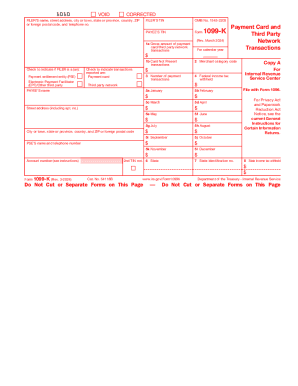

IRS 1099-K 2011 free printable template

Show details

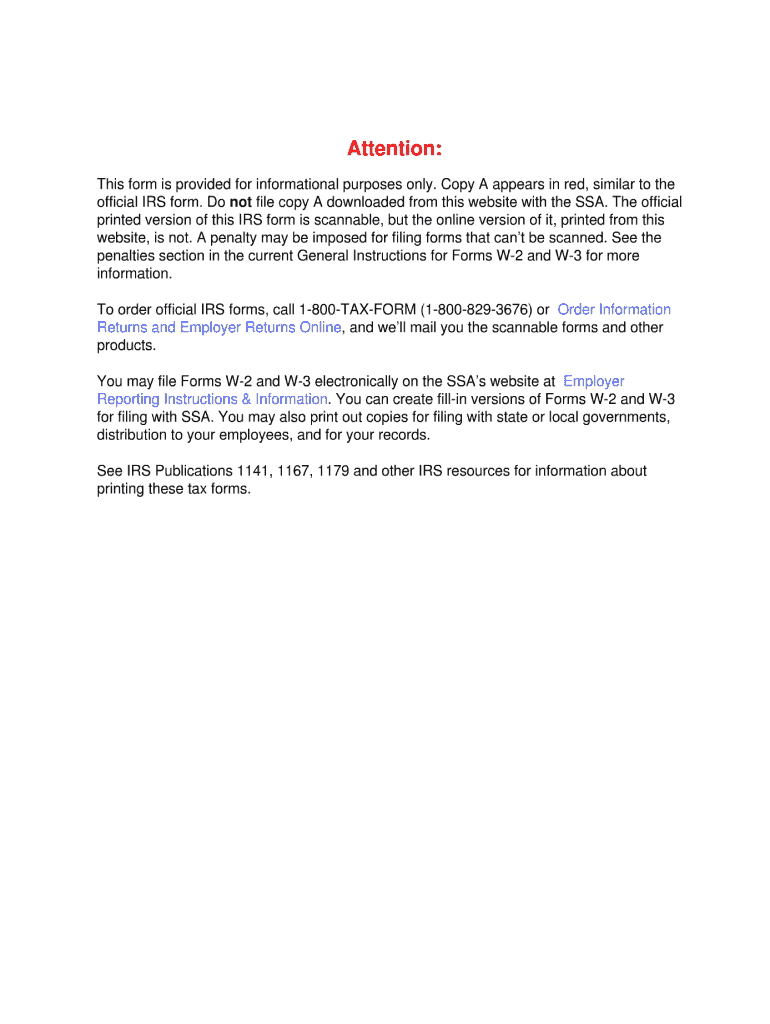

Attention: This form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. Do not file copy A downloaded from this website. The official printed version

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1099-K

How to edit IRS 1099-K

How to fill out IRS 1099-K

Instructions and Help about IRS 1099-K

How to edit IRS 1099-K

To edit IRS 1099-K, you can utilize pdfFiller for convenient editing. This tool allows users to upload their 1099-K forms and make necessary adjustments, such as correcting information like payment amounts or recipient details. Once you have completed the edits, ensure to save the changes and follow the submission guidelines.

How to fill out IRS 1099-K

Filling out the IRS 1099-K involves several steps. First, gather all relevant transaction data that needs to be reported for the year. Next, download the form from the IRS website or edit it using pdfFiller. The form must include information about the payment settlement entity and the total reportable payment transactions made during the year.

01

Enter the legal name, address, and taxpayer identification number of the payment settlement entity.

02

Report gross payment amounts from transactions made during the calendar year.

