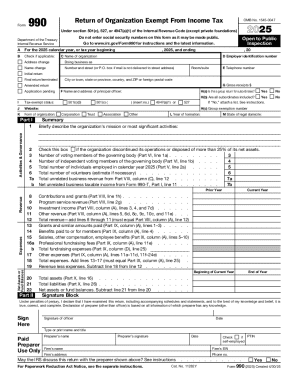

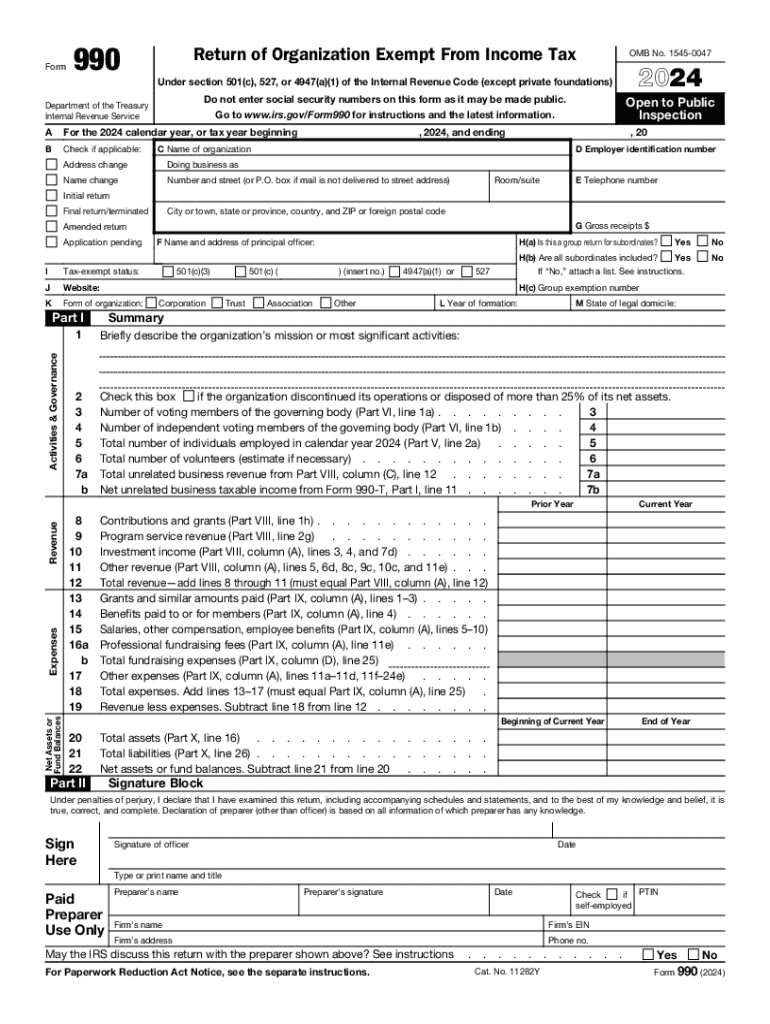

IRS 990 2024 free printable template

Instructions and Help about form 990

How to edit form 990

How to fill out form 990

Latest updates to form 990

All You Need to Know About form 990

What is form 990?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 990

What should I do if I discover an error after submitting Form 990?

If you realize there's a mistake after submitting Form 990, you can submit an amended return to correct the errors. Ensure that your amended Form 990 is clearly marked as such and include a brief explanation of the changes made. It's important to file the amended form as soon as possible to minimize any potential tax implications or penalties.

How can I verify if my Form 990 has been received and processed?

To track your Form 990 submission, you may need to contact the IRS directly or use the online IRS tool if available. Common e-file rejection codes can provide insights on why a submission might have failed. Be sure to keep confirmation emails or receipts as proof of your submission while waiting for processing updates.

What is the recommended period for retaining records related to Form 990?

The recommended record retention period for documents related to Form 990 is generally three to six years from the date of filing. This duration supports compliance with IRS rules and allows for responses to inquiries or potential audits. Always keep your records organized and secure to protect sensitive information.

What should I do if I receive an audit notice after filing Form 990?

If you receive an audit notice concerning your Form 990, promptly review the notice and gather the required documentation to support your filing. Consult with a tax professional to prepare an appropriate response and clarify any discrepancies. Acting quickly and carefully will help ensure a smoother audit process.

Are there specific technical requirements for e-filing Form 990?

Yes, e-filing Form 990 requires compatible software that meets IRS technical standards. You should ensure your browser and device are updated to avoid issues during submission. Check the IRS website for the latest list of approved e-file software and any specific technical requirements necessary for a successful file.

See what our users say