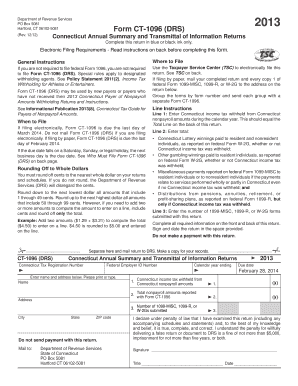

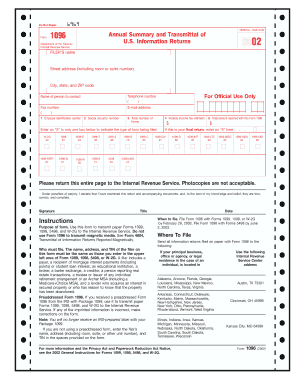

What is 1096 Form?

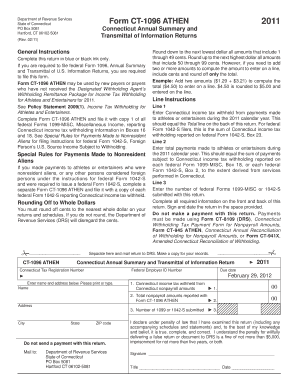

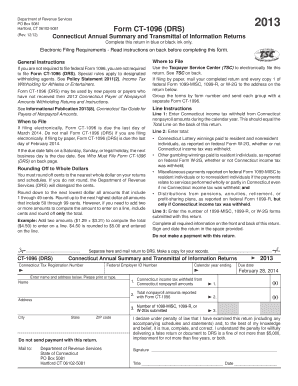

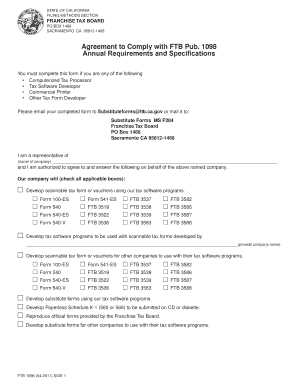

The 1096 form is an IRS document used for transmitting paper copies of information returns to the Internal Revenue Service. It serves as a summary document, containing totals and a recapitulation of the information returns filed. The form includes important details such as the payer's contact information, the total number of forms being transmitted, and a summary of the amounts reported on the individual forms.

What are the types of 1096 Form?

There are several types of 1096 forms, depending on the type of information return being filed. Some common types include:

1096 Form for 1099-MISC: Used for reporting miscellaneous income such as payments to independent contractors or rental income.

1096 Form for 1099-INT: Used for reporting interest income received from banks, credit unions, or other financial institutions.

1096 Form for 1099-DIV: Used for reporting dividends and distributions received from corporations, mutual funds, or other entities.

1096 Form for 1099-R: Used for reporting distributions from retirement plans, IRAs, pensions, or annuities.

1096 Form for 1099-B: Used for reporting sales or redemptions of securities or commodities.

1096 Form for 1099-S: Used for reporting real estate transactions, including sales or exchanges of property.

1096 Form for 1099-C: Used for reporting cancellation of debt by banks, credit unions, or other financial institutions.

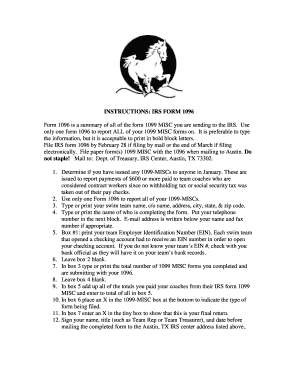

How to complete 1096 Form

Completing the 1096 form is a relatively straightforward process. Here's a step-by-step guide to help you fill it out correctly:

01

Start by providing your contact information, including your name, address, and phone number.

02

Indicate the total number of forms being transmitted in the designated field.

03

Review the individual forms being transmitted and enter a summary of the amounts reported on each form in the respective boxes.

04

Double-check all the information provided and ensure its accuracy.

05

Sign and date the form before submitting it to the IRS.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.