IRS Instructions 8857 2014 free printable template

Show details

Future Developments For the latest information about developments related to Form 8857 and its instructions such as legislation enacted after they were published go to www.irs.gov/form8857. Send Form 8822 to the address shown in the addresses shown in these Form 8857 instructions. Generally it takes 4 to 6 weeks to process your change of address. If the address on line 4 matches the address in our records you do not need to file Form 8822 unless ...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 8857

Edit your IRS Instructions 8857 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 8857 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Instructions 8857 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS Instructions 8857. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 8857 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instructions 8857

How to fill out IRS Instructions 8857

01

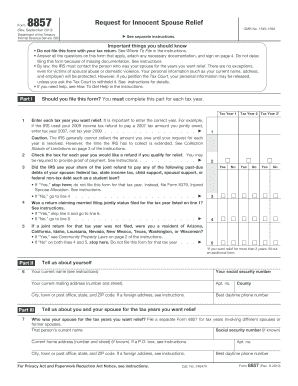

Gather necessary documents: Collect all relevant financial documents, including income statements, tax returns, and any documentation related to your tax liability.

02

Identify the reason for requesting relief: Determine if you qualify for innocent spouse relief, separation of liability, or equitable relief.

03

Complete the form: Fill out IRS Form 8857 with accurate information, ensuring to provide all required details about your spouse's income and any applicable adjustments.

04

Explain your situation: Clearly describe why you believe you qualify for relief, including any pertinent details about your marriage and financial situation.

05

Attach supporting documents: Include copies of any relevant documents that support your claim, such as tax returns or evidence of income discrepancies.

06

Sign and date the form: Ensure that both you and your spouse (if applicable) sign and date the form before submitting it.

07

Submit the form: Send the completed Form 8857 to the appropriate IRS office as indicated in the form instructions.

Who needs IRS Instructions 8857?

01

Individuals who filed a joint tax return but believe they should not be held responsible for tax, interest, and penalties due to specific circumstances related to their spouse.

02

Those who were adversely affected by their spouse's tax reporting or tax liability and believe they qualify for relief under IRS guidelines.

03

People seeking to separate their tax liability from their spouse or ex-spouse due to divorce or separation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in IRS Instructions 8857?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your IRS Instructions 8857 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out IRS Instructions 8857 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign IRS Instructions 8857 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete IRS Instructions 8857 on an Android device?

Use the pdfFiller Android app to finish your IRS Instructions 8857 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

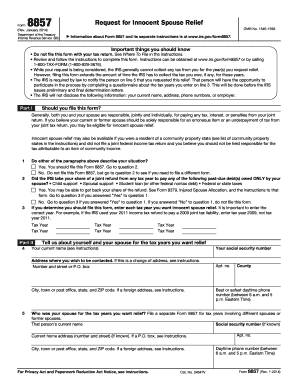

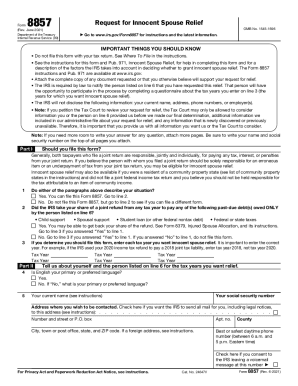

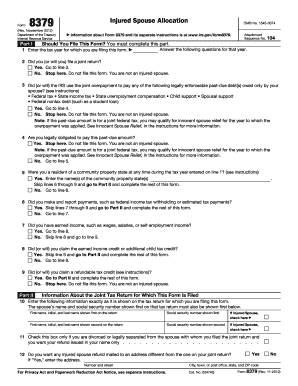

What is IRS Instructions 8857?

IRS Instructions 8857 refer to the instructions for Form 8857, which is the Request for Innocent Spouse Relief. This form allows a spouse to request relief from joint tax liability when the other spouse incorrectly reported income or claimed improper deductions or credits.

Who is required to file IRS Instructions 8857?

Individuals who believe they should qualify for innocent spouse relief and have filed a joint tax return must file IRS Form 8857 to request relief from joint liability.

How to fill out IRS Instructions 8857?

To fill out IRS Form 8857, you need to provide personal information, details about the joint return, the reason you believe you qualify for relief, and any supporting documentation related to the request.

What is the purpose of IRS Instructions 8857?

The purpose of IRS Instructions 8857 is to guide individuals on how to properly complete Form 8857 to seek relief from tax liabilities incurred on a joint tax return, specifically when one spouse is not responsible for the tax liability.

What information must be reported on IRS Instructions 8857?

Information that must be reported on Form 8857 includes personal identification details, particulars of the joint return, the nature of the tax issues, the claimed innocence or lack of knowledge about inaccuracies, and other relevant financial information.

Fill out your IRS Instructions 8857 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 8857 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.