Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

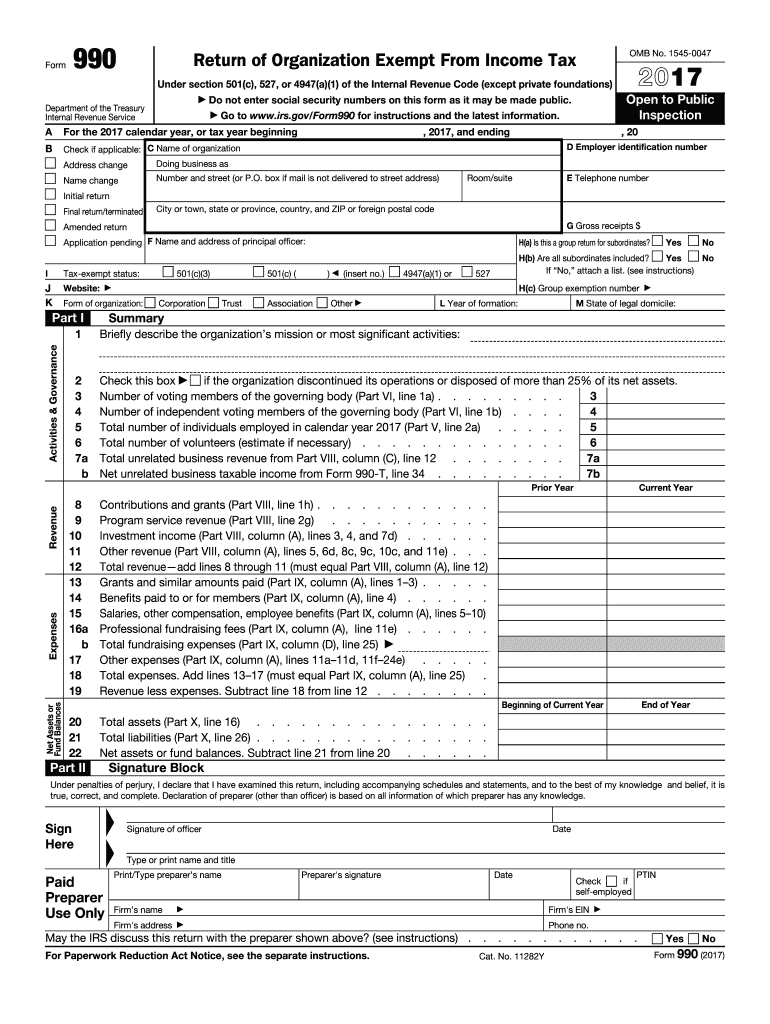

A 990 form, also known as Form 990, is a document used by nonprofit organizations in the United States to provide the Internal Revenue Service (IRS) with information about their operations, finances, and governance. The form is used to ensure transparency and accountability of tax-exempt organizations. It includes details such as the organization's mission, programs and activities, revenue and expenses, compensation of key employees, and other financial data. The form is made available to the public and can be used by donors, researchers, and other interested parties to assess the organization's financial health and adherence to tax regulations.

Who is required to file 990 form?

The 990 form is required to be filed by tax-exempt organizations in the United States. This includes nonprofit organizations under section 501(c) of the Internal Revenue Code, such as charitable, educational, religious, scientific, and other types of organizations. However, there are certain exceptions and thresholds that determine which organizations must file a 990 form. For example, smaller nonprofits with annual gross receipts below a certain threshold may be eligible to file a simplified version called the Form 990-N (e-Postcard). It is recommended for organizations to consult the IRS guidelines or seek professional advice to determine their specific filing requirements.

How to fill out 990 form?

The 990 form is used by tax-exempt organizations in the United States to provide information to the Internal Revenue Service (IRS) on their activities, finances, and governance. Here are the general steps to fill out this form:

1. Obtain the form: Visit the IRS website (www.irs.gov) and search for Form 990. Download the appropriate version of the form and accompanying instructions for your organization's type (such as Form 990, 990-EZ, or 990-N).

2. Gather necessary information: Collect all the required information about your organization, including its name, address, EIN (Employer Identification Number), fiscal year dates, mission statement, and contact details.

3. Part I: Complete the top section of the form, providing general information about your organization. Include its name, address, principal officer's details, and statements regarding gross receipts and assets.

4. Part II: Fill out details about your organization's activities, including its mission, program services, and the type of organization it is (such as educational, religious, charitable, etc.).

5. Part III: Here, provide information about your organization's governing body, key management, and general policies. Include details such as names, titles, and addresses of officers, directors, and key employees.

6. Part IV: Describe your organization's compensation policies, including how salaries and benefits are determined for key individuals.

