VA DoT 760 2011 free printable template

Show details

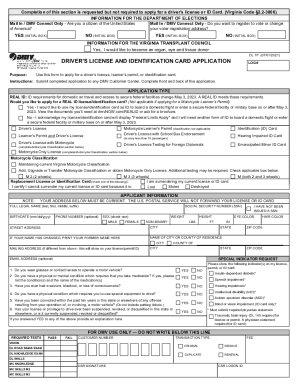

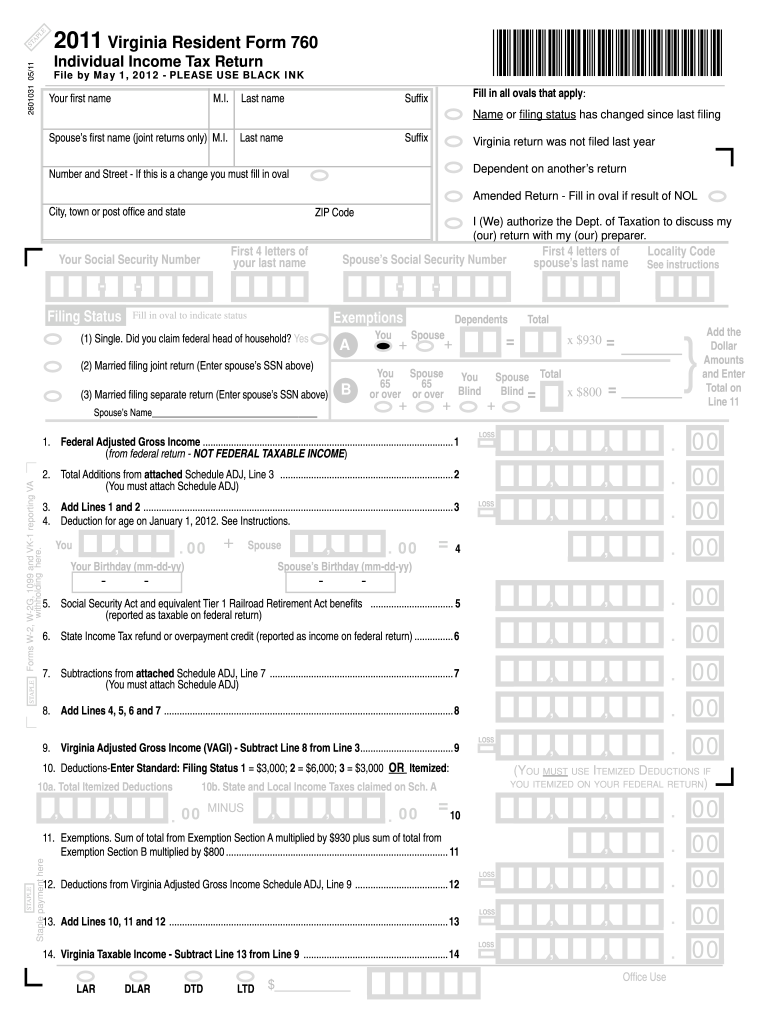

PL E ST A 2011 Virginia Resident Form 760 2601031 05/11 Individual Income Tax Return File by May 1, 2012, PLEASE USE BLACK INK Your RST name M.I. Last name Fill in all ovals that apply: Sub x Name

pdfFiller is not affiliated with any government organization

Instructions and Help about VA DoT 760

How to edit VA DoT 760

How to fill out VA DoT 760

Instructions and Help about VA DoT 760

How to edit VA DoT 760

To edit VA DoT 760, download the PDF form from the appropriate Virginia Department of Taxation website. Use a PDF editing tool such as pdfFiller, which allows users to fill in the necessary fields and make corrections easily. Ensure all changes are accurate and saved before submitting the form to prevent delays in processing.

How to fill out VA DoT 760

To fill out VA DoT 760 accurately, start by reading through the complete instructions accompanying the form. Proceed to input your personal information, including your name, address, and Social Security number, at the designated areas. Make sure to include any pertinent financial information as required, such as reporting income or deductions related to Virginia state taxes.

It's crucial to review all entries for accuracy before submitting the form to ensure compliance with state tax regulations. Utilize pdfFiller's features for convenient access and input verification.

About VA DoT previous version

What is VA DoT 760?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About VA DoT previous version

What is VA DoT 760?

VA DoT 760 is a tax form used for individuals in Virginia to report personal income for state taxation purposes. This form is essential for accurately calculating state income taxes owed by residents, as well as for meeting annual tax filing obligations.

What is the purpose of this form?

The purpose of VA DoT 760 is to document the income earned by Virginia residents and to calculate the appropriate state taxes owed. It serves as a means for the Virginia Department of Taxation to assess taxable income and ensure that taxpayers comply with state tax laws.

Who needs the form?

Residents of Virginia who earn income, including wages, business revenue, or investment profits, must file VA DoT 760. Additionally, non-residents who earned income from Virginia sources are also required to submit this form.

When am I exempt from filling out this form?

Individuals are exempt from filling out VA DoT 760 if their total income falls below the filing threshold set by the Virginia Department of Taxation. Additionally, those who solely have income from sources that are not taxable in Virginia may also avoid filing this form.

Components of the form

VA DoT 760 includes several key components, such as personal identification details, income reporting sections, and tax calculation fields. Taxpayers must provide specifics on different income streams, including wages and interest, as well as any applicable deductions that may reduce taxable income.

What are the penalties for not issuing the form?

Failing to file VA DoT 760 may result in penalties imposed by the Virginia Department of Taxation. These penalties can include fines based on the amount of taxes owed and interest accrued on any late payments. Timely submission is important to avoid these additional costs.

What information do you need when you file the form?

When filing VA DoT 760, you will need your Social Security number, information regarding all income earned, and details of any tax deductions or credits applicable for the filing year. Additionally, prepare any supporting documents that verify your income and deductions for accuracy.

Is the form accompanied by other forms?

VA DoT 760 may need to be accompanied by additional forms, such as schedules or support documentation that relate to specific types of income or deductions. Ensure you check the instructions for any such requirements to ensure proper submission and compliance with IRS and state tax regulations.

Where do I send the form?

Completed VA DoT 760 forms should be mailed to the address specified in the form's instructions or the Virginia Department of Taxation's guidelines. Be sure to use the correct mailing address based on whether you are including payment or filing a return without a payment.

See what our users say