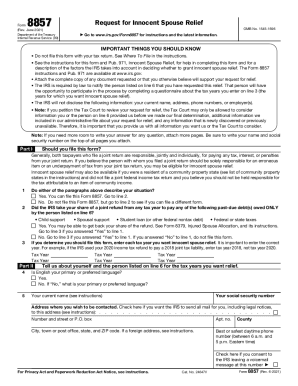

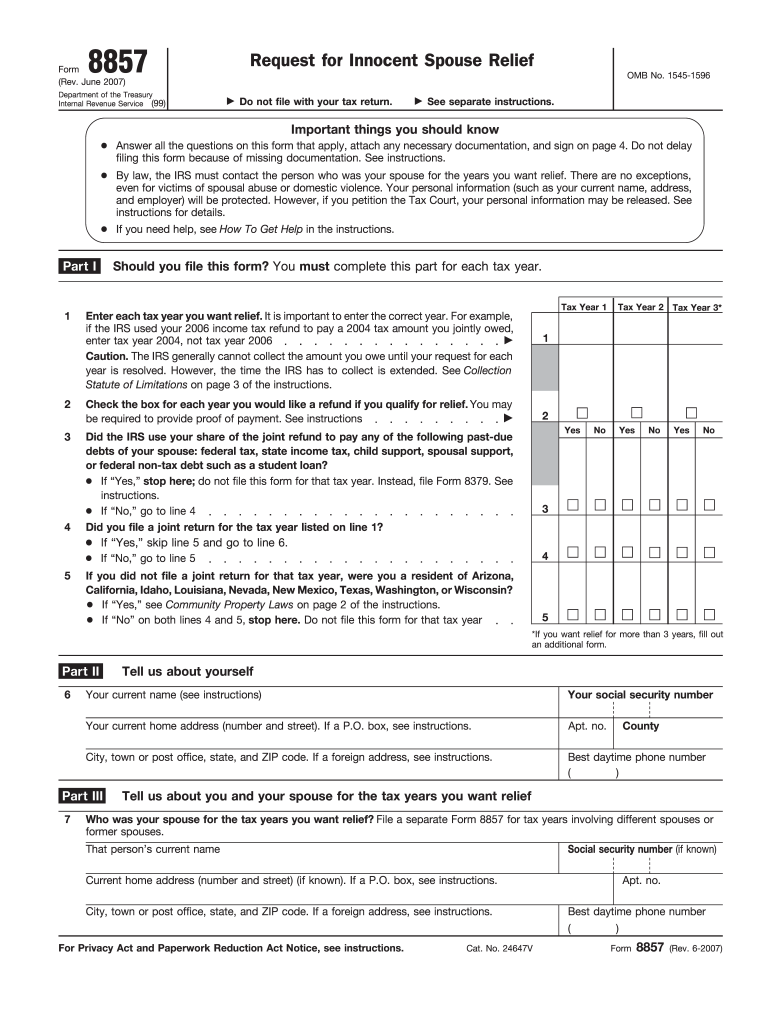

IRS 8857 2007 free printable template

Instructions and Help about IRS 8857

How to edit IRS 8857

How to fill out IRS 8857

About IRS 8 previous version

What is IRS 8857?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8857

What should I do if I made a mistake on my submitted form 8857 from irs?

If you discover an error after submitting your form 8857 from irs, you may need to file an amended form. It's essential to gather all relevant documentation to support your corrections and ensure that the new submission accurately reflects your financial situation. Remember to track the status of your amended form for timely processing.

How can I track the status of my form 8857 from irs after submission?

To verify the receipt and processing of your form 8857 from irs, you can use the IRS online tools designed for tracking your submissions. Make sure to have your details ready for a smooth experience, as these tools can provide insights into common processing issues and e-file rejection codes if applicable.

What are the legal implications of using an e-signature for form 8857 from irs?

Using an e-signature on your form 8857 from irs is generally accepted by the IRS, provided it meets specific criteria. It's important to maintain compliance with e-signature regulations to ensure that your submission is valid and protect your privacy and data security throughout the process.

What should I do if I receive an audit notice after submitting form 8857 from irs?

Receiving an audit notice after filing your form 8857 from irs can be daunting, but staying organized is key. Prepare to gather all documentation related to your submission and consider seeking professional advice on how to respond. Be proactive in communicating with the IRS to clarify any points and resolve issues.

Are there common errors to avoid when submitting form 8857 from irs?

Yes, there are several common errors you should watch out for when submitting form 8857 from irs. Miscalculating amounts, omitting required information, and not checking for inconsistencies can result in processing delays. Always double-check your entries to help ensure your submission is accurate and complete.

See what our users say