CT DRS CT-1041 2022 free printable template

Show details

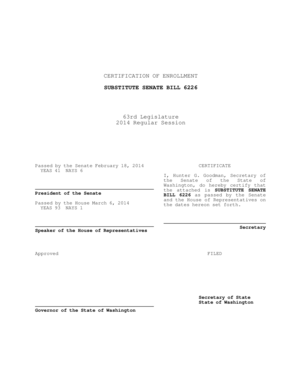

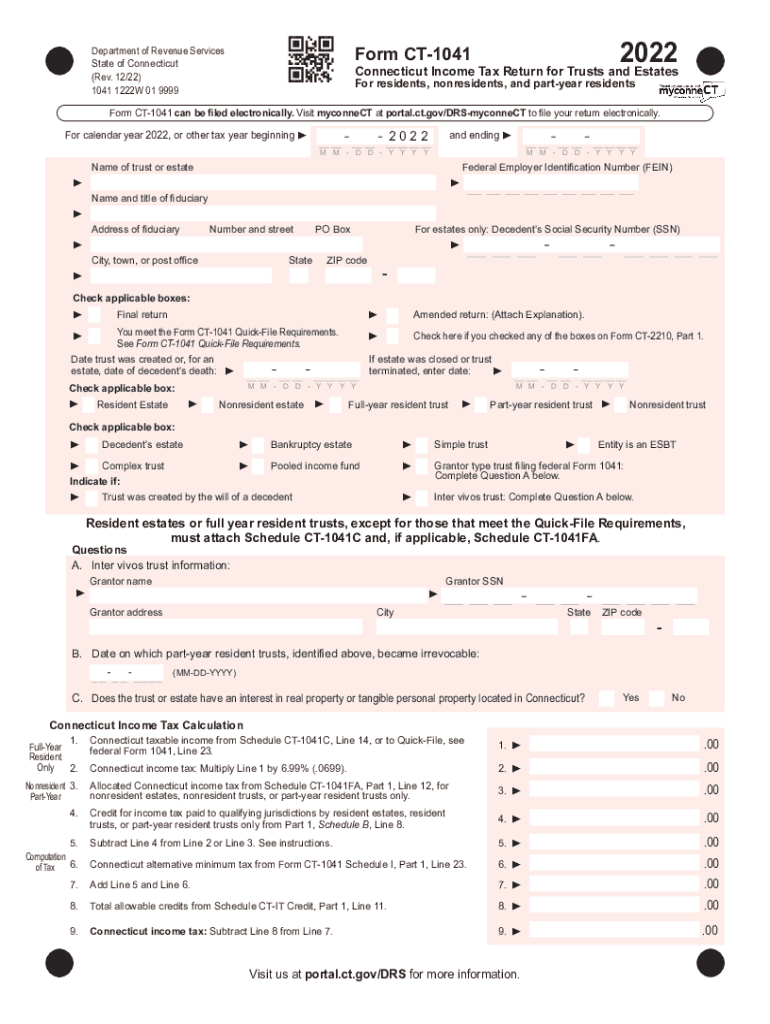

2022Form CT1041Department of Revenue Services State of Connecticut (Rev. 12/22) 1041 1222W 01 9999Connecticut Income Tax Return for Trusts and Estates For residents, nonresidents, and part year residentsForm

pdfFiller is not affiliated with any government organization

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

How to fill out CT DRS CT-1041

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

To edit the CT DRS CT-1041 tax form, start by downloading a copy of the form in PDF format from a reliable source. If using pdfFiller, upload the form to the platform. Utilize the editing tools to fill in or alter any necessary sections. Save the changes to ensure your edits are preserved, and you can later print or submit the document as required.

How to fill out CT DRS CT-1041

To properly fill out the CT DRS CT-1041, carefully read the instructions provided with the form. Begin by entering the entity's name and address in the designated fields. Then, report all relevant taxable income, deductions, and credits as applicable. Ensure accuracy by verifying all figures before submitting, as errors can lead to complications with your filings.

About CT DRS CT- previous version

What is CT DRS CT-1041?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CT DRS CT- previous version

What is CT DRS CT-1041?

CT DRS CT-1041 is a tax form used by fiduciaries in Connecticut to report income received on behalf of trusts and estates. This form allows fiduciaries to comply with state tax laws and accurately report financial information to the Connecticut Department of Revenue Services (DRS).

What is the purpose of this form?

The purpose of the CT DRS CT-1041 is to report the income and expenses of an estate or trust, ensuring that the correct taxation is applied. It serves to inform the Connecticut DRS of the income generated from the trust or estate during the tax year, enabling proper assessment and collection of state taxes.

Who needs the form?

This form must be completed by fiduciaries of estates and trusts that conduct business or have income in Connecticut, including executors of estates and trustees of irrevocable or revocable trust arrangements. If the estate or trust exceeds certain income thresholds, filing this form is mandatory.

When am I exempt from filling out this form?

Exemptions from filing the CT DRS CT-1041 may apply to estates and trusts with minimal income or those that do not meet the required filing thresholds set by the Connecticut DRS. Generally, if the trust or estate does not exceed specific income limits or does not generate taxable income, it may not need to file this form.

Components of the form

The CT DRS CT-1041 consists of several components, including sections for reporting the fiduciary’s name, address, identification number, income details, deductions, and credits. Each section must be completed with accurate and relevant information to ensure compliance with tax regulations.

Due date

The due date for filing the CT DRS CT-1041 is typically the 15th day of the fourth month following the end of the tax year. For most estates and trusts following the calendar year, this means the form is due by April 15. It is crucial to file on time to avoid penalties and interest charges.

What are the penalties for not issuing the form?

Penalties for failing to file the CT DRS CT-1041 on time can include monetary fines and interest on unpaid taxes. Additionally, the fiduciary may face challenges in managing the trust or estate if proper reporting is not maintained. It is essential to adhere to the filing deadlines to mitigate these risks.

What information do you need when you file the form?

When filing the CT DRS CT-1041, you will need the trust or estate’s name, address, federal identification number, and detailed information on incomes, expenses, and deductions. Accurate records of all financial transactions conducted during the tax year are vital for filling out the form correctly.

Is the form accompanied by other forms?

The CT DRS CT-1041 may need to be accompanied by other forms, such as federal returns if applicable, or additional schedules that detail specific income sources or deductions. Ensure you refer to the instructions of the form for guidance on any accompanying paperwork required.

Where do I send the form?

Completed CT DRS CT-1041 forms should be mailed to the Connecticut Department of Revenue Services at the address specified in the form's instructions. Filing electronically may also be available; consult the DRS website for more information on the electronic submission process.

See what our users say