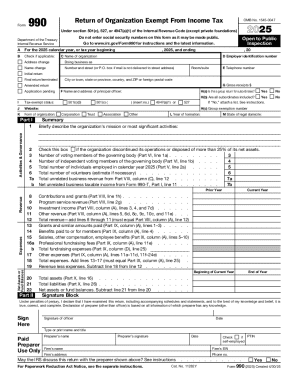

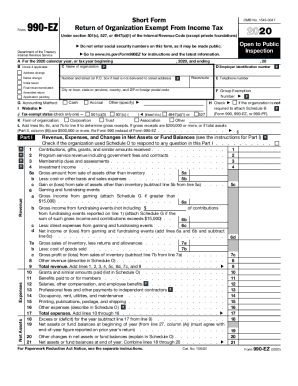

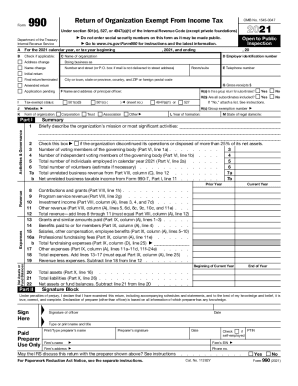

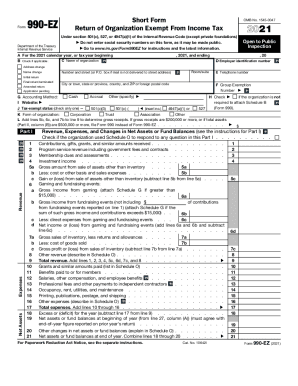

IRS 990 2020 free printable template

Instructions and Help about IRS 990

How to edit IRS 990

How to fill out IRS 990

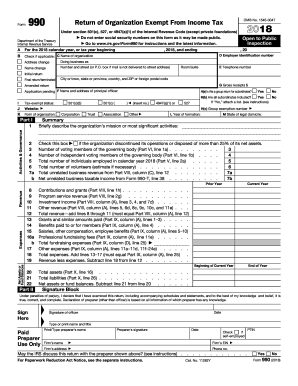

About IRS previous version

What is IRS 990?

Who needs the form?

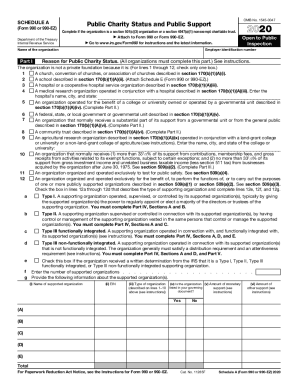

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 990

What should I do if I realize I've made a mistake on my already filed IRS 990?

If you discover an error on your filed IRS 990, you should prepare and submit an amended return using Form 990-X, which is specifically designed for this purpose. Be sure to clearly indicate the changes made and include a brief explanation for each correction. Submitting an amended form can help avoid potential penalties and ensure your organization's information remains accurate.

How can I verify the status of my submitted IRS 990?

To check the status of your submitted IRS 990, you can contact the IRS directly or use their online resources. Be prepared to provide specific details about your submission, such as the filing date and the name of the organization. If you filed electronically, confirmation emails or notifications will also assist in tracking the status of your submission.

What should I do if I receive a notice from the IRS regarding my IRS 990 submission?

If you receive a notice from the IRS about your IRS 990, carefully read the correspondence to understand the issue. Gather relevant documentation that supports your case and respond promptly, addressing the IRS's queries or concerns officially. If needed, seek professional advice to ensure that your response meets IRS requirements.

Are electronic signatures acceptable when filing the IRS 990?

Yes, electronic signatures are acceptable for IRS 990 submissions, but they must comply with specific IRS guidelines regarding authenticity. Ensure that your e-signature process captures the necessary elements to guarantee compliance with IRS regulations. This feature facilitates a more streamlined filing process, especially for organizations that file electronically.

See what our users say