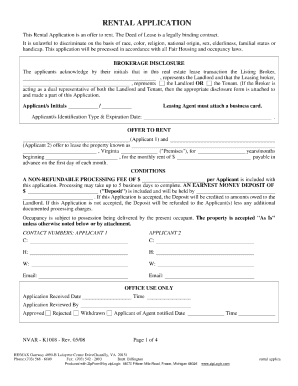

Canada T661 2011 free printable template

Show details

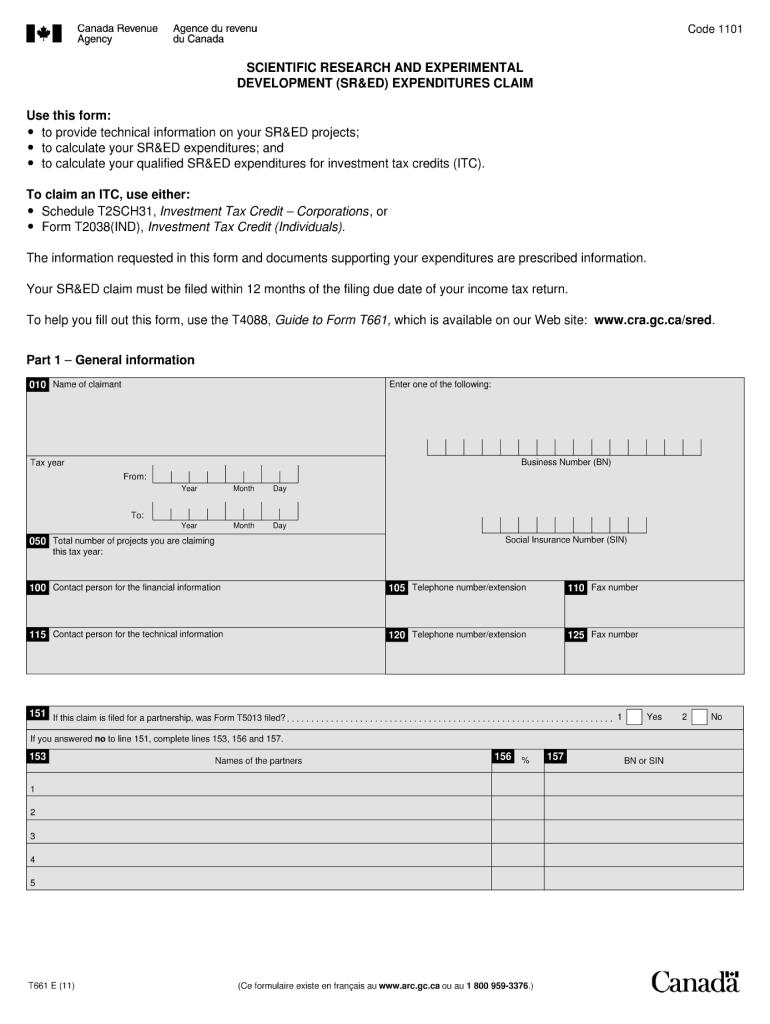

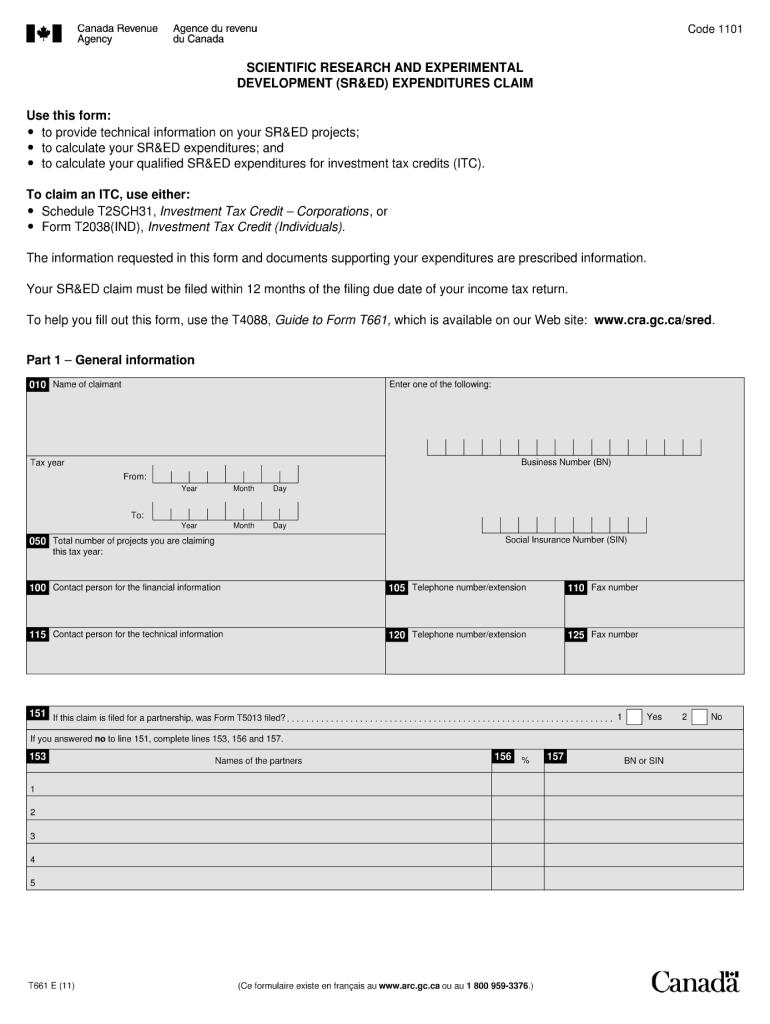

Code 1101 SCIENTIFIC RESEARCH AND EXPERIMENTAL DEVELOPMENT (SERVED) EXPENDITURES CLAIM Use this form: to provide technical information on your SERVED projects; to calculate your SERVED expenditures;

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign t661 form 2011

Edit your t661 form 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t661 form 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit t661 form 2011 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit t661 form 2011. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T661 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out t661 form 2011

How to fill out Canada T661

01

Obtain the Canada T661 form from the Canada Revenue Agency (CRA) website.

02

Read the guide provided with the form to understand eligibility and requirements.

03

Fill out your personal information in the designated sections, including your name, address, and social insurance number.

04

Detail the qualifying expenditure by listing eligible expenses related to your scientific research and experimental development (SR&ED) projects.

05

Provide a description of the SR&ED projects, specifying how they meet the criteria stated by CRA.

06

Include any supporting documents, such as invoices or receipts that substantiate your expenses.

07

Double-check all the filled information for accuracy before submitting.

08

Submit the completed T661 form along with your income tax return or separately if required.

Who needs Canada T661?

01

Businesses engaged in scientific research and experimental development (SR&ED) activities in Canada.

02

Claimants seeking to receive tax credits or refunds related to their SR&ED expenditures.

03

Individuals or companies looking to support their claims for investment tax credits from the CRA.

Fill

form

: Try Risk Free

People Also Ask about

What does name with SR mean?

A man with the same name as his father uses “Jr.” after his name as long as his father is alive. His father may use the suffix “Sr.” for “senior.” The son may either drop the suffix after his father's death or, if he prefers, retain it so that he won't be confused with his late father.

What does SR mean for school?

SR = student restriction - means student is restricted from registration by their time assignment, student status, academic standing, holds or readmit term. C = closed class - means the class is full.

What is Form T661?

