VA DoT 760 2024-2025 free printable template

Show details

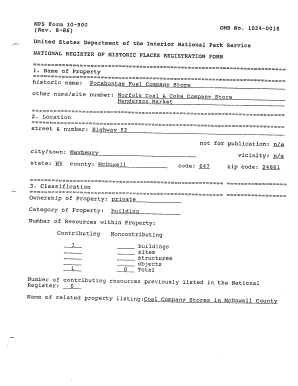

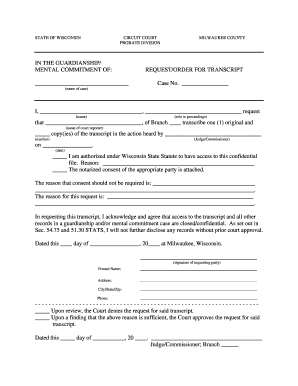

2018 Virginia Resident Form 760 WEB 2601031 Rev. 10/18 VA0760118888 Individual Income Tax Return File by May 1 2019 - PLEASE USE BLACK INK Your first name M. 14 15. Add Lines 12 13 and 14. 15 16. Virginia Taxable Income - Subtract Line 15 from Line 9. 16 LAR DTD LTD Page 2 2018 Form 760 Your SSN 17. Amount of Tax from Tax Table or Tax Rate Schedule round to whole dollars. 17 18. Spouse Tax Adjustment STA. Virginia Adjusted Gross Income VAGI - Subtract Line 8 from Line 3. Enter the result on this...line. Note If less than 11 950 for Filing Status 1 or 3 or 23 900 for Filing Status 2 your tax is 0. 00. 9 13. Exemptions. Sum of total from Exemption Section A plus Exemption Section B. 13 14. Deductions from Schedule ADJ Line 9. 14 15. Add Lines 12 13 and 14. 15 16. Virginia Taxable Income - Subtract Line 15 from Line 9. 16 LAR DTD LTD Page 2 2018 Form 760 Your SSN 17. I. Last name including suffix Spouse s first name joint returns only M. I. You - Spouse State ZIP Code VA Driver s License...Information Fill in all ovals that apply Name or Filing Status changed Virginia return not filed last year Dependent on another s return Qualifying farmer fisherman or merchant seaman Amended Return - Result of NOL YES Overseas on due date Federal Schedule C filed Earned Income Credit on federal return Amount claimed Customer ID Federal head of household YES If Filing Status 3 enter spouse s SSN in the Spouse s Social Security Number You 65 or over box at top of form and enter Spouse s Name...Blind loss 2. Additions from enclosed Schedule ADJ Line 3. 2 3. Add Lines 1 and 2. 3 4. Age Deduction* See Instructions. Be sure to provide date of birth above. Total Section A 1. Adjusted Gross Income from federal return - Not federal taxable income. 1 Issue Date Dependents - - - Do you need to file See Line 9 and Instructions - - - Locality Code Exemptions Add Sections A and B. Enter the sum on Line 13. Filing Status Enter in box 1 Single 2 Joint and 3 Married Filing Separately Deceased Birth...Date mm-dd-yyyy Number and Street - If this is a change you must fill in oval City town or post office First 4 letters of last name Social Security Number X 930 X 800 6. State Income Tax refund or overpayment credit reported as income on federal return. 6 7. Subtractions from enclosed Schedule ADJ Line 7. 7 8. Add Lines 4 5 6 and 7. 8 10. Itemized Deductions from Virginia Schedule A. 10 11. State and Local Income Taxes claimed on Virginia Schedule A. 11 12. Subtract Line 11 from Line 10 if...claiming itemized deductions. Otherwise enter standard deduction 9. Virginia Adjusted Gross Income VAGI - Subtract Line 8 from Line 3. Enter the result on this line. Note If less than 11 950 for Filing Status 1 or 3 or 23 900 for Filing Status 2 your tax is 0. 00. 9 13. Exemptions. Sum of total from Exemption Section A plus Exemption Section B. 13 14. Deductions from Schedule ADJ Line 9. 14 15. Add Lines 12 13 and 14. 15 16. Virginia Taxable Income - Subtract Line 15 from Line 9. 16 LAR DTD LTD...Page 2 2018 Form 760 Your SSN 17.

pdfFiller is not affiliated with any government organization

Instructions and Help about VA DoT 760

How to edit VA DoT 760

How to fill out VA DoT 760

Instructions and Help about VA DoT 760

How to edit VA DoT 760

To edit the VA DoT 760 Tax Form, use an online PDF editor, such as pdfFiller. This tool allows you to make necessary changes without the need to print the document. Simply upload the form, make your edits, and save the updated version.

How to fill out VA DoT 760

Filling out the VA DoT 760 involves several key steps. Begin by entering your personal information, such as your name and contact details. Next, provide relevant financial data that applies to your tax situation. Make sure to double-check the form for accuracy before submission.

Latest updates to VA DoT 760

Latest updates to VA DoT 760

The VA DoT 760 Tax Form undergoes periodic updates to reflect changes in tax law and filing requirements. Always check the official state website or IRS guidelines for the most current version of the form to ensure compliance.

All You Need to Know About VA DoT 760

What is VA DoT 760?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About VA DoT 760

What is VA DoT 760?

The VA DoT 760 is a tax form used by Virginia residents to report income and determine state taxes owed. It is essential for residents to file this form accurately to avoid penalties and ensure proper tax payments.

What is the purpose of this form?

The purpose of the VA DoT 760 is to compute a taxpayer's Virginia income tax liability. It includes reporting various types of income and relevant deductions, ensuring that the state receives accurate tax revenue based on individual earnings.

Who needs the form?

Virginia residents who earn income must file the VA DoT 760. This includes individuals with employment income, business income, or other taxable earnings. Additionally, residents must file if they received income from out-of-state or if they qualify for specific deductions or credits.

When am I exempt from filling out this form?

You may be exempt from filling out the VA DoT 760 if you are a non-resident of Virginia, have no taxable income, or if your income falls below a specified threshold. Check the Virginia Department of Taxation guidelines for the latest exemption criteria.

Components of the form

The primary components of the VA DoT 760 include personal identification information, income details, and calculations for credits and deductions. It is crucial to comprehensively complete each section to facilitate accurate tax processing and calculations.

What are the penalties for not issuing the form?

Failing to file the VA DoT 760 can result in various penalties, including monetary fines and interest on unpaid taxes. It is vital for taxpayers to understand their obligations to prevent unnecessary liabilities.

What information do you need when you file the form?

When filing the VA DoT 760, you typically need your Social Security number, details of all income earned, proof of withholdings, and any documentation related to deductions. Gathering this information beforehand simplifies the filing process.

Is the form accompanied by other forms?

Often, the VA DoT 760 may require additional forms depending on your tax situation. Commonly used forms include schedules for specific deductions and credits. Ensure you consult the instructions provided with the VA DoT 760 to confirm any required supplementary documentation.

Where do I send the form?

The completed VA DoT 760 should be sent to the Virginia Department of Taxation. You can submit it via mail to the provided address on the form or file electronically through the state’s e-filing portal. Be sure to keep a copy for your records.

See what our users say