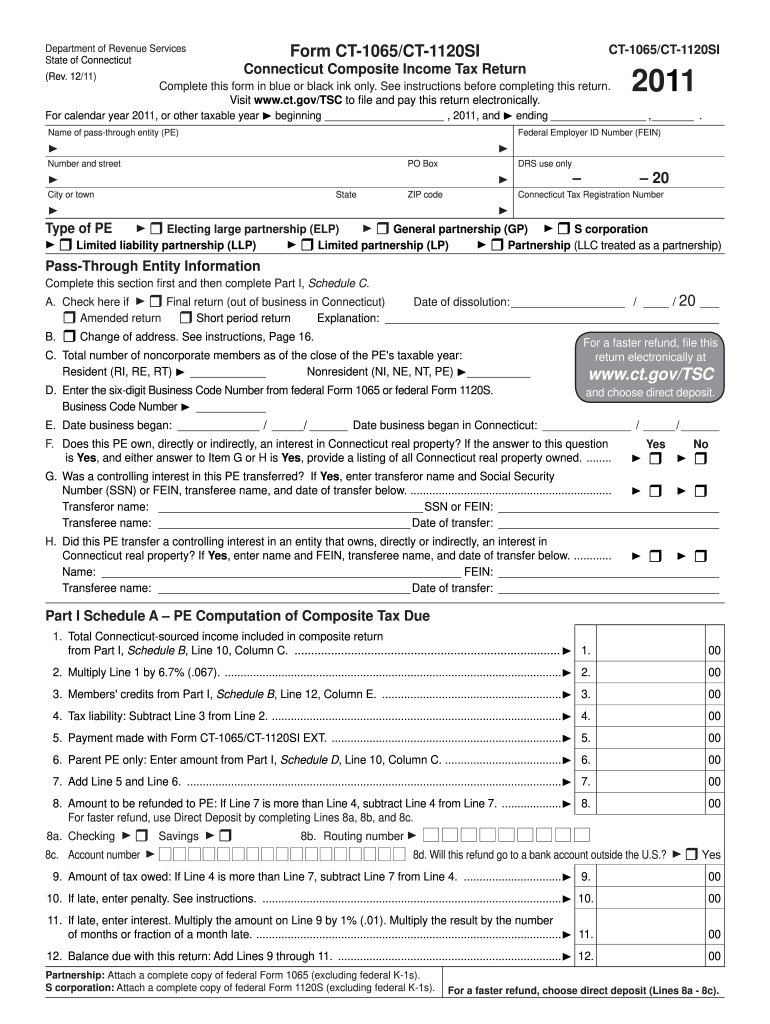

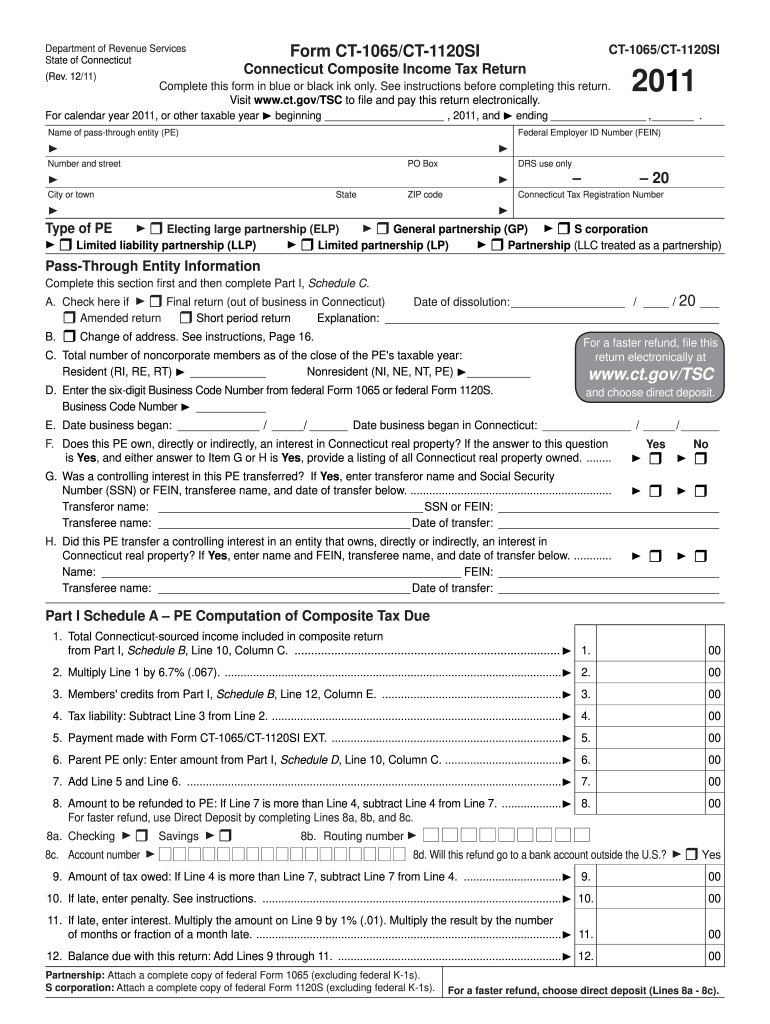

CT DRS CT-1065/CT-1120SI 2011 free printable template

Get, Create, Make and Sign CT DRS CT-1065CT-1120SI

How to edit CT DRS CT-1065CT-1120SI online

Uncompromising security for your PDF editing and eSignature needs

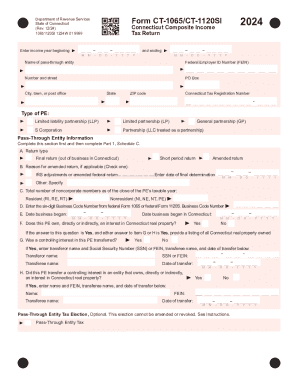

CT DRS CT-1065/CT-1120SI Form Versions

How to fill out CT DRS CT-1065CT-1120SI

How to fill out CT DRS CT-1065/CT-1120SI

Who needs CT DRS CT-1065/CT-1120SI?

Instructions and Help about CT DRS CT-1065CT-1120SI

I'm Steve Maelstrom corporate product specialist for the Park Place dealerships, and today we're looking at the redesign 2014 Lexus CT 200h the CT is a rare combination of sporty good looks spirited handling and world-class fuel economy a very hard blend to achieve but one that Lexus has done quite nicely in this updated version of its most affordable model with an EPA estimated 42 miles per gallon the CT is an extremely fuel-efficient vehicle the CT 208 gets a few notable exterior changes including LED running lights and a new front fascia with the signature Lexus spindle grille it's a really clever design with the contoured headlights kind of diving into the spindle grille to create an aggressive fashionable front end in the rear the back glass is framed by a large functional spoiler Lexus has lowered the rear ground effects of the vehicle this year and a contoured rear treatment that extends out from the muscular launch of the car the optional f sport model receives a black roof and a more aggressive looking rear spoiler the battery pack is located beneath the load floor and back still it has a respectable 14.3 cubic feet of storage space with the seats folded back it opens up to a massive 32.3 cubic feet which means the CT 200h is more capable than any sedan if you're heading for the grocery store or the home-improvement store 17-inch rims which might be an upgrade on many competitive models are standard on the CT 200h, and they have a new split 5-spoke design that looks fabulous on this car the 2014 CT comes with standard stability control 4-wheel anti-lock brakes