IRS 5472 2011 free printable template

Show details

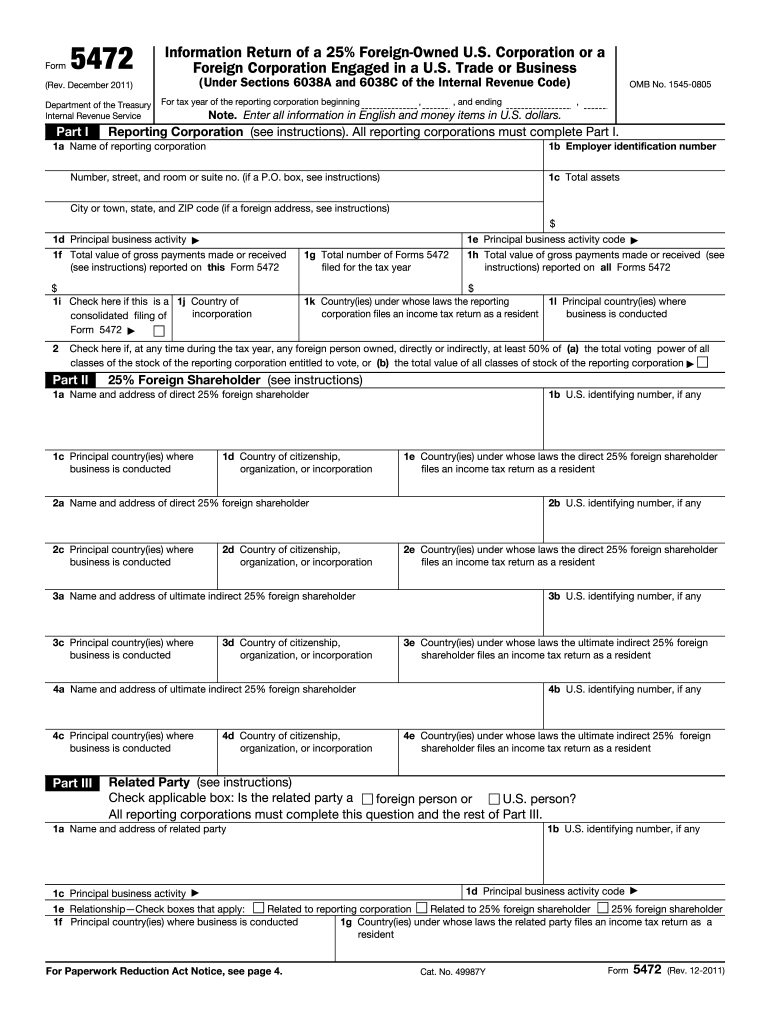

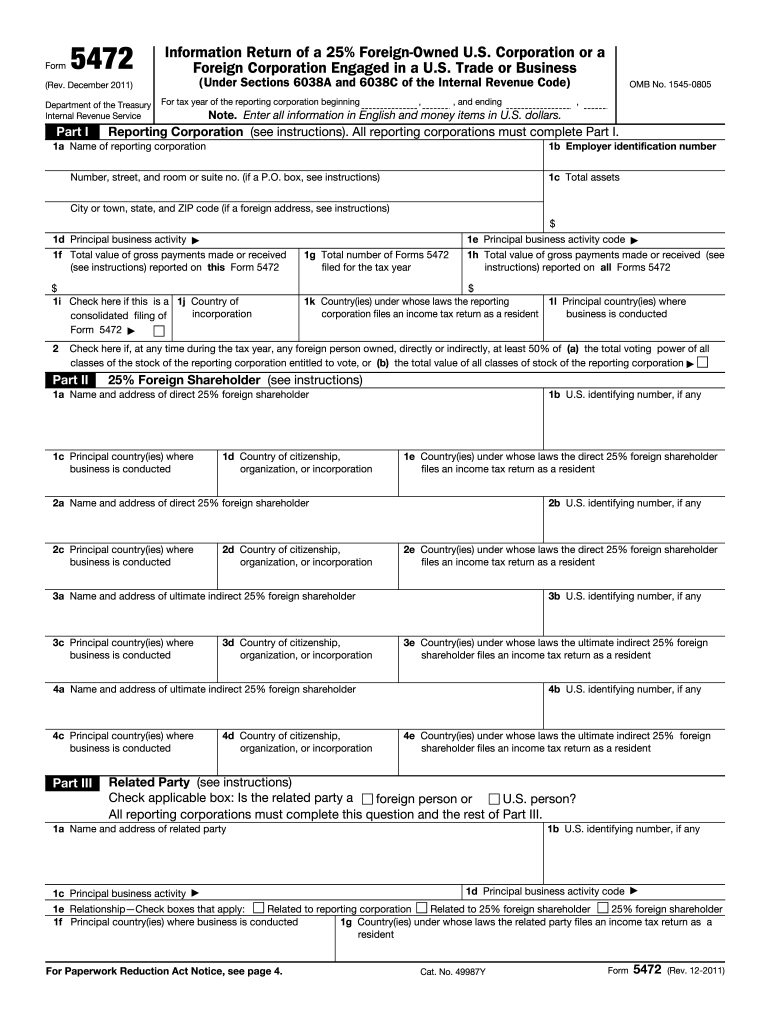

General Instructions Section references are to the Internal Revenue Code unless otherwise noted. What s New T. D. 9529 2011-30 I. R.B. 57 removed the duplicate filing requirement for Form 5472 contained in Regulations sections 1. Cat. No. 49987Y Rev. 12-2011 Form 5472 Rev. 12-2011 Page Monetary Transactions Between Reporting Corporations and Foreign Related Party see instructions Caution Part IV must be completed if the foreign person box is chec...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign form 5472 instructions 2011

Edit your form 5472 instructions 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 5472 instructions 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 5472 instructions 2011 online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 5472 instructions 2011. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 5472 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 5472 instructions 2011

How to fill out IRS 5472

01

Download IRS Form 5472 from the IRS website.

02

Fill out your name and address in Part I, Line 1a.

03

Enter the employer identification number (EIN) in Line 1b.

04

Provide the country of incorporation in Line 2.

05

Complete Part II with information about the foreign related party, including their name and address.

06

Fill in transactions with your foreign related party in Part III.

07

Ensure all applicable boxes are checked to indicate the types of transactions.

08

Review the form for accuracy and completeness.

09

Sign and date the form in Part IV.

10

Submit the form along with your tax return by the due date.

Who needs IRS 5472?

01

Any foreign corporation that is engaged in a trade or business in the U.S.

02

U.S. corporations that have foreign owners owning at least 25% of the company.

03

Entities that engage in reportable transactions with foreign related parties.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 5472 instructions?

More In Forms and Instructions Corporations file Form 5472 to provide information required under sections 6038A and 6038C when reportable transactions occur with a foreign or domestic related party.

What transactions are to be reported on Form 5472?

The following are the reportable transactions listed in Part IV of the Form 5472*: Purchases/Sales of stock in trade (inventory). Purchases/Sales of tangible property other than stock in trade. Platform contribution transaction payments received/paid. Cost-sharing transaction payments received/paid.

Is Form 5472 required if no reportable transactions?

