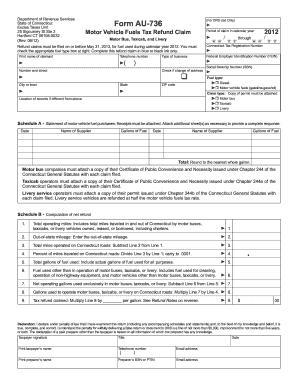

CT AU-736 2014-2025 free printable template

Show details

You must also le a separate Form AU-736 for each fuel type and each claim type in effect between July 1 2014 and December 31 2014. The appropriate fuel type and claim type box must be marked on the front of this form to process this claim. You must le a separate Form AU-736 Motor Vehicle Fuels Tax Refund Claim for each motor vehicle fuel type and claim type. Form AU-736 Back Rev. 07/14 Additional Information Mail the completed refund application to If you need additional information or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form au 736

Edit your connecticut au736 online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your connecticut au736 refund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 736 connecticut fill online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit connecticut refund claim form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT AU-736 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out revenue au 736 printable form

How to fill out CT AU-736

01

Obtain a copy of the CT AU-736 form from the Connecticut Department of Revenue Services website.

02

Fill in your personal details in the designated fields, including your name, address, and contact information.

03

Enter your identification number, such as your Social Security number or Employer Identification Number (EIN).

04

Provide the necessary financial information as required on the form, including details on income, expenses, and deductions.

05

Review the completed form for accuracy and ensure all required fields are filled.

06

Sign and date the form at the bottom.

07

Submit the form via mail or electronically, as per the instructions provided.

Who needs CT AU-736?

01

Individuals or businesses in Connecticut that are required to report certain tax information.

02

Taxpayers seeking to claim a tax exemption or filing for a specific tax credit in Connecticut.

03

Residents who need to document their financial status for state taxes.

Video instructions and help with filling out and completing au736

Instructions and Help about connecticut au 736 pdf

Fill

motor claim pdf form

: Try Risk Free

People Also Ask about

How is vehicle property tax calculated in CT?

State of Connecticut Office of Policy and Management To calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000.

What is considered an excise tax?

Excise taxes are type of indirect tax levied on specific goods, services and activities. Products like motor fuel, tobacco, and other heavily regulated goods are subject to excise taxes. Certain activities like highway usage can be subject to excise tax too.

Is excise tax the same as per unit tax?

an excise is typically a per unit tax, costing a specific amount for a volume or unit of the item purchased, whereas a sales tax or value-added tax is an ad valorem tax and proportional to the price of the goods, an excise typically applies to a narrow range of products, and.

What is the excise tax rate in Connecticut?

Connecticut Tax Rates, Collections, and Burdens Connecticut also has a 7.50 percent corporate income tax rate. Connecticut has a 6.35 percent state sales tax rate and levies no local sales taxes. Connecticut's tax system ranks 47th overall on our 2023 State Business Tax Climate Index.

What is the CT DRS diesel tax?

The Commissioner utilized the statutorily prescribed formula and calculated the motor vehicle fuels tax rate applicable to the sale or use of diesel fuel for the period from July 1, 2022, through June 30, 2023, to be 49.2¢. Claim, Commuter Vans.

What is the excise tax on vehicles in CT?

Passenger vehicles and light duty trucks purchased from private owners (not a dealership) are subject to sales tax of 6.35% (or 7.75% for vehicles over $50,000). Connecticut Sales and Use Tax is based on the NADA average trade-in value or bill of sale value (whichever is higher).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit au736 2014-2025 form from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like au736 2014-2025 form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send au736 2014-2025 form to be eSigned by others?

au736 2014-2025 form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit au736 2014-2025 form straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing au736 2014-2025 form.

What is CT AU-736?

CT AU-736 is a form used in Connecticut for reporting utility company tax information.

Who is required to file CT AU-736?

Utility companies operating in Connecticut are required to file CT AU-736.

How to fill out CT AU-736?

To fill out CT AU-736, companies must provide accurate information regarding their utility services, corporate structure, and financial data as specified in the form.

What is the purpose of CT AU-736?

The purpose of CT AU-736 is to collect data for assessing utility companies for taxation and regulatory purposes.

What information must be reported on CT AU-736?

CT AU-736 requires reporting on utility revenues, operational areas, financial statements, and relevant company details.

Fill out your au736 2014-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

au736 2014-2025 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.