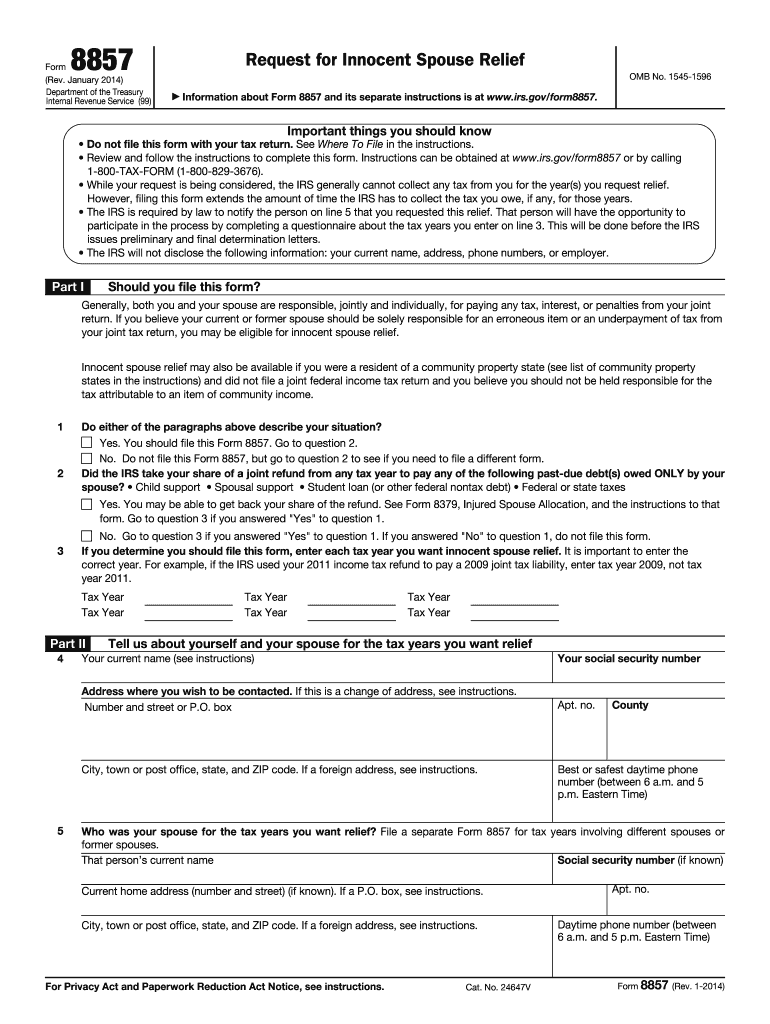

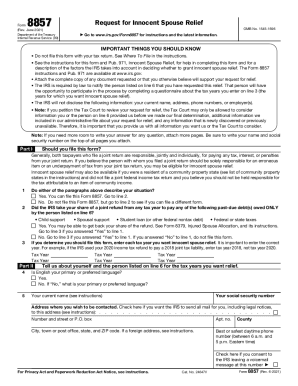

Who needs an IRS Form 8857?

An IRS form 8857 which is a Request for Innocent Spouse Relief should be submitted by person who believes and can prove that their spouse or ex-spouse should be held responsible for all or part of the tax. Therefore, a person filing the 8857 Request Form avoids paying their spouse’s tax and applied penalties, in case the claimant can prove that no benefit has been gained from underreporting or failure to report.

What is IRS Form 8857 for?

The fillable IRS 8857 Form is designed to release a person from paying their spouse’s taxes, which weren’t fully reported or concealed without claimant’s being aware of such fact.

Is the Tax form 8857 accompanied by other forms?

If spouses who are legally separated are concerned, the divorce decree must be attached.

When is IRS 8857 form due?

The fillable form must be filed with the IRS as soon as a person discovers a tax liability incident, according to their belief, for which they shouldn’t be held responsible jointly with their spouse. The revealing of such an incident can occur when the IRS furnishes an appropriate notice.

The form must be filled out no later than since two years after the IRS’s first attempt to collect taxes from the “innocent spouse”.

How do I fill out the IRS 8857 fillable form?

The IRS form 8857 itself has very comprehensive and detailed instruction, which should be strictly followed.

Where do I send the IRS tax form 8857?

The completed Request for Innocent Spouse Relief form must be submitted with the IRS local office.