IRS 1040 Tax Table 2011 free printable template

Instructions and Help about IRS 1040 Tax Table

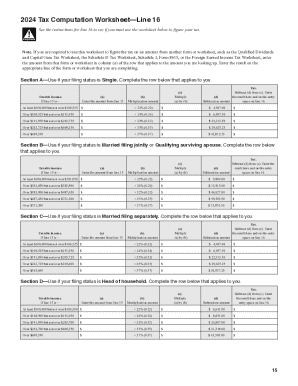

How to edit IRS 1040 Tax Table

How to fill out IRS 1040 Tax Table

About IRS 1040 Tax Table 2011 previous version

What is IRS 1040 Tax Table?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040 Tax Table

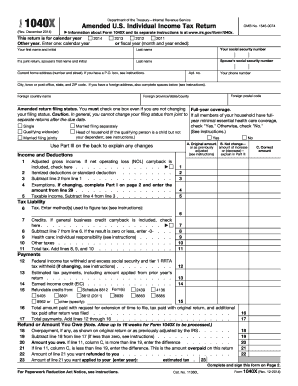

How can I amend my submitted IRS 1040 Tax Table if I've made an error?

To amend your submitted IRS 1040 Tax Table, you need to file Form 1040-X, which allows you to correct any mistakes found after you've submitted your original tax return. Ensure that you provide accurate details regarding the changes made, and submit the form to the address specified for your original filing. Remember to check the IRS website or consult a tax professional for specific guidance related to your situation.

What steps should I take if my e-filed IRS 1040 Tax Table gets rejected?

If your e-filed IRS 1040 Tax Table is rejected, first review the rejection notice for error codes and specific reasons for the rejection. Make necessary corrections promptly, then resubmit your tax table electronically. Keep track of your submission and any confirmation codes received post-resubmission, as this can help verify successful acceptance by the IRS.

How long should I retain records related to my IRS 1040 Tax Table?

It's advisable to retain records related to your IRS 1040 Tax Table for at least three years from the date you filed your return or the due date of your return, whichever is later. This period allows for any potential audits or inquiries from the IRS. For certain situations, such as unreported income, you may need to keep records for longer, so consult IRS guidelines for specific cases.

What should I do if I receive an IRS notice after filing my 1040 Tax Table?

Upon receiving an IRS notice after filing your IRS 1040 Tax Table, carefully read the notice to understand its nature and required actions. If the notice requests additional information or clarification, respond with the necessary documentation as quickly as possible. If you disagree with the notice, you can appeal the decision by following the instructions provided in the correspondence.

See what our users say