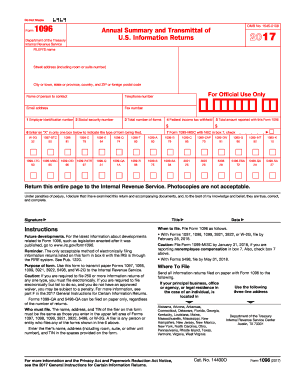

1096 Tax Form 2016

What is 1096 tax form 2016?

The 1096 tax form 2016 is a summary transmittal form that is used by businesses to report the summary information of various types of forms, such as 1099 forms, to the Internal Revenue Service (IRS). It is important for businesses to accurately complete and submit the 1096 form along with the corresponding 1099 forms to ensure compliance with tax regulations.

What are the types of 1096 tax form 2016?

The types of 1096 tax form 2016 include:

1096 tax form for 1099-MISC

1096 tax form for 1099-INT

1096 tax form for 1099-DIV

1096 tax form for 1099-R

1096 tax form for 1099-S

How to complete 1096 tax form 2016

To successfully complete the 1096 tax form 2016, follow these steps:

01

Gather all the necessary 1099 forms you have issued during the tax year.

02

Fill in your business information accurately at the top of the 1096 tax form.

03

Enter the total number of forms being transmitted.

04

Specify the total amount of federal income tax withheld from the payments reported on the 1099 forms.

05

Double-check all the information entered on the form for accuracy and completeness.

06

Sign and date the form before mailing it to the IRS.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 1096 tax form 2016

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Related templates