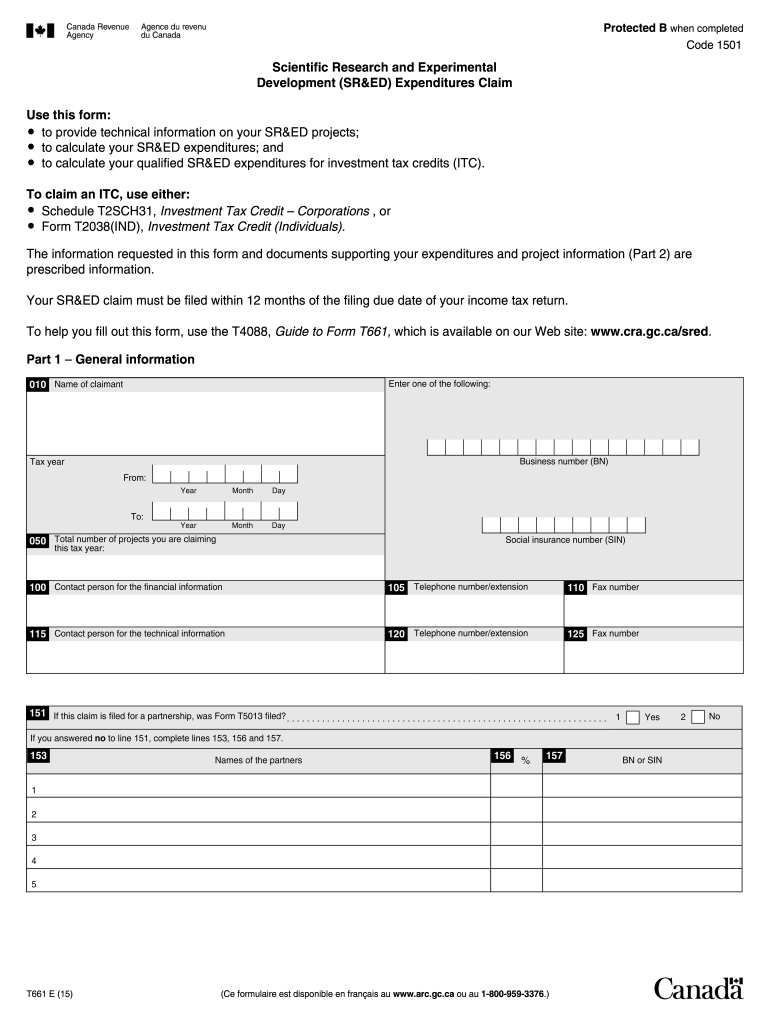

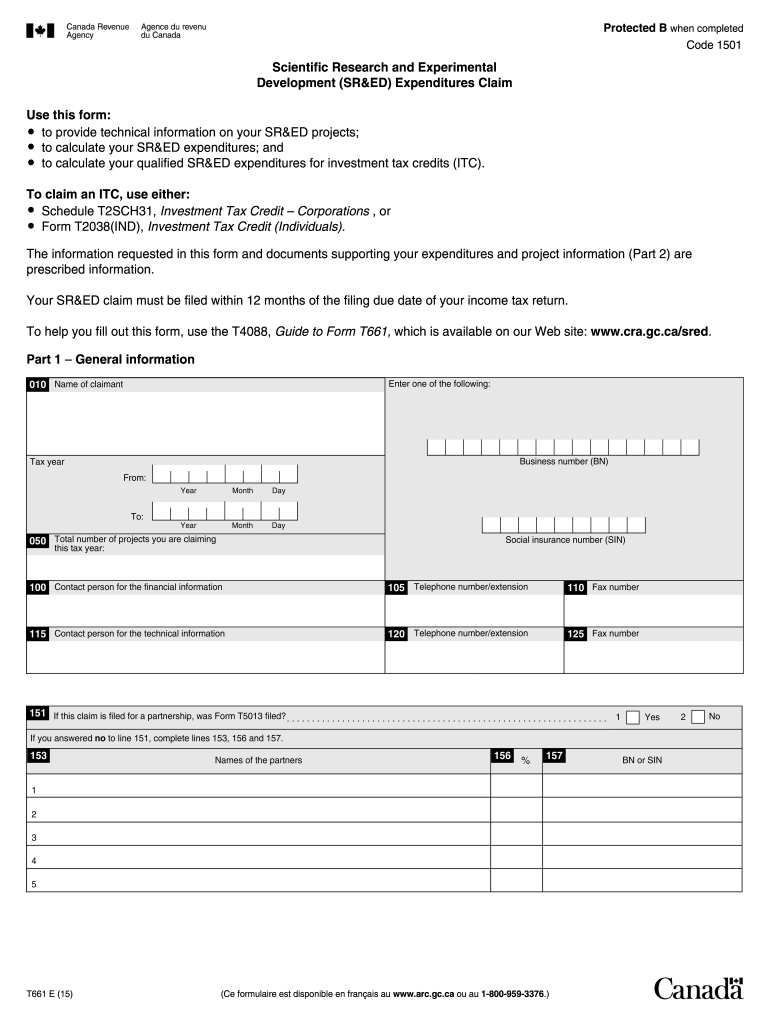

Canada T661 2015 free printable template

Get, Create, Make and Sign latest version of t661

How to edit latest version of t661 online

Uncompromising security for your PDF editing and eSignature needs

Canada T661 Form Versions

How to fill out latest version of t661

How to fill out Canada T661

Who needs Canada T661?

Instructions and Help about latest version of t661

Hi my name is Kevin Dean and I have clarity and co-director of SR and ed tax services what I'd like to talk to you about today is CRA s new version of the T 661 form every Stamp;ED claimed involving a taxpayer's fiscal year which ends on or after 1 January 2009 must use this revised t 661 there are two significant changes that I'd like to discuss today CRA has DE men stand up changes from taxpayers in regard to evidence they have to support their claim while they have 10 which they have generated while the SRM ed was in progress in that it must be declared to belong to one of 12 categories these documents must prove one the technological advancements sought to the technological obstacles 3 the work done for the start mandates and five the employees or contractors involved CRA has indicated which types of documents support which types of filing requirements for example records of trial runs cannot substantiate technological obstacles as a result contemporaneous creation of correct project documentation is crucial another major changes the elimination of free format technical descriptions instead projects must be described in two or three text boxes with severe word limits on each section in our opinion this word limit does not allow taxpayers either describe a business context of their s red projects nor describe to systemic aspects of complicated projects involving manufacturing trials or complicated software development cycles we anticipate that as a result many technical more technological reviews will be performed as CRA seeks further information about the projects as a result the prudent way for taxpayers to proceed is to write their technical descriptions of us as was done in previous years than cut paste and edit the appropriate material into the new t 661 but retain their original technical descriptions as it will be useful information to give to the CRE CRA technical reviewer if you think you could use some help with your Stamp;ED claims please give me a call or email me

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in latest version of t661?

Can I create an eSignature for the latest version of t661 in Gmail?

How do I edit latest version of t661 straight from my smartphone?

What is Canada T661?

Who is required to file Canada T661?

How to fill out Canada T661?

What is the purpose of Canada T661?

What information must be reported on Canada T661?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.