CT DRS CT-1065/CT-1120SI 2016 free printable template

Show details

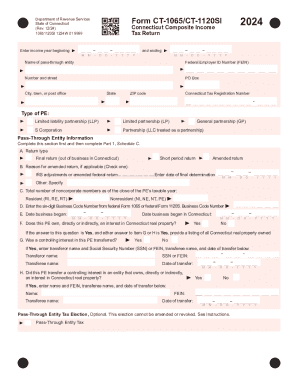

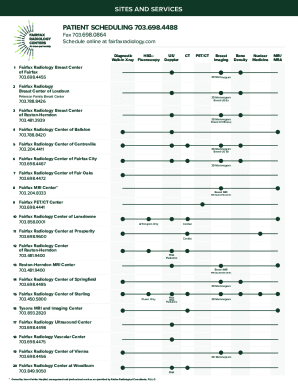

Department of Revenue Services State of Connecticut (Rev. 12/16) 10651120SI 1216W 01 99992016Form CT1065/CT1120SI Connecticut Composite Income Tax Returner income year beginning and ending MMDDYYYYMName

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-1065CT-1120SI

Edit your CT DRS CT-1065CT-1120SI form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-1065CT-1120SI form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT DRS CT-1065CT-1120SI online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CT DRS CT-1065CT-1120SI. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-1065/CT-1120SI Form Versions

Version

Form Popularity

Fillable & printabley

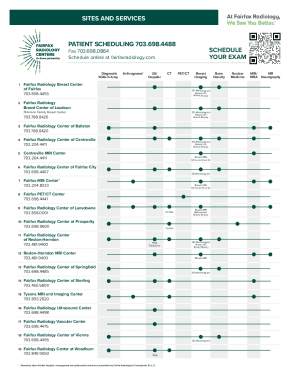

How to fill out CT DRS CT-1065CT-1120SI

How to fill out CT DRS CT-1065/CT-1120SI

01

Obtain the CT-1065 or CT-1120SI form from the Connecticut Department of Revenue Services website.

02

Fill out the basic information section, including the entity's name, address, and federal Employer Identification Number (EIN).

03

Complete the income section, listing all sources of income, deductions, and calculating the taxable income.

04

Distribute the income and deductions among partners or shareholders, as applicable, and record this information in the designated section.

05

Fill in any credits that the entity is eligible for, based on the instructions provided.

06

Review the form for accuracy and ensure all required signatures are included.

07

Submit the completed form by the due date, following the filing instructions provided.

Who needs CT DRS CT-1065/CT-1120SI?

01

Business entities operating in Connecticut that are classified as partnerships or S-corporations.

02

Partners or shareholders in these businesses who need to report their share of income, deductions, and credits.

03

Any business needing to comply with state tax obligations related to income generated in Connecticut.

Instructions and Help about CT DRS CT-1065CT-1120SI

Fill

form

: Try Risk Free

People Also Ask about

Who needs to file CT 1065?

Every PE that does business in Connecticut or has income derived from or connected with sources within Connecticut must file Form CT‑1065/CT‑1120SI regardless of the amount of its income or loss.

What is CT 1065?

A pass-through entity subject to pass-through entity tax with an annual tax payment of $1,000 or more is required to make estimated payments. These payments must be made electronically unless the entity has been granted a waiver. Form CT-1065/CT-1120SI ES is used to make payments by mail.

What is the tax rate for CT 1065?

The law imposes a 6.99 percent tax on partnerships, LLCs, and S corporations. The tax is imposed on either the entity's entire Connecticut-sourced taxable income or an alternative tax base, which reduces taxable income by the percentage of nonresident ownership.

Who must file a CT return?

If you are a part-year resident and you meet the requirements for Who Must File Form CT-1040NR/PY for the 2022 taxable year, you must file Form CT-1040NR/PY, Connecticut Nonresident and Part-Year Resident Income Tax Return.Connecticut Resident Income Tax Information. Gross Income$100,000Expenses($92,000)Net Income$8,000

What is CT Form 1065?

The 2021 Form CT-1065/CT-1120SI, Connecticut Pass-Through Entity Tax Return Instructions, contains information about the Department of Revenue Services' (DRS) myconneCT online system.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CT DRS CT-1065CT-1120SI directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your CT DRS CT-1065CT-1120SI and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out the CT DRS CT-1065CT-1120SI form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign CT DRS CT-1065CT-1120SI and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete CT DRS CT-1065CT-1120SI on an Android device?

Complete your CT DRS CT-1065CT-1120SI and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CT DRS CT-1065/CT-1120SI?

CT DRS CT-1065 is a form used for Partnerships and Limited Liability Companies (LLCs) that are treated as partnerships for tax purposes in Connecticut. CT-1120SI is used for S Corporations. Both forms are used to report income and tax for these entities.

Who is required to file CT DRS CT-1065/CT-1120SI?

Partnerships, LLCs treated as partnerships, and S Corporations doing business or having income derived from Connecticut are required to file CT DRS CT-1065 or CT-1120SI.

How to fill out CT DRS CT-1065/CT-1120SI?

To fill out CT DRS CT-1065/CT-1120SI, business entities must provide accurate information regarding their income, deductions, and other relevant financial details as specified in the form's instructions. Proper classification of income and costs must also be maintained.

What is the purpose of CT DRS CT-1065/CT-1120SI?

The purpose of CT DRS CT-1065/CT-1120SI is to report income, gains, losses, deductions, and credits of partnerships and S Corporations in Connecticut to ensure compliance with state tax laws.

What information must be reported on CT DRS CT-1065/CT-1120SI?

Information that must be reported on CT DRS CT-1065/CT-1120SI includes the entity's name, address, federal employer identification number (FEIN), income, deductions, and any contributions received, along with the names and addresses of partners or shareholders.

Fill out your CT DRS CT-1065CT-1120SI online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-1065ct-1120si is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.