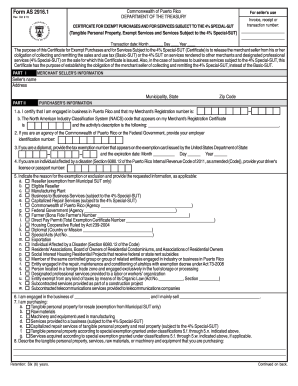

PR AS 2916.1 2013 free printable template

Get, Create, Make and Sign PR AS 29161

How to edit PR AS 29161 online

Uncompromising security for your PDF editing and eSignature needs

PR AS 2916.1 Form Versions

How to fill out PR AS 29161

How to fill out PR AS 2916.1

Who needs PR AS 2916.1?

Instructions and Help about PR AS 29161

Hello and welcome to the permanent resident card application video at Emma Group this video serves as a guide for those persons who are applying for a permanent resident card and need instruction on how to complete their application we will go through the application step by step the application can be obtained from Citizenship and Immigration Canada or from our offices in this video we will discuss how to complete the PR card application the additional documentation you must provide obtaining and completing the supplementary form photograph specifications and paying your government fees many of the sections in this application form are simple and straightforward however some sections in the application can cause some confusion we will discuss those sections right now the MM five four four four the application for a permanent resident card Part A section one you must write your name as it appears on your lining document if you currently use a different name than the one you had when you entered the country because of a marriage divorce or legal name change you must fill in section two with your new name you're expected to provide evidence of your name change such as a marriage certificate divorce certificate or notice from a government agency approving your name change Part C section 16 if you have been a permanent resident for five years or more you must list all the addresses where you have lived for a full five years if you have been a permanent resident for less than five years you must list all the addresses where you have lived for the entire time you have been a permanent resident if you have traveled to a foreign country you do not have to list where you stayed unless you travelled for an extended period of time and considered the address to be a residence Part C section 17 if you have been a permanent resident for five years or more you must list your entire employment or study history for a full five years if you have been a permanent resident for less than five years you must list your employment or study history for the entire time you have been a permanent resident if you have not worked or studied during this time right not applicable in the space provided Part C section 18 if you have been a permanent resident for five years or more you must list all of your travel outside of Canada for a full five years if you have been a permanent resident for less than five years you must list all of your travel outside of Canada for the entire time you have been a permanent resident if you haven't traveled outside the Canada in this time right not applicable in the space provided day trips into the United States where you did not stay overnight do not need to be included however if you stayed overnight in any other country then you must list that trip in the end you must add up all the days that you were absent from Canada if the number is 1095 days or more you must move on to Section D if the number is 1090 four days or less than move on to...

People Also Ask about

Does Puerto Rico have tax exempt status?

What is the certificate for exempt purchases in Puerto Rico?

What is the Act 20 and 22 in Puerto Rico?

How can I move to Puerto Rico to avoid taxes?

Does Puerto Rico have tax exemption?

Is Puerto Rico a tax free state?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify PR AS 29161 without leaving Google Drive?

Can I create an electronic signature for the PR AS 29161 in Chrome?

How can I edit PR AS 29161 on a smartphone?

What is PR AS 2916.1?

Who is required to file PR AS 2916.1?

How to fill out PR AS 2916.1?

What is the purpose of PR AS 2916.1?

What information must be reported on PR AS 2916.1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.