CT AU-736 2008 free printable template

Show details

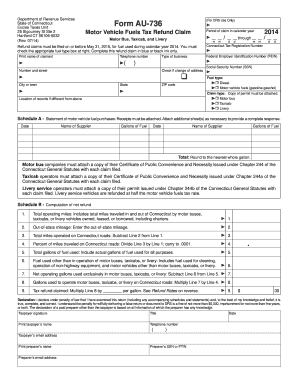

Department of Revenue Services Excise Taxes Unit 25 Sigourney Street Hartford CT 06106-5032 Form AU-736 Motor Bus Taxicab and Livery. 00 and entered on the line. Form AU-736 Back Rev. 07/08 Mail the completed refund application to Additional Information If you need additional information or assistance call the 8 30 a.m. to 4 30 p.m. Visit the DRS website at www. ct. gov/DRS to download and print Connecticut tax forms. Your refund will be applied against any outstanding DRS tax liability. You...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ct form au 736

Edit your ct form au 736 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct form au 736 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct form au 736 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ct form au 736. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT AU-736 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ct form au 736

How to fill out CT AU-736

01

Begin by downloading the CT AU-736 form from the official Connecticut Department of Revenue Services website.

02

Fill in your name and contact information at the top of the form.

03

Provide your mailing address in the designated section.

04

Indicate your social security number or federal identification number.

05

Specify the tax year for which you are filing the form.

06

Complete the sections regarding your gross income, including any adjustments or deductions as applicable.

07

Calculate your total tax liability based on the provided tables or instructions.

08

Sign and date the form to certify that the information is accurate to the best of your knowledge.

09

Submit the completed form to the appropriate address listed in the instructions.

Who needs CT AU-736?

01

Individuals or businesses subject to estate or gift taxes in Connecticut may need to fill out the CT AU-736 form.

02

Executor or personal representative of a deceased person's estate must file this form as part of the estate settlement process.

03

Taxpayers who are claiming adjustments to their tax returns in Connecticut may also be required to submit this form.

Fill

form

: Try Risk Free

People Also Ask about

What is the property tax credit for vehicles in CT?

Act No. 22-118 §410 (effective May 26, 2022). Personal Income Tax Credit for Property Taxes Paid. Beginning in 2022, residents that own motor vehicles or homes in Connecticut will receive a property tax credit of up to $300, which is increased from the prior credit of $200.

What is the excise tax on vehicles in CT?

Passenger vehicles and light duty trucks purchased from private owners (not a dealership) are subject to sales tax of 6.35% (or 7.75% for vehicles over $50,000). Connecticut Sales and Use Tax is based on the NADA average trade-in value or bill of sale value (whichever is higher).

What is Connecticut gas tax diesel?

Gas tax by state StateGasoline TaxUndyed Diesel TaxCalifornia$0.539 / gallon$0.41 / gallonColorado$0.22 / gallon$0.205 / gallonConnecticut$0.25 / gallon***$0.492 / gallon***Delaware$0.23 / gallon$0.22 / gallon47 more rows

What is the new diesel tax in CT?

While Connecticut motorists are getting a price break on gas expenses, the state's diesel tax rate increased on July 1. The increase was attributed to wholesale fuel prices that more than doubled over the previous year. As a result, the then-40.1-cent excise rate increased by 9 cents to 49.2 cents per gallon.

What is the CT DRS diesel tax?

The Commissioner utilized the statutorily prescribed formula and calculated the motor vehicle fuels tax rate applicable to the sale or use of diesel fuel for the period from July 1, 2022, through June 30, 2023, to be 49.2¢. Claim, Commuter Vans.

What is the new fuel tax in CT?

The Department of Revenue Services (DRS) is making motor vehicle fuels tax distributors, sellers, and consumers aware of legislative changes to the 25 cent-per-gallon excise tax on gasoline and gasohol that were made by the General Assembly during the November 2022 Special Session.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ct form au 736?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific ct form au 736 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete ct form au 736 online?

Easy online ct form au 736 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I complete ct form au 736 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your ct form au 736. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is CT AU-736?

CT AU-736 is a Connecticut state tax form used by businesses to report and pay their business entity taxes.

Who is required to file CT AU-736?

Businesses operating in Connecticut, including corporations and limited liability companies, are required to file CT AU-736 if they are subject to the state's business entity tax.

How to fill out CT AU-736?

To fill out CT AU-736, businesses must provide their identification information, report their taxable income, calculate the tax owed, and sign the form before submitting it to the Connecticut Department of Revenue Services.

What is the purpose of CT AU-736?

The purpose of CT AU-736 is to ensure that businesses comply with Connecticut's requirements for payment of business entity taxes.

What information must be reported on CT AU-736?

CT AU-736 requires businesses to report their entity type, Connecticut business ID, total income, allowable deductions, and calculate the total tax owed.

Fill out your ct form au 736 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct Form Au 736 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.