and eight airbags including full-length side curtain airbags if you choose the optional adaptive cruise control system it features a collision prevent system with automatic braking capability the CT is a nimble car with efficient and agile responsiveness for a vehicle with this kind of fuel economy I was favorably impressed with the driving experience it's a vehicle that will actually have you craving more time on the open road, and you'll spend a lot more of it on the road since you're going to be passing up all those fuel stations the CT has a decidedly sporty feel on the interior the seats are low slung and pleasantly form-fitting while the layout of the instrumentation provides a hit like feel as you'd expect in Alexis the CT 200h has its technological bases covered standard features include a tilt and telescoping steering wheel the Lexus six speaker sound system with in-dash CD player USB and Bluetooth audio connectivity and a remote touch interface infotainment system which upgrades next generation software and hardware you can choose the EV mode at low speeds and short distances to completely eliminate emissions as your operating only on battery power the Eco mode moderates throttle response and engine performance for increased efficiency, or you can choose sport mode for a thrilling throttle response and maximize steering feel the mouse like controller here is a very, very...

People Also Ask about

Who must file a CT return?

Who must file a CT 1065?

Who is required to file a CT tax return?

What is CT 1065 CT 1120SI?

What is the pass-through entity tax for S Corp in CT?

What is a CT 1065?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CT DRS CT-1065CT-1120SI to be eSigned by others?

How do I edit CT DRS CT-1065CT-1120SI online?

Can I create an electronic signature for the CT DRS CT-1065CT-1120SI in Chrome?

What is CT DRS CT-1065/CT-1120SI?

Who is required to file CT DRS CT-1065/CT-1120SI?

How to fill out CT DRS CT-1065/CT-1120SI?

What is the purpose of CT DRS CT-1065/CT-1120SI?

What information must be reported on CT DRS CT-1065/CT-1120SI?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.