7. Part V: Report your organization's total revenue, expenses, and net assets for the fiscal year in question. Provide detailed breakdowns and explanations as requested.

8. Part VI: Address questions related to governance, including conflict of interest policies, whistleblower procedures, and board meetings.

9. Part VII: Complete this section if your organization had any unusual grants or financial transactions during the fiscal year.

10. Part VIII: Provide additional information about your organization's finances, such as revenue from fundraising events, membership dues, and more.

11. Part IX: Answer questions related to your organization's public support, activities, and compliance with specific requirements.

12. Part X: Provide information about your organization's lobbying activities and political campaign intervention, if applicable.

13. Part XI: Answer questions about your organization's financial statements and other required disclosures.

14. Part XII: If your organization had any tax-exempt bond issues during the fiscal year, complete this section with the necessary details.

15. Part XIII: Sign and date the form, certifying its accuracy and compliance.

16. Attach any necessary schedules or supporting documentation as outlined in the form instructions.

17. Review the completed form for accuracy and completeness.

18. Submit the form: Mail the completed form to the appropriate IRS address listed in the form instructions, ensuring you keep a copy for your records.

Note: The above steps provide a general overview of completing the 990 form. It is strongly advised to refer to the specific form instructions and seek professional guidance if needed, as the requirements may vary depending on the type and size of your organization.

What is the purpose of 990 form?

The purpose of a 990 form is to provide information about the financial activities, programs, and governance of tax-exempt organizations in the United States. It is an annual reporting requirement for organizations that are classified as tax-exempt under section 501(c) of the Internal Revenue Code. The form provides transparency and accountability to the public, as well as to the Internal Revenue Service (IRS), by disclosing important financial and operational details of these organizations. The information reported on the 990 form helps donors, stakeholders, and the general public evaluate the organization's financial health, management practices, and overall impact.

What information must be reported on 990 form?

The 990 form is used by tax-exempt organizations in the United States to report information about their finances and activities. It requires the following information to be reported:

1. Identification Information: This includes the organization's name, address, employer identification number (EIN), and the type of organization (e.g., public charity, private foundation).

2. Statement of Program Service Accomplishments: A description of the organization's mission, key programs, and activities during the tax year.

3. Financial Information: This includes a balance sheet, statement of revenue and expenses, and a statement of functional expenses. It provides details about the organization's assets, liabilities, revenues, and expenses.

4. Governance, Management, and Disclosure Information: This section requires the disclosure of information about the organization's governing body, key management personnel, conflicts of interest policies, and other governance practices.

5. Contributions and Grants: A breakdown of contributions and grants received by the organization during the tax year, including information on donor restrictions, grants distributed, and details about any significant contributors.

6. Public Support: This section is applicable to public charities and requires reporting on the sources of public support, such as contributions, grants, membership fees, and fundraising events.

7. Compensation of Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees: Details of compensation provided to these individuals, including salaries, benefits, and other forms of compensation.

8. Other Information: This section captures various additional details like foreign activities, political campaign and lobbying activities, public support schedule, tax-exempt bond information, and excess benefit transactions.

9. Certification Statement: A statement signed by an authorized officer of the organization, affirming that the information provided is true, complete, and accurate.

It is important to note that the specific reporting requirements depend on the size, type, and activities of the tax-exempt organization. Some organizations may have additional schedules or forms to complete based on their specific circumstances.

When is the deadline to file 990 form in 2023?

The deadline to file Form 990 for the tax year 2022, which is usually due on the 15th day of the fifth month after the organization's tax year ends. Therefore, the deadline to file Form 990 for the tax year 2023 would likely be May 15, 2024. However, it is always advisable to check with the Internal Revenue Service (IRS) or consult a tax professional for the most accurate and up-to-date information regarding deadlines.

What is the penalty for the late filing of 990 form?

The penalty for late filing of the 990 form (Return of Organization Exempt from Income Tax) varies depending on the organization's annual gross receipts.

For organizations with gross receipts less than $1,000,000, the penalty is $20 per day for each day the return is late, up to a maximum penalty of $10,000 or 5% of the organization's gross receipts, whichever is less.

For organizations with gross receipts greater than $1,000,000, the penalty is $100 per day for each day the return is late, up to a maximum penalty of $50,000.

In certain cases, the IRS may waive or reduce the penalty if the organization can show reasonable cause for the late filing.

How can I manage my 990 2017 form directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 990 2017 form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send 990 2017 form for eSignature?

Once your 990 2017 form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete 990 2017 form on an Android device?

Use the pdfFiller mobile app to complete your 990 2017 form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.