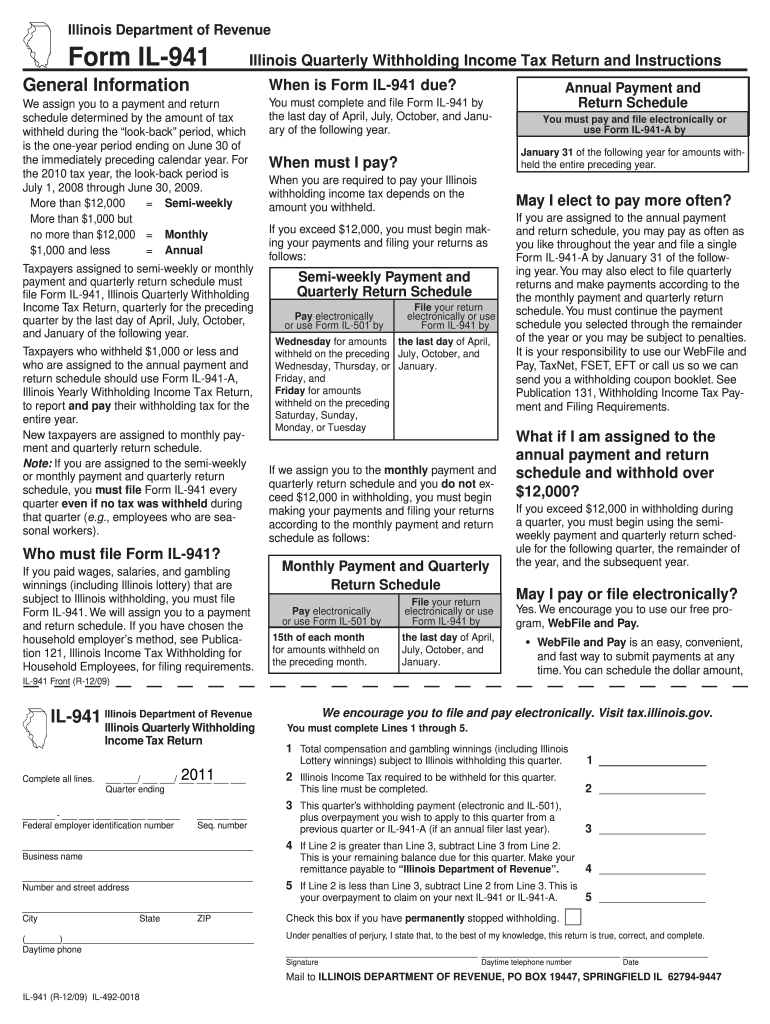

Who needs a form IL-941?

Employers in the State of Illinois have to file this form quarterly to report their federal income taxes to Internal Revenue Service.

What is form IL-941 for?

This federal tax return is used to report payments for medicare, social security and income taxes if an employer deducts them from employee’s salaries. Employer may use the payment voucher on page 3 and pay the taxes with this return but only in those situations described in the instructions above the voucher. Otherwise, the employer should use electronic funds in order to make the payment.

Is it accompanied by other forms?

Other than the payment voucher, which is necessary only in specific cases, this federal tax income return for employers does not require any addenda.

When is form IL-941 due?

The due date depends on the quarter during which the form is submitted. The due date for the first quarter is March, 12th; for the second quarter, June, 12th; for the third quarter, September, 12th; and for the fourth quarter, December, 12th.

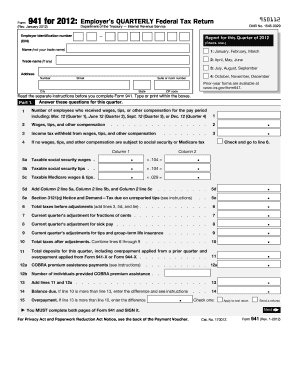

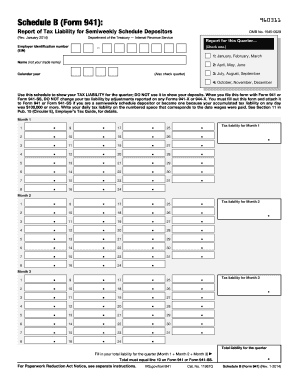

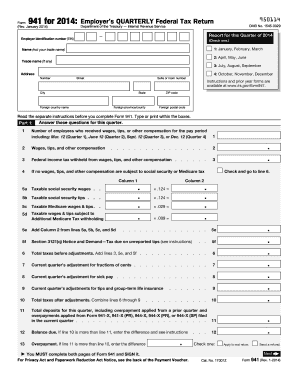

How do I fill out form IL-941?

The top box is for the information about your company. Include the employer’s identification number, company name and trade name (if any) and address. Check in the adjacent box the quarter you for which you are filing. Part 1 contains questions about the number of employees who received wages, tips or other types of compensations. You have to put the exact amount for these payments. Add a table of taxable social security wages and tips and Medicare wages and tips. Calculate total taxes before adjustments, fill in the current quarter adjustment and total taxes after adjustments. Give the amount of the deposit for this quarter and balance due, and if necessary, specify the overpayment. Part 2 of the form is dedicated to changes in the deposit schedule and tax liability. Give contacts of your designee if it’s possible.

Where do I send form IL-941?

Complete the Illinois income tax return form 2014 and file it electronically or send it to IRS office by mail.