Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

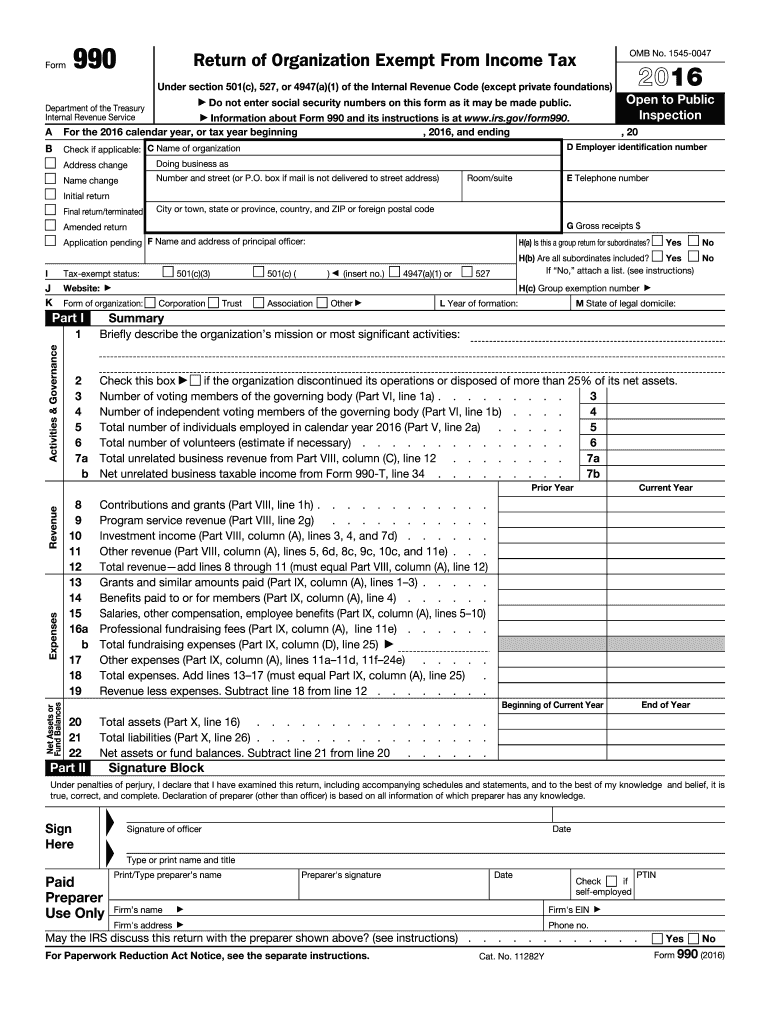

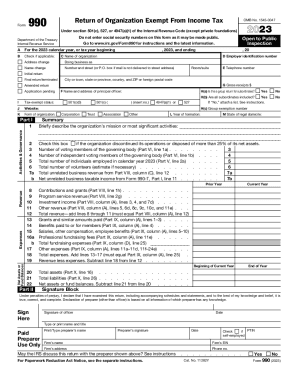

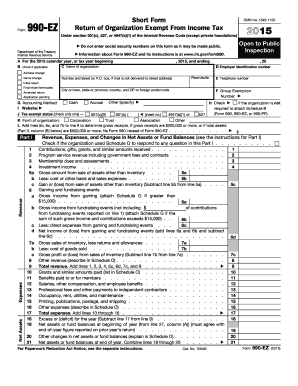

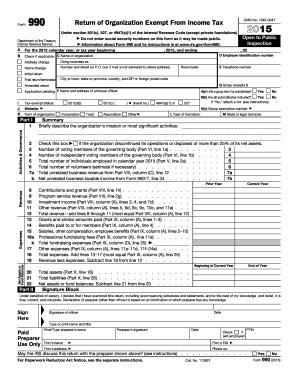

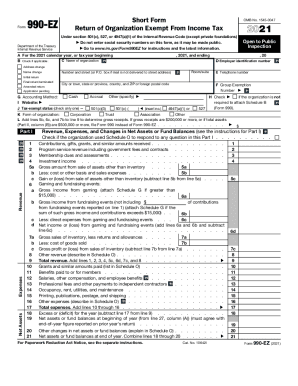

Form 990 is a reporting form used by tax-exempt organizations in the United States to provide information about their activities, finances, and governance. It is filed annually with the Internal Revenue Service (IRS) and is part of the public record, meaning it can be accessed by anyone who wants to learn more about a particular tax-exempt organization. The form requires organizations to disclose details such as their mission, programs, revenue, expenses, and executive compensation. It is used by the IRS and other stakeholders to ensure transparency and accountability in the nonprofit sector.

Who is required to file form 990?

Form 990 is required to be filed by tax-exempt organizations and certain non-profit organizations, including charitable, religious, scientific, and educational organizations. This includes organizations exempt under section 501(c)(3) of the Internal Revenue Code.

What is the purpose of form 990?

The purpose of Form 990 is to provide the public and the federal government with financial information about tax-exempt organizations. This form is filed by organizations that are exempt from federal income tax under section 501(c) of the Internal Revenue Code. The information reported on Form 990 includes details on the organization's mission, programs, governance, finances, and executive compensation. This transparency allows donors, stakeholders, and the government to evaluate how the organization operates and how it uses its resources, ensuring accountability and promoting transparency in the nonprofit sector.

When is the deadline to file form 990 in 2023?

