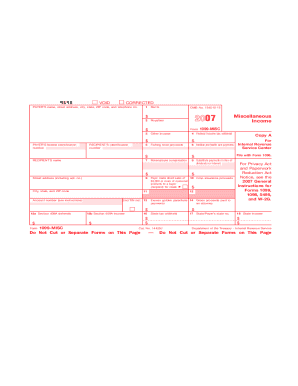

IRS 1099-MISC 2010 free printable template

Instructions and Help about IRS 1099-MISC

How to edit IRS 1099-MISC

How to fill out IRS 1099-MISC

About IRS 1099-MISC 2010 previous version

What is IRS 1099-MISC?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-MISC

What should I do if I need to amend my IRS 1099-MISC after submission?

If you discover an error in your already submitted IRS 1099-MISC, you can correct it by filing a Form 1099-MISC with the correct information, marking it as 'Corrected.' Make sure to provide an explanation for the changes, as this will help the IRS update their records accordingly. It's crucial to send this amended form as soon as possible to avoid potential penalties.

How can I verify if my IRS 1099-MISC has been processed?

To verify the processing of your IRS 1099-MISC, you can contact the IRS directly or check your records if you e-filed. Additionally, most e-filing services provide tools to track the status of your submission. Be aware of common rejection codes to address any issues timely and ensure proper processing of your form.

What are the legal considerations for filing an IRS 1099-MISC on behalf of someone else?

When filing an IRS 1099-MISC for another individual, it's essential to have the proper authorization, such as a Power of Attorney (POA). Ensure that you have all relevant information needed for accurate reporting and that the individual is aware of the filing to maintain transparency. It's vital to protect their privacy by handling their information securely throughout the process.

What common errors should I look out for when preparing my IRS 1099-MISC?

Some common errors include incorrect taxpayer identification numbers (TIN), mismatched names, or failing to report all required payments. To avoid these mistakes, double-check all entries and refer to previous filings for consistency. Utilizing e-filing software can help minimize errors by prompting for correct information and flagging discrepancies before submission.

See what our users say