CT DRS CT-1041 2011 free printable template

Show details

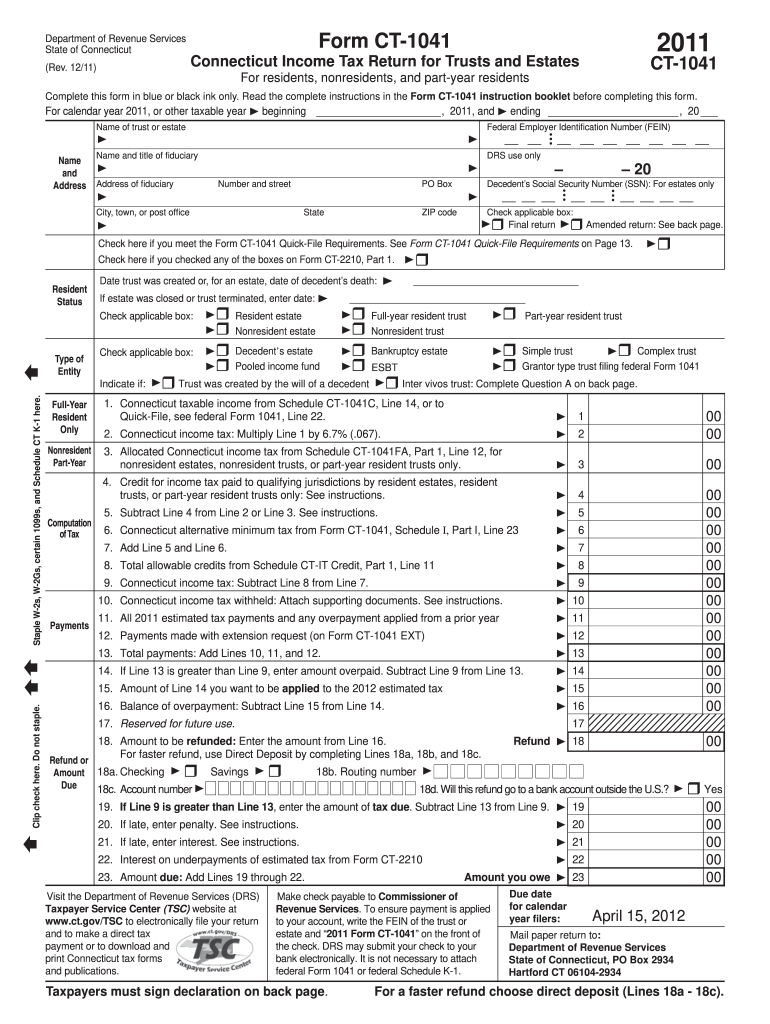

11. All 2011 estimated tax payments and any overpayment applied from a prior year 12. Payments made with extension request on Form CT-1041 EXT 13. Amount you owe 23 Make check payable to Commissioner of Revenue Services. To ensure payment is applied to your account write the FEIN of the trust or estate and 2011 Form CT-1041 on the front of the check. Read the complete instructions in the Form CT-1041 instruction booklet before completing this form. For calendar year 2011 or other taxable year ...beginning 2011 and ending 20 Name of trust or estate Federal Employer Identi cation Number FEIN Name and title of duciary Name and Address Address of duciary Number and street PO Box State ZIP code Decedent s Social Security Number SSN For estates only City town or post of ce Check applicable box Final return Amended return See back page. DRS may submit your check to your bank electronically. It is not necessary to attach federal Form 1041 or federal Schedule K-1. Taxpayers must sign...declaration on back page. Due date for calendar year lers April 15 2012 Mail paper return to Hartford CT 06104-2934 Schedule A - Connecticut Fiduciary Adjustments See instructions. Additions 1. Interest on state and local government obligations other than Connecticut 3. Loss on sale of Connecticut state and local government bonds Enter as a positive number. This amount may be positive or negative. Enter on Schedule CT-1041B Part 1 Line f Column 5. 10. Refunds of Connecticut income tax...Requirements must attach Schedule CT-1041C and if applicable Schedule CT-1041FA. Questions A. If the trust is an inter vivos trust enter name address and Social Security Number of grantor B. If you checked Part-year resident trust on the front of this return enter the date on which the trust became irrevocable C. Does the trust or estate have an interest in real property or tangible personal property located in Yes No Completed CT-1041 schedules must be attached to the back of Form CT-1041 in...the following order unless the trust or estate meets the Quick-File Requirements. 1. Schedule CT-1041B Also attach the following if applicable 2. Worksheet B Worksheet for Schedule CT-IT Credit 3. Forms W-2 W-2G 1099 and Schedule CT K-1 if Connecticut income tax was withheld or the tax withheld will be disallowed and 4. Total subtractions Add Lines 7 through 11. 13. Connecticut duciary adjustment Subtract Line 12 from Line 6. This amount may be positive or negative. Enter on Schedule CT-1041B...Part 1 Line f Column 5. 10. Refunds of Connecticut income tax Requirements must attach Schedule CT-1041C and if applicable Schedule CT-1041FA. Questions A. If the trust is an inter vivos trust enter name address and Social Security Number of grantor B. Clip check here. Do not staple. Type of Entity Indicate if Full-Year Only DRS use only Decedent s estate Pooled income fund Resident estate Nonresident estate Full-year resident trust Nonresident trust Bankruptcy estate ESBT Part-year resident...trust Simple trust Complex trust Grantor type trust ling federal Form 1041 Trust was created by the will of a decedent Inter vivos trust Complete Question A on back page. 3. Allocated Connecticut income tax from Schedule CT-1041FA Part 1 Line 12 for 5. Subtract Line 4 from Line 2 or Line 3.