The deadline to file Form 990 in 2023 depends on the fiscal year of the organization. Generally, for organizations that follow the calendar year (ending on December 31), the deadline to file Form 990 is on the 15th day of the fifth month after the end of their fiscal year. Therefore, for a calendar year organization, the deadline to file Form 990 for the year 2022 would be May 15, 2023. However, it's important to note that organizations can request an automatic 6-month extension by filing Form 8868, which would extend the deadline to November 15, 2023.

What is the penalty for the late filing of form 990?

The penalty for late filing of Form 990 (Return of Organization Exempt from Income Tax) depends on the organization's gross receipts.

If the gross receipts are less than $1 million, the penalty is $20 for each day the return is late, with a maximum penalty of $10,000 or 5% of the organization's gross receipts, whichever is lower.

For organizations with gross receipts over $1 million, the penalty is $100 for each day the return is late, with a maximum penalty of $50,000.

Additionally, if an organization fails to file Form 990 for three consecutive years, it may lose its tax-exempt status.

It is important to note that penalties and consequences may vary, and it is advisable to consult the IRS guidelines or seek professional advice for specific situations.

What information must be reported on form 990?

Form 990 is an annual reporting form that must be filed by tax-exempt organizations in the United States. The information that must be reported on Form 990 includes:

1. Identifying information: This includes the name, address, and employer identification number (EIN) of the organization.

2. Exemption status: The organization must indicate its tax-exempt status, such as 501(c)(3) or other applicable section of the Internal Revenue Code.

3. Mission statement: The organization must provide a brief description of its mission or purpose.

4. Governance and management: Information about the organization's governing body, officers, and key employees must be reported.

5. Program descriptions: The organization must describe its significant activities and programs, including any grants or scholarships it provides.

6. Financial information: Detailed financial statements, including revenue and expenses, assets and liabilities, and net assets at the beginning and end of the year, must be reported.

7. Compensation of key individuals: The organization must disclose the compensation and other benefits provided to its key employees, officers, directors, and highest-paid employees.

8. Public support and activities: Organizations must report information regarding their sources of revenue, including contributions, grants, and program service revenue.

9. Lobbying and political activities: If applicable, organizations must report their lobbying and political activities.

10. Related organizations and transactions: Information about transactions with related organizations, such as controlled entities and certain insiders, must be disclosed.

11. Other required disclosures: There are various other specific disclosures required depending on the type of organization, such as foreign activities, investments, and compliance with certain federal regulations.

It's important to note that the specific reporting requirements can vary depending on the type and size of the tax-exempt organization. The form and its instructions provide detailed guidance on what information is required to be reported.

How to fill out form 990?

Form 990 is an annual information return that certain tax-exempt organizations must file with the Internal Revenue Service (IRS) in the United States. Here are the general steps to fill out Form 990:

1. Gather the necessary information: Collect all the required documentation and information such as organization's name, address, Employer Identification Number (EIN), governance structure, financial statements, information on key employees, and program activities.

2. Review the instructions: Before starting, carefully read the instructions provided with Form 990. It will help you understand how to answer each question correctly and what schedules may be required.

3. Complete the required sections:

a. Part I - Summary: Provide an overview of your organization's mission, activities, and financial data.

b. Part II - Signature Block: Include the required signatures certifying that the return is accurate and complete.

c. Part III - Statement of Program Service Accomplishments: Report the organization's primary exempt purpose and describe its mission-related activities.

d. Part IV - Checklist of Required Schedules: Indicate which specific schedules need to be attached based on the organization's operations and activities.

e. Part V - Statements Regarding Other IRS Filings and Tax Compliance: Provide information about any previous filings, notifications, or penalties.

f. Part VI - Governance, Management, and Disclosure: Report information about the organization's governing body, management policies, and disclosure practices.

g. Part VII - Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors: Detail compensation and benefits given to key employees or independent contractors.

h. Part VIII - Statement of Revenue: Provide information about the organization's revenue, contributions, grants, and other types of support.

i. Part IX - Statement of Functional Expenses: Report the organization's expenses by functional category (e.g., program services, management, fundraising).

j. Part X - Balance Sheet: Present the organization's financial position at the end of the fiscal year.

k. Part XI - Reconciliation of Net Assets: Explain the changes in net assets for the fiscal year, including details of gains, losses, and ending balances.

l. Part XII - Financial Statements and Reporting: Attach financial statements prepared according to Generally Accepted Accounting Principles (GAAP) or an alternative method specific to tax-exempt organizations.

4. Complete any additional applicable schedules: Based on the nature of your organization, specific schedules may be required. Examples include Schedule A (Public Charity Status and Public Support), Schedule C (Political Campaign and Lobbying Activities), Schedule L (Transactions with Interested Persons), etc.

5. Review and sign the form: Thoroughly review the completed form to ensure accuracy and consistency. Obtain the necessary signatures, including those of the authorized officers and preparer(s).

6. File the form: Mail or electronically submit the completed Form 990 to the IRS within the specified deadline. Note that organizations with gross receipts under a certain threshold may have the option to file a simplified version called Form 990-EZ or an e-postcard known as Form 990-N.

It is important to remember that filling out Form 990 accurately can be complex, and it may be beneficial to seek professional assistance from a certified public accountant or tax advisor with expertise in nonprofit taxation.

How can I edit form 990 2016 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your form 990 2016 into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an eSignature for the form 990 2016 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your form 990 2016 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit form 990 2016 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing form 990 2016.