS 14039?

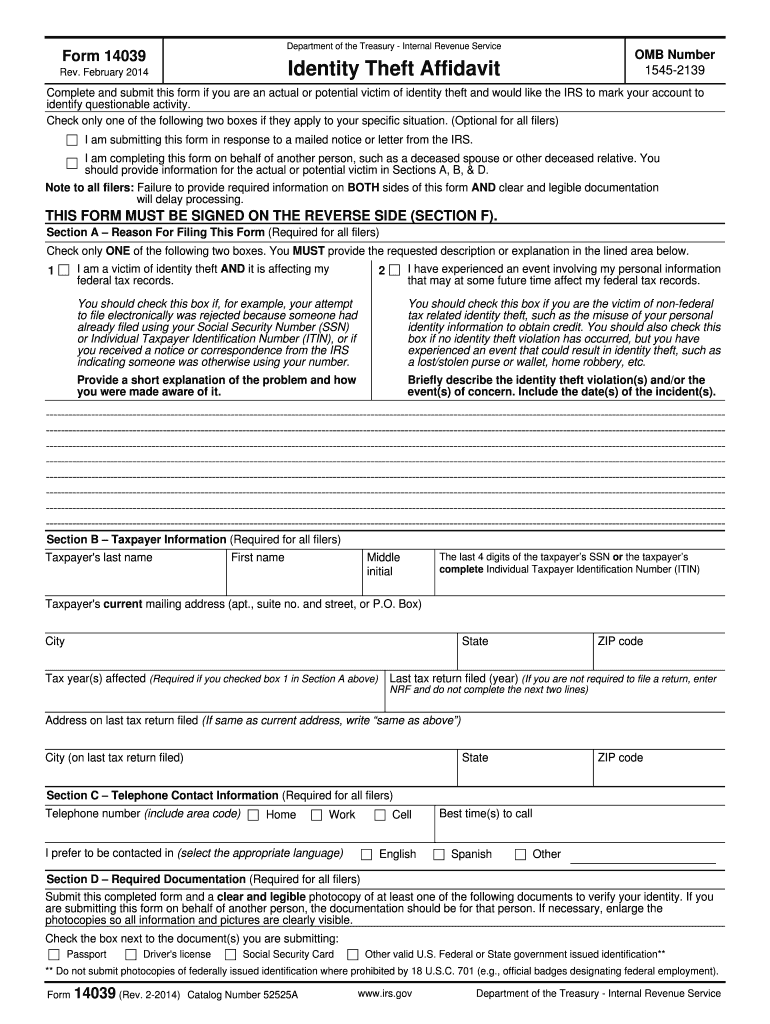

IRS 14039, also known as the Identity Theft Affidavit, is a form that taxpayers use to report identity theft. This form is essential for individuals whose personal information has been misused to file fraudulent tax returns or other forms of identity theft. By completing this form, taxpayers can notify the IRS of identity fraud claims and seek relief from any associated tax responsibilities.

What is the purpose of this form?

The primary purpose of IRS 14039 is to provide the IRS with official documentation that a taxpayer has experienced identity theft. It serves as a means to protect the taxpayer’s identity and to correct any misinformation that may have been used in filing tax returns. Effective use of this form can help prevent future issues with false claims and restore one's tax records accurately.

Who needs the form?

Individuals who suspect that their personal information has been compromised or used fraudulently for tax purposes need to file IRS 14039. Typically, this includes those who have been notified of identity theft by the IRS or who notice discrepancies in their tax records. By filing this form, they take proactive steps to address the situation with tax authorities.

When am I exempt from filling out this form?

Taxpayers are generally not required to fill out IRS 14039 if they have not experienced identity theft or if their tax returns are accurate and legitimate. Furthermore, if the IRS has indicated that there is no identity theft associated with a taxpayer’s account, then submission of this form would be unnecessary.

Components of the form

The IRS 14039 contains several key components, including sections for personal information, a description of the identity theft incident, and declarations related to the validity of the claims. Each section must be filled out clearly and accurately to ensure the IRS understands the taxpayer's situation and can process the request effectively.

What are the penalties for not issuing the form?

If a taxpayer fails to file IRS 14039 after experiencing identity theft, they may face challenges in addressing fraudulent tax claims. This could result in complications, including delayed refunds, unpaid debts on illegitimate claims, or an inability to resolve matters with the IRS. It is crucial for affected individuals to act promptly to mitigate these potential penalties.

What information do you need when you file the form?

When filing IRS 14039, you will need to provide personal information, such as your name, address, Social Security Number, date of birth, and any other identification used when filing tax returns. Additionally, details regarding the specific incidents of identity theft and supporting documentation may be required to substantiate your claims.

Is the form accompanied by other forms?

IRS 14039 may be submitted alongside other documentation relevant to the case of identity theft. Although it does not require specific accompanying forms, including a police report or any correspondence from the IRS regarding the identity theft can bolster your submission and assist with your claims.

Where do I send the form?

Once completed, IRS 14039 should be mailed to the appropriate IRS address listed in the form instructions. This address may vary depending on your state of residency as well as the nature of your claims. Be sure to review the instructions carefully to ensure proper submission.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I just stumbled upon this site and so far I am satisfied with the ease of use.

its awesome! makes sending forms so convenient

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.