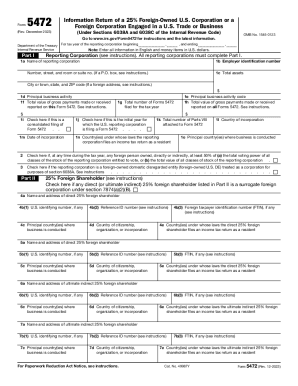

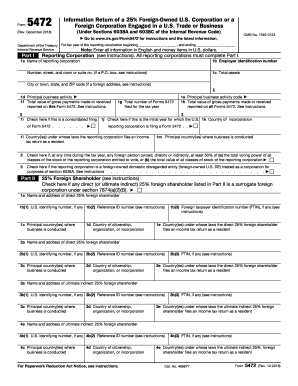

IRS 5472 2012 free printable template

Get, Create, Make and Sign form 5472 2012

How to edit form 5472 2012 online

Uncompromising security for your PDF editing and eSignature needs

IRS 5472 Form Versions

How to fill out form 5472 2012

How to fill out IRS 5472

Who needs IRS 5472?

Instructions and Help about form 5472 2012

Forum 54 72 is an information tax return that must be filed by reportable corporations that have reportable transactions with related parties a reporting corporation is generally an u.s. corporation that is 25% foreign owned or a foreign corporation that is engaged in a trade or business in the U.S. in part one you have basic information about the reporting corporation such as its name address employer identification number total assets and business activity online 1f you list the total payments made or received as reported on this 54 72 note that a separate form 54 72 is required for each related party that there are reportable transactions for example if a reporting corporation has reportable transactions with two related parties then two forms 54 72 should be filed one for each of the related parties line 1g asks how many forms 54 72 are being filed by the reporting Corporation and line 1h asks for the total payments made or received for all 54 72 s if the reporting corporation is part of an affiliated group filing an u.s. consolidated tax return then a consolidated form 54 72 can be filed by the group you list the country of incorporation the country where the reporting corporation files its tax return as a resident and the principal country where it conducts business on line 2 you check the box if the reporting corporation had a 50 percent or greater foreign shareholder part 2 needs to be completed only by US corporations foreign corporations engaged in a trade or business in the United States can skip part 2 entirely the term 25% foreign owned can be a bit misleading to be considered 25 percent foreign owned the U.S. corporation must have at least one direct or indirect 25 percent foreign shareholder if an u.s. corporation were owned 20 percent each by five foreign persons that were unrelated to each other you might think that the U.S. corporation would be 25 percent foreign owned, but it wouldn't be because it doesn't have a 25 percent for shareholder a reporting corporation can have direct form shareholders and indirect foreign shareholders on lines one and two of part two you list the basic information about the direct 25% foreign shareholders and on lines three and four you list the basic information about the ultimate indirect 25% foreign shareholders' revenue procedure ninety-one — 55 has some examples of situations of direct 25% foreign shareholders and ultimate indirect 25% foreign shareholders part three of forum 54 72 lists the information about the related party for which there were reportable transactions as mentioned before a separate forum 54 72 is prepared for each related party that there are reportable transactions this part 3 identifies which related party the 54 72 is being filed for parts four and five are completed only for reportable transactions with foreign related parties if the transactions are with us related parties you still need to file form 54 72, but you do not need to list the amounts in parts four or five...

People Also Ask about

What is a w9 form used for?

Can I download and print tax forms?

Who needs to fill out a W9?

What is a W9 and when is it required?

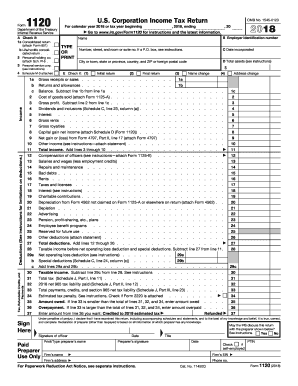

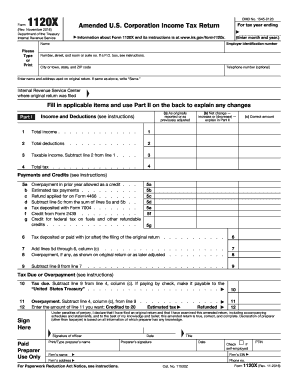

What is the main IRS form?

How do I get an official IRS form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 5472 2012 online?

Can I create an eSignature for the form 5472 2012 in Gmail?

How can I fill out form 5472 2012 on an iOS device?

What is IRS 5472?

Who is required to file IRS 5472?

How to fill out IRS 5472?

What is the purpose of IRS 5472?

What information must be reported on IRS 5472?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.