03

Indicate the number of payment transactions completed.

About IRS 1099-K 2011 previous version

What is IRS 1099-K?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1099-K 2011 previous version

What is IRS 1099-K?

IRS 1099-K is a tax form used to report payment card and third-party network transactions. It plays a critical role in ensuring that payment processors report incomes accurately to the IRS, thus aiding in tax compliance for self-employed individuals and businesses receiving payments through certain platforms.

What is the purpose of this form?

The purpose of IRS 1099-K is to report transactions made through payment card networks and third-party payment networks. This form helps the IRS track income that may not be reported on other tax forms, ensuring that taxpayers report their earnings accurately. Businesses and individuals who receive payments over the reporting threshold will receive this form to report their income.

Who needs the form?

Businesses and individuals who receive payments exceeding $600 in a calendar year through payment cards or third-party networks need to file IRS 1099-K. This includes those who operate in e-commerce or provide services where customers pay online. Payment processors are responsible for issuing the form directly to the recipients.

When am I exempt from filling out this form?

You are exempt from filing IRS 1099-K if your businesses do not meet the $600 payment threshold through third-party networks, or if payments are not processed via payment cards. Additionally, certain types of transactions, such as those between family members or personal payments, may not require a 1099-K.

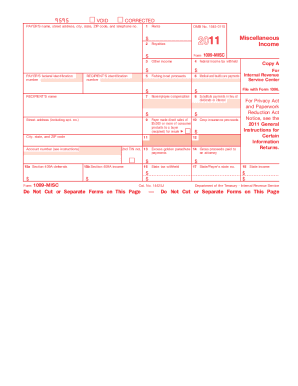

Components of the form

IRS 1099-K consists of multiple parts, including the payer's information (payment settlement entity), recipient's details, and transaction information. Specifically, it lists the total gross payments made during the year, the number of transactions, and includes details to help ensure accurate tax reporting.

Due date

The due date for IRS 1099-K is typically January 31 of the year following the reporting year if you are filing the form with the IRS electronically. If you're submitting paper forms, the due date is usually the last day of February. Always check the IRS guidelines for any updates regarding submission timelines.

What payments and purchases are reported?

Payments reported on IRS 1099-K include those made through payment cards and third-party networks for goods or services. This may include credit card transactions, e-commerce payments, and other processed transactions that exceed the reporting threshold.

How many copies of the form should I complete?

When filing IRS 1099-K, you generally need to prepare three copies: one for the IRS, one for the state tax agency (if applicable), and one for the recipient. Each copy should reflect the accurate transaction details to ensure proper reporting at all levels.

What are the penalties for not issuing the form?

Failure to issue IRS 1099-K when required can result in penalties ranging from $50 to $550 per form, depending on how late the form is filed. Continued non-compliance can lead to more severe repercussions, including potential audits and fines from the IRS.

What information do you need when you file the form?

When filing IRS 1099-K, you will need the following information: the payer’s name, address, and taxpayer identification number (TIN); the recipient's name, address, and TIN; total reportable payment amounts; and the number of transactions. Accurate information is crucial for compliance.

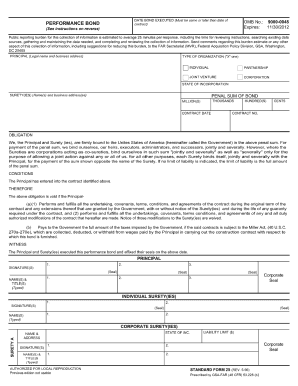

Is the form accompanied by other forms?

IRS 1099-K is usually submitted independently but may be accompanied by forms such as 1096, especially when filing paper forms. Form 1096 is a summary form that aggregates multiple 1099 forms filed with the IRS.

Where do I send the form?

The submission location for IRS 1099-K depends on whether you are filing electronically or via paper. Electronic filings are sent through the IRS e-file system. Paper forms should be mailed to the address specified by the IRS, which can change based on the filing location and circumstances.

See what our users say