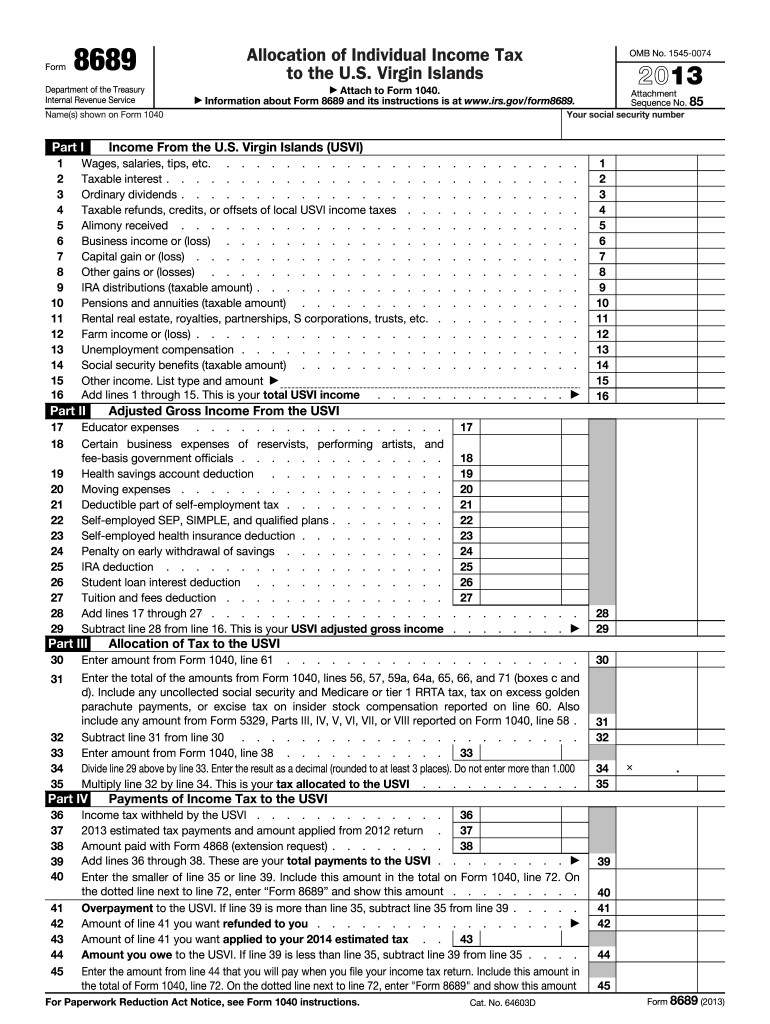

IRS 8689 2013 free printable template

Instructions and Help about IRS 8689

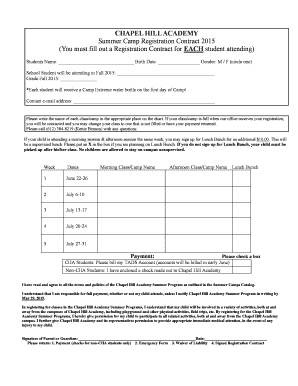

How to edit IRS 8689

How to fill out IRS 8689

About IRS 8 previous version

What is IRS 8689?

What is the purpose of this form?

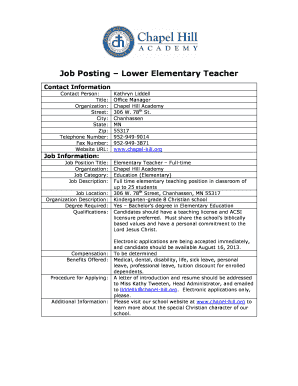

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8689

What should I do if I realize there’s an error on my submitted publication 570 - tax?

If you find an error on your submitted publication 570 - tax, you can amend the form to correct the information. It’s important to follow the procedures outlined by the IRS for filing an amended return, ensuring that the corrections do not create further discrepancies. Keep documentation that supports the changes made for your records.

How can I check the status of my publication 570 - tax submission?

To check the status of your publication 570 - tax submission, you can use the IRS online tracking system or contact the IRS directly. This will allow you to confirm whether your form has been received and is being processed. Be aware of common e-file rejection codes that may hinder the approval of your submission.

Are e-signatures accepted for the publication 570 - tax?

Yes, e-signatures are generally accepted for the publication 570 - tax, making the filing process more convenient. Ensure that your e-signature complies with IRS standards and that you're maintaining proper security and privacy measures for your submitted information.

What should I do if I receive a notice regarding my publication 570 - tax?

If you receive a notice regarding your publication 570 - tax, it’s critical to read it carefully and understand the issues raised. Be prepared to provide any requested documentation and respond within the time frame specified. Addressing the notice promptly can help prevent delays and ensure compliance.

What are some common errors to avoid when filing the publication 570 - tax?

Common errors when filing the publication 570 - tax include incorrect identification numbers, misclassifying payments, and failing to include required supporting documentation. To minimize mistakes, review the information thoroughly and consider using tax preparation software that is compatible with your filing needs.