T661 Scientific Research and Experimental Development (SR&ED) Expenditures Claim.

What is a T661 form?

T661 Scientific Research and Experimental Development (SR&ED) Expenditures Claim.

What is the full form of SR&ED?

Scientific Research and Experimental Development (SR&ED) tax incentives.

How do I file an SR&ED in Canada?

In order for the CRA to process a SR&ED claim, a claimant must file with the CRA : prescribed forms (Form T661 and Schedule T2SCH31 or Form T2038( IND ), as applicable) containing the prescribed information in respect of an expenditure and the ITC earned on an expenditure by the SR&ED reporting deadline; and.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the t661 form 2011 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the t661 form 2011 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your t661 form 2011 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit t661 form 2011 on an Android device?

You can make any changes to PDF files, such as t661 form 2011, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is Canada T661?

Canada T661 is a tax form used to claim the Scientific Research and Experimental Development (SR&ED) tax incentive, which allows eligible Canadian businesses to receive tax credits or refunds for expenditures on qualifying research and development activities.

Who is required to file Canada T661?

Businesses, including corporations and partnerships, that have incurred eligible R&D expenditures in Canada are required to file Canada T661 to claim SR&ED tax credits.

How to fill out Canada T661?

To fill out Canada T661, taxpayers must provide detailed information about their R&D projects, including project descriptions, expenditures on qualifying activities, and supporting documentation. The form should be completed accurately and submitted with the income tax return.

What is the purpose of Canada T661?

The purpose of Canada T661 is to provide the Canada Revenue Agency (CRA) with the necessary information to assess a claimant's eligibility for SR&ED tax incentives and to facilitate the processing of claims for tax credits or refunds associated with R&D activities.

What information must be reported on Canada T661?

The information that must be reported on Canada T661 includes project details, types of eligible expenditures (such as wages, materials, and overhead costs), information about the skilled workforce involved, and descriptions of the scientific or technological advancements sought through the R&D activities.

Fill out your t661 form 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

t661 Form 2011 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.