(1) No reportable transactions. A reporting corporation is not required to file Form 5472 if it has no transactions of the types listed in paragraphs (b) (3) and (4) of this section during the taxable year with any related party. (2) Transactions solely with a domestic reporting corporation.

How to file a final form 5472?

How to File Forms 5472 and 1120 for a Foreign-Owned Single Member Get an Employer Identification Number (EIN) In order to file Form 5472, you have to apply for a U.S Employer Identification Number, or EIN. Fill out Form 5472. Fill out Pro Forma Form 1120. 4. Mail or Fax Forms 5472 and 1120 to the IRS.

What is the purpose of Form 5472?

Corporations file Form 5472 to provide information required under sections 6038A and 6038C when reportable transactions occur with a foreign or domestic related party.

What is the 5472 filing requirement?

Who has to file? A U.S. corporation with 25% or more foreign ownership, or foreign corporations that do business or trade in the U.S. are required to file IRS Form 5472. You must report the existence of all related parties in Form 5472 as well, and fill out a separate form for each foreign owner.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 5472 instructions 2011 to be eSigned by others?

Once you are ready to share your form 5472 instructions 2011, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make edits in form 5472 instructions 2011 without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing form 5472 instructions 2011 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit form 5472 instructions 2011 on an Android device?

You can make any changes to PDF files, like form 5472 instructions 2011, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is IRS 5472?

IRS 5472 is a form that is used by foreign-owned U.S. disregarded entities to report information about certain transactions with related parties.

Who is required to file IRS 5472?

A foreign corporation that owns a U.S. disregarded entity and any U.S. disregarded entity that has a foreign owner is required to file IRS 5472.

How to fill out IRS 5472?

To fill out IRS 5472, the entity must provide information about itself, the foreign owner, and the transactions between them, following the instructions provided by the IRS.

What is the purpose of IRS 5472?

The purpose of IRS 5472 is to ensure that the IRS is informed about the financial activities between foreign owners and U.S. disregarded entities to prevent tax evasion.

What information must be reported on IRS 5472?

The information that must be reported on IRS 5472 includes details about the reporting entity, the foreign owner, and the nature and amount of related party transactions.

Fill out your form 5472 instructions 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 5472 Instructions 2011 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.