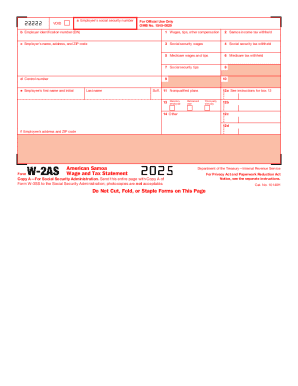

IRS W-2AS 2011 free printable template

Instructions and Help about IRS W-2AS

How to edit IRS W-2AS

How to fill out IRS W-2AS

About IRS W-2AS 2011 previous version

What is IRS W-2AS?

Who needs the form?

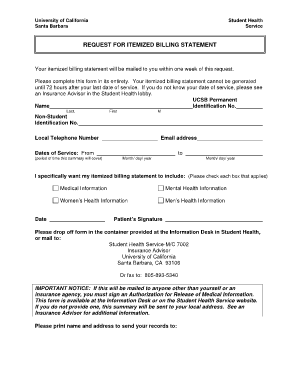

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

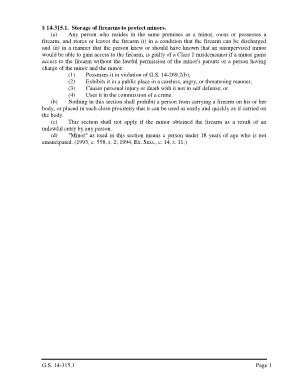

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

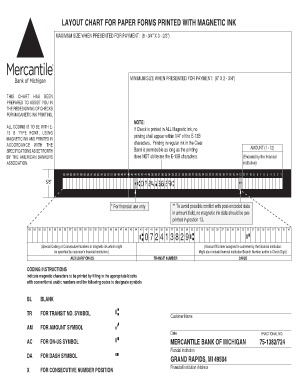

Where do I send the form?

FAQ about IRS W-2AS

What should I do if I realize I made a mistake on my 2011 w 2as form after submitting it?

If you discover an error after submission, you should prepare to submit a corrected 2011 w 2as form. It's crucial to indicate the corrections clearly and provide any necessary explanations or documentation. Additionally, keep a record of this revised filing for future reference.

How can I verify if my 2011 w 2as form has been processed by the IRS?

To check the status of your 2011 w 2as form, you can contact the IRS or use their online tools. Be prepared to provide identifying information, and make note of common e-file rejection codes which might necessitate your action if applicable.

What are some common errors to watch for when submitting a 2011 w 2as form?

When filing a 2011 w 2as form, watch out for errors such as incorrect taxpayer identification numbers or mismatches in reported income. These inaccuracies can lead to processing delays and potential audits, so it's essential to double-check your entries.

What are the privacy and data security considerations when submitting a 2011 w 2as form electronically?

When e-filing your 2011 w 2as form, ensure that you're using approved software and secure connections. Protect your sensitive information by verifying that you're on secure sites and that the software handles your data in compliance with privacy standards.

See what our users say