PR AS 2916.1 2006 free printable template

Show details

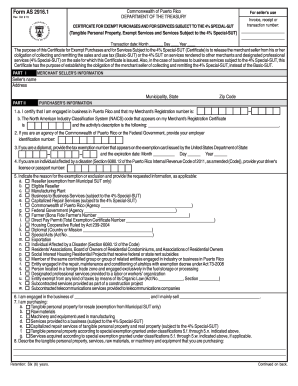

I will only use this certificate to buy taxable items for which I am entitled to claim an exemption or exclusion. If I acquire taxable items but I use or consume them for non-exempt purposes in Puerto Rico I will report and pay the sales and use tax directly to the Department of the Treasury. Purchaser s name Telephone Retention Six 6 years. State INSTRUCTIONS Who must complete this form This form must be completed by 1. Form AS 2916. 1 Commonwealth of Puerto Rico DEPARTMENT OF THE TREASURY...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign puerto rico tax form

Edit your puerto rico tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your puerto rico tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit puerto rico tax form online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit puerto rico tax form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PR AS 2916.1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out puerto rico tax form

How to fill out PR AS 2916.1

01

Begin with the identification section: enter your full name and contact details.

02

Provide the date of the application in the specified format.

03

Complete the sections regarding your personal background and qualifications.

04

Specify the purpose of your application clearly.

05

Refer to any previous related applications or reference numbers, if applicable.

06

Attach required documents such as proof of identity or educational qualifications.

07

Review all filled sections for accuracy and completeness.

08

Sign and date the form at the designated area.

Who needs PR AS 2916.1?

01

Individuals seeking to apply for specific permits or registrations related to their professional qualifications.

02

Organizations or businesses that require compliance with regulatory standards.

03

Professionals in fields that necessitate formal recognition of their credentials.

Fill

form

: Try Risk Free

People Also Ask about

When was Section 936 repealed?

(Section 936 was phased out over the ten year period from the beginning of 1996.) The top line in Figure 1 shows the course of manufacturing employment from 1990 to 2013. From its peak of 159.1 thousand employees in 1995, manufacturing fell off sharply.

What economic crisis was created by the elimination of Section 936?

However, because section 936 made foreign investment in Puerto Rico artificially attractive – creating, in effect, an economic bubble – it left the island vulnerable to a crash if the tax provisions were ever to be repealed.

What is the year of move exception in Puerto Rico?

The “Year of the Move” Exception Maintaining a tax home in Puerto Rico for the last 183 days of the year. Not having been a bona fide resident of Puerto Rico in the three tax years before the year of the move. Achieving bona fide residency in the year of the move and the two years following it.

What is Section 936 of the US tax code?

How Section 936 Works. Section 936, a provision of the U.S. Internal Revenue Code, was passed in 1976, replacing an earlier tax-incentive law. Section 936 exempts U.S.-based companies operating in Puerto Rico and other U.S. possessions from paying federal income taxes on the production of their subsidiaries.

What are the tax exemptions for Puerto Rico?

U.S. citizens who become bona fide residents of Puerto Rico can maintain their U.S. citizenship, avoid U.S. federal income tax on capital gains, including U.S.-source capital gains, and avoid paying any income tax on interest and dividends from Puerto Rican sources.

Does Puerto Rico have a sales tax exemption certificate?

If you buy products at retail in Puerto Rico in order to resell them, you can often avoid paying sales tax when purchasing those products by using a Puerto Rico resale certificate, otherwise known as an exemption certificate.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete puerto rico tax form online?

Filling out and eSigning puerto rico tax form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the puerto rico tax form in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your puerto rico tax form in minutes.

How do I edit puerto rico tax form on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign puerto rico tax form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is PR AS 2916.1?

PR AS 2916.1 is a regulatory form required for specific reporting compliance within certain sectors, detailing operational or financial data.

Who is required to file PR AS 2916.1?

Entities operating within the designated sectors as specified by regulatory authorities are required to file PR AS 2916.1.

How to fill out PR AS 2916.1?

To fill out PR AS 2916.1, follow the provided guidelines, ensuring all required fields are accurately completed and supported by necessary documentation.

What is the purpose of PR AS 2916.1?

The purpose of PR AS 2916.1 is to ensure regulatory transparency and accountability by capturing essential data from affected entities.

What information must be reported on PR AS 2916.1?

The information required on PR AS 2916.1 typically includes financial figures, operational metrics, and compliance-related data as mandated by the regulatory framework.

Fill out your puerto rico tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Puerto Rico Tax Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.