Canada NR303 E 2010 free printable template

Show details

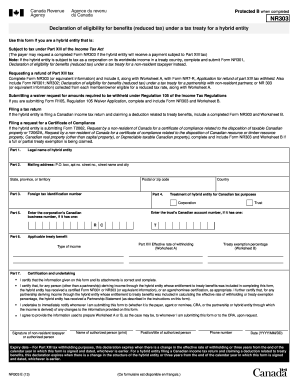

You may need to attach Form NR302 or NR303 to an application for a waiver in certain circumstances such as when the applicant for the waiver is a partnership or hybrid entity. For hybrid entities listed in column A the percent treaty exempt should be obtained from part 5 Treaty exemption percentage of Form NR303 for the hybrid entity. Mr. Smith provides a USCO is a hybrid entity and provides a completed Form NR303 to APAN. According to the NR303 ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form nr303 2010

Edit your form nr303 2010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form nr303 2010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form nr303 2010 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form nr303 2010. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada NR303 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form nr303 2010

How to fill out Canada NR303 E

01

Obtain a copy of the Canada NR303 E form from the Canada Revenue Agency website or other official sources.

02

Fill in your personal information including your name, address, and social insurance number at the top of the form.

03

Specify your role as the resident of Canada (individual or organization) and provide the corresponding details.

04

Identify the income being reported and fill in the relevant information related to the income source.

05

Indicate if you wish to claim any deductions or tax credits available under the tax treaty.

06

Sign and date the form at the designated section to validate your information.

07

Submit the completed form to the appropriate tax office as per the instructions provided.

Who needs Canada NR303 E?

01

Individuals or organizations that earn income from sources in Canada but also reside in another country.

02

Tax residents of Canada planning to claim a tax treaty benefit.

03

Non-resident investors looking to avoid double taxation on Canadian-source income.

Fill

form

: Try Risk Free

People Also Ask about

Does the NR301 expire?

Once certified that the non-resident taxpayer is subject to treaty-based tax benefits, the individual/ corporation/trust can claim the benefits of the treaty for 3 years from the date it was signed, and/or until there are changes in the taxpayer's eligibility for claiming the treaty benefits, such as: change in mailing

What form do I need to declare non-resident Canada?

Pros and Cons of Form NR73 If you are leaving Canada, you have the option of filling out the Determination of Residency Status form (Form NR73) with the CRA. Pros: By completing this form, the CRA can provide you with a notice of determination on your residency status.

Do Canadian non residents have to file a tax return?

As a non-resident of Canada, you pay tax on income you receive from sources in Canada. The type of tax you pay and the requirement to file an income tax return depend on the type of income you receive. Generally, Canadian income received by a non-resident is subject to Part XIII tax or Part I tax.

How long is a NR301 valid for?

How long is NR301 valid for? However, the information/certification has to be kept for 6 years from the end of the last tax year to which it relates for audit purposes.

Is NR301 required?

The completion of forms NR301, NR302 and NR303, is not mandatory. Equivalent information (on beneficial ownership, residency, and eligibility for treaty benefits) can be collected from multiple sources. You can enter the requested information on an in-house form that collects other information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form nr303 2010 directly from Gmail?

form nr303 2010 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit form nr303 2010 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing form nr303 2010, you can start right away.

How do I complete form nr303 2010 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your form nr303 2010. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is Canada NR303 E?

Canada NR303 E is a form used by non-residents of Canada who are receiving certain types of income from Canadian sources. It is used to report information related to withholding tax and to apply for reduced or exempt tax rates under tax treaties.

Who is required to file Canada NR303 E?

Non-residents of Canada who receive specific types of income such as royalties, pensions, or dividends from Canadian sources are required to file Canada NR303 E to ensure proper tax handling and to substantiate claims for reduced withholding tax rates.

How to fill out Canada NR303 E?

To fill out Canada NR303 E, applicants must provide personal information including their name, address, country of residence, and details about the income received. They must also include information about the applicable tax treaty and indicate which type of income is being reported.

What is the purpose of Canada NR303 E?

The purpose of Canada NR303 E is to facilitate non-residents in declaring their Canadian income and applying for the correct withholding tax treatment as per applicable tax treaties, thereby avoiding double taxation.

What information must be reported on Canada NR303 E?

Information that must be reported on Canada NR303 E includes the type of income, details of the payer, the country of residence of the non-resident, and the applicable tax treaty provisions that support any claim for reduced tax rates.

Fill out your form nr303 2010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form nr303 2010 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.