pdfFiller is not affiliated with any government organization

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

How to fill out CT DRS CT-1041

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

To edit the CT DRS CT-1041 form, you need to first download the form from the Connecticut Department of Revenue Services (DRS) website or other authoritative sources. Once you have the form, you can use pdfFiller to edit the document directly online, allowing for seamless updates to any incorrect or outdated information. Make sure to save your changes to avoid losing any edits made during the process.

How to fill out CT DRS CT-1041

Filling out the CT DRS CT-1041 involves several steps to ensure accurate reporting. Begin by collecting necessary financial information pertaining to your business income, expenses, and deductions. Follow these steps:

01

Download the CT DRS CT-1041 form.

02

Enter your business information at the top of the form.

03

Provide details of your income in the appropriate sections.

04

List any deductions you qualify for as stated in the form guidelines.

05

Double-check all entries for accuracy.

Utilizing pdfFiller can streamline this process, enabling you to complete each section methodically and check for errors before submission.

About CT DRS CT- previous version

What is CT DRS CT-1041?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CT DRS CT- previous version

What is CT DRS CT-1041?

CT DRS CT-1041 is the Connecticut Department of Revenue Services tax form used by certain estates and trusts to report income, deductions, and credits to the state. This form is pivotal for the tax compliance of estates and trusts that generate taxable income. Understanding how to properly fill out CT DRS CT-1041 is essential to avoid penalties and ensure compliance with state regulations.

What is the purpose of this form?

The purpose of the CT DRS CT-1041 is to report the income earned by estates and trusts and calculate any Connecticut tax liability. The form provides the state with crucial information about the financial activities of estates and trusts, ensuring proper tax assessment and collection.

Who needs the form?

Estates and trusts that generate income must file the CT DRS CT-1041. This includes, but is not limited to, family trusts, charitable trusts, and other fiduciary entities. If the estate or trust meets the income threshold set by the state, filing this form becomes a requirement for tax compliance.

When am I exempt from filling out this form?

You may be exempt from filling out the CT DRS CT-1041 if the estate or trust does not generate taxable income or if its gross income is below the threshold specified by Connecticut tax law. It's advisable to review the guidelines published by the Connecticut DRS to determine specific exemptions.

Components of the form

The CT DRS CT-1041 consists of several key sections, including personal identification information of the fiduciary, income reporting sections, deduction details, and payment information. Each section must be filled out accurately to ensure compliance with state tax regulations.

Due date

The due date for filing the CT DRS CT-1041 is typically April 15th of the year following the tax year being reported. If this date falls on a weekend or holiday, the due date is adjusted to the next business day. Timely submission is crucial to avoid penalties and interest.

What payments and purchases are reported?

The CT DRS CT-1041 requires reporting of all income earned by the estate or trust, including interest, dividends, rent, and other sources. Additionally, any significant purchases or distributions made by the estate or trust must be reflected in the form for accurate record-keeping and tax assessment.

How many copies of the form should I complete?

Generally, you should complete one original CT DRS CT-1041 form for submission to the Connecticut DRS. If the form is requested for informational purposes by other entities, additional copies may be created. Always retain a copy for your records as well.

What are the penalties for not issuing the form?

Failure to file the CT DRS CT-1041 can result in significant penalties, including fines and interest on unpaid taxes. The Connecticut DRS imposes these penalties to encourage compliance and timely reporting. It is vital to be aware of these repercussions to avoid unnecessary financial burdens.

What information do you need when you file the form?

When filing the CT DRS CT-1041, you will need the following information: personal identification for the fiduciary, detailed income reports for the estate or trust, applicable deductions and credits, and any relevant tax payments made throughout the year. Having this information organized in advance can facilitate a smoother filing process.

Is the form accompanied by other forms?

The CT DRS CT-1041 may need to be filed alongside other forms, such as specific schedules that detail income sources or deductions. Check the instructions provided with the form to determine if additional documentation is necessary for comprehensive reporting.

Where do I send the form?

The completed CT DRS CT-1041 should be sent to the Connecticut Department of Revenue Services. You can choose to mail the form to the address specified on the form's instructions or submit it electronically if applicable. Always ensure that you follow the filing guidelines to prevent any processing delays.

See what our users say