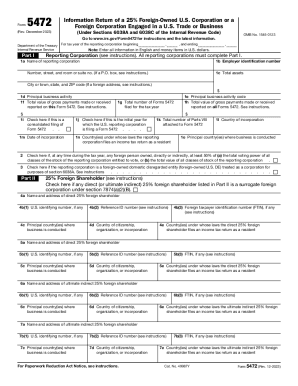

IRS 5472 2021 free printable template

Get, Create, Make and Sign 5472

Editing 5472 online

Uncompromising security for your PDF editing and eSignature needs

IRS 5472 Form Versions

How to fill out 5472

How to fill out IRS 5472

Who needs IRS 5472?

Instructions and Help about 5472

Hello everyone I've been asked this question a number of times, so I'm making a video to explain and show all the support and go into the nitty-gritty details of what is a reportable transaction for forum 5 for 72 and this is for basically for if you own an if you're a foreign person, and you have a single member, and you have an LLC in the US and you open the LLC in the current year, and you put money in your company bank account you have to file this form the penalty for not filing the form or for filing it late is 10000, so you need to complete this form and to answer my question the reportable transactions are the same if you are it's a foreign owned corporation or if it's foreign owned LLC with one exception so, and it's a single member LLC, so a partnership sum will have to file this form so if you have is there's a corporation if you are had a corporation you have more than 25 percent of it is from a foreign owner and a foreign person would be a non-us resident that's fine, but you have to file this form to report the transactions the trends specifically listed which will go over between foreign related parties and the US corporation, and also you need to file it for us related parties we don't need to include the information, so you'd file this page for a US related party where you do business, and you can leave a page to blank, so I'm not going to go into details how to fill out the form there are instructions and I have them right here, so you can check out the instructions but if you are, so we'll start with an LLC we'll start with the corporation if you're a corporation the purpose of this form is to provide information required in these code sections when reportable transactions occur during the tax year of a reporting corporation and our reporting corporation is a corporation with more than 25 percent foreign owners, and it goes through here 25 percent for 9 25 foreign shareholder direct or ultimate indirect 25 percent foreign shareholder so if this is owned by a court it's owned by foreign shareholder then this would still indirectly be owned by foreign person, so reportable transactions are any type of transaction listed in part 4 we've got that right here part 4 monetary transaction is between reporting corpse and foreign related parties, so this would be sales of stock-in-trade inventory sales of property contributions cost sharing transactions rents royalties any other sales any other consideration received and this is um sales you had and then these are purchases the reporting company has so if the company is purchasing inventory from a foreign related party you just report here the total amount of the purchases during the year and if it's all of your purchases are from this that should match your cost of goods sold on your tax return, so these are you have to fill this out, and you have to do it accurately and again if you do it incorrectly incomplete or wrong or late then the IRS is just going to can assess the 10000...

People Also Ask about

Who must file IRS Form 5472?

What is 5472 form used for?

Is Form 5472 required?

What transactions are reported on Form 5472?

What are the exceptions to filing Form 5472?

What is the difference between IRS Form 5471 and 5472?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 5472 for eSignature?

Can I create an electronic signature for the 5472 in Chrome?

How do I fill out 5472 using my mobile device?

What is IRS 5472?

Who is required to file IRS 5472?

How to fill out IRS 5472?

What is the purpose of IRS 5472?

What information must be reported on IRS 5472?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.