Canada NR303 E 2013-2026 free printable template

Show details

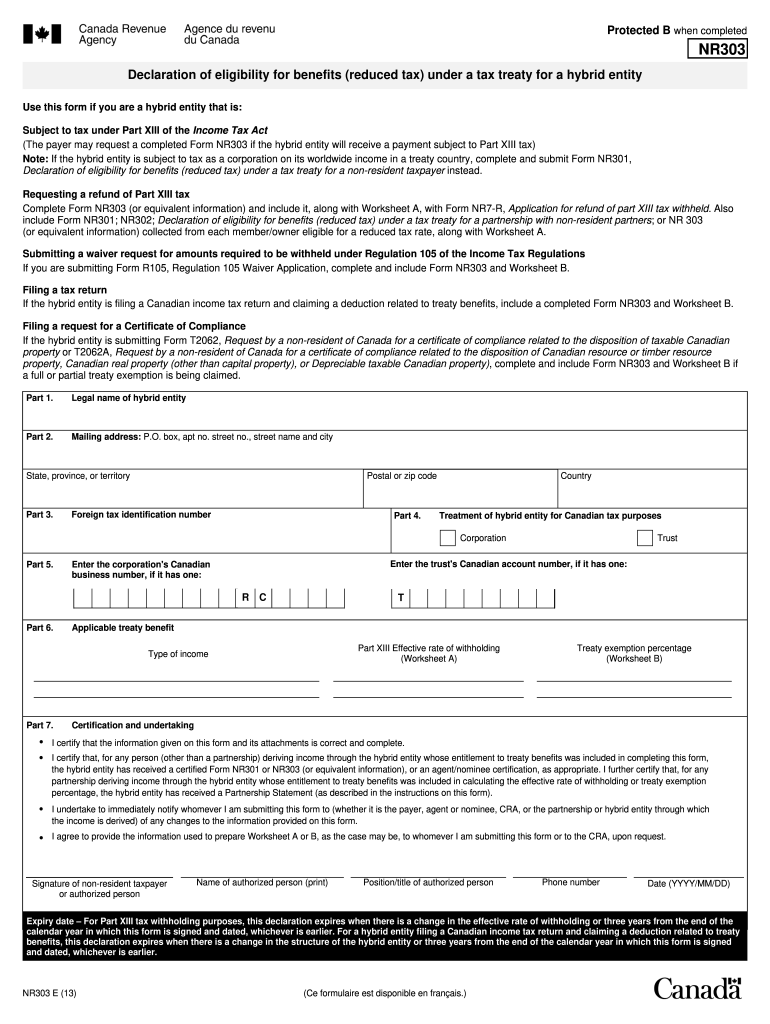

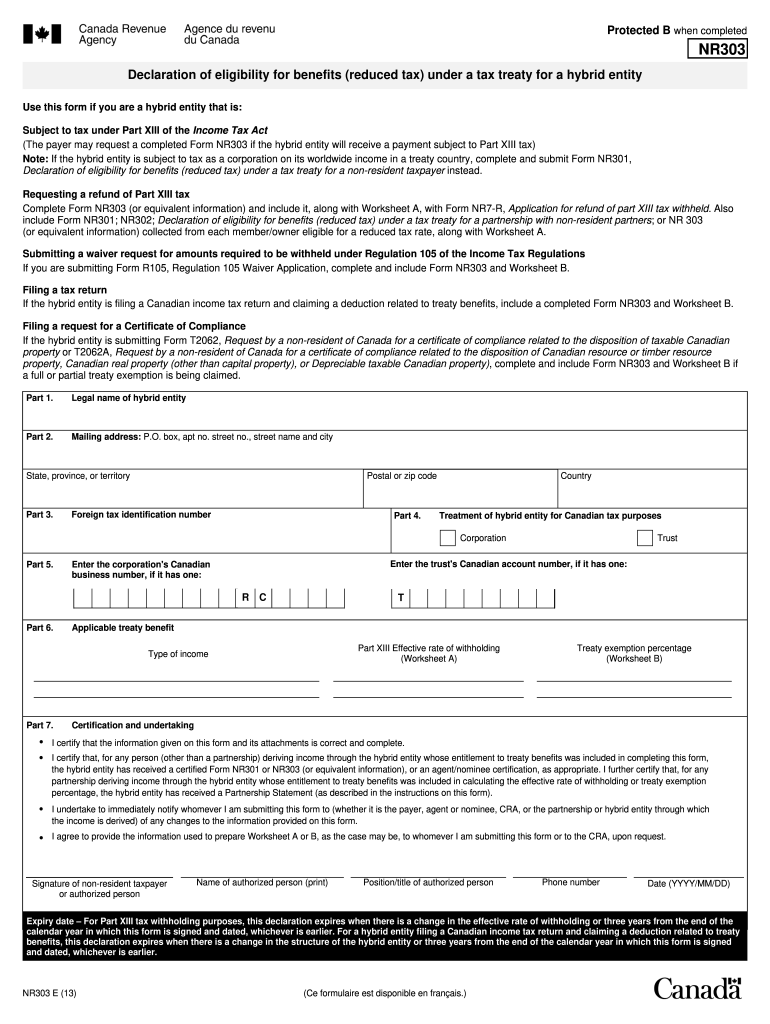

For hybrid entities listed in column A the percent treaty exempt should be obtained from part 6 Treaty exemption percentage of Form NR303 for the hybrid entity. NR303 E 13 Ce formulaire est disponible en fran ais. Do not use this form To support exemptions from tax under Article XXI of the Canada U.S. tax treaty. Mr. Smith provides a USCO1 is a hybrid entity and provides a completed Form NR303 to APAN. According to the NR303 the effective withholding rate for USCO1 is 5. Filing a tax return...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nr303 form

Edit your Canada NR303 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada NR303 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada NR303 E online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada NR303 E. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada NR303 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada NR303 E

How to fill out Canada NR303 E

01

Download the Canada NR303 E form from the official Canada Revenue Agency (CRA) website.

02

Read the instructions carefully provided at the beginning of the form.

03

Fill in your personal information including name, address, and Social Insurance Number (SIN).

04

Indicate your residency status in Canada.

05

Specify the type of income you are receiving from Canada.

06

Complete the certification section to declare that the information provided is true.

07

Review the form for any errors or missing information.

08

Submit the completed NR303 E form to the relevant tax authorities as instructed.

Who needs Canada NR303 E?

01

Individuals or entities that receive income from Canadian sources and are not residents of Canada may need to fill out the Canada NR303 E form.

02

Non-residents claiming a tax exemption or reduction based on a tax treaty between Canada and their country of residence.

Fill

form

: Try Risk Free

People Also Ask about

Can I claim back Canadian withholding tax?

Generally, the CRA can refund excess non-resident tax withheld if you complete and send Form NR7-R no later than two years after the end of the calendar year that the payer sent the CRA the tax withheld.

What form do I need to declare non-resident Canada?

Pros and Cons of Form NR73 If you are leaving Canada, you have the option of filling out the Determination of Residency Status form (Form NR73) with the CRA. Pros: By completing this form, the CRA can provide you with a notice of determination on your residency status.

What form do I need to declare non residency in Canada?

If you are still not sure whether you were a non-resident of Canada for tax purposes in 2022, complete Form NR74, Determination of Residency Status (entering Canada), or Form NR73, Determination of Residency Status (leaving Canada), whichever applies, and send it to the CRA as soon as possible.

Do Canadian non residents have to file a tax return?

As a non-resident of Canada, you pay tax on income you receive from sources in Canada. The type of tax you pay and the requirement to file an income tax return depend on the type of income you receive. Generally, Canadian income received by a non-resident is subject to Part XIII tax or Part I tax.

Can you claim Canadian tax back?

How does a tax refund work in Canada? Whenever the Canada Revenue Agency (CRA) collects more income tax from you than you owe, you'll receive the excess amount back as a refund.

Can you get back withholding tax?

With every paycheck, your employer withholds some of your earnings for taxes. If too much is withheld, it's true that you will receive a refund, but when you really think about it, by waiting until tax season to claim that money back, you've essentially provided the IRS with an interest-free loan during the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada NR303 E to be eSigned by others?

To distribute your Canada NR303 E, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the Canada NR303 E electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your Canada NR303 E in seconds.

How do I complete Canada NR303 E on an Android device?

Use the pdfFiller app for Android to finish your Canada NR303 E. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is Canada NR303 E?

Canada NR303 E is a tax form used by non-residents of Canada to report their Canadian-source income, such as employment income or rental income, and to claim any applicable tax treaty benefits.

Who is required to file Canada NR303 E?

Non-residents of Canada who earn income from Canadian sources and wish to claim a reduced withholding tax rate or exemption as per the tax treaty provisions are required to file Canada NR303 E.

How to fill out Canada NR303 E?

To fill out Canada NR303 E, individuals must provide their personal information, the type of income received, applicable tax treaty article, and details necessary to justify the reduced withholding tax rate or exemption they are claiming.

What is the purpose of Canada NR303 E?

The purpose of Canada NR303 E is to allow non-residents to report their income from Canadian sources and to claim any applicable reductions in tax withholding based on tax treaties between Canada and their country of residence.

What information must be reported on Canada NR303 E?

The information that must be reported on Canada NR303 E includes the taxpayer's identification details, the full description of the income, the country of residence, and the specific tax treaty article being claimed for any benefits.

Fill out your Canada NR303 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada nr303 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.