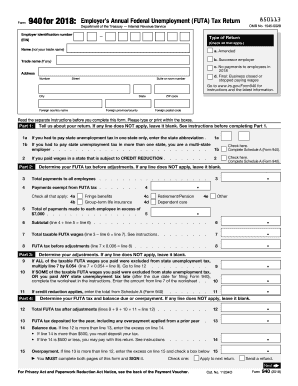

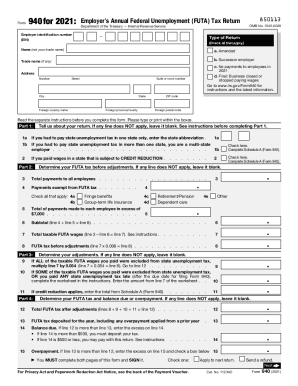

IRS 940 - Schedule A 2010 free printable template

Instructions and Help about IRS 940 - Schedule A

How to edit IRS 940 - Schedule A

How to fill out IRS 940 - Schedule A

About IRS 940 - Schedule A 2010 previous version

What is IRS 940 - Schedule A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 940 - Schedule A

What should I do if I discover an error after submitting the 2010 940 schedule a?

If you find a mistake after filing the 2010 940 schedule a, you may need to submit an amended form. Corrections to previously filed information can help prevent issues with the IRS. Make sure you understand the requirements and the process for amending to ensure proper handling.

How can I check the status of my 2010 940 schedule a submission?

You can verify the status of your 2010 940 schedule a by checking your account on the IRS website. It’s essential to keep track of any confirmation numbers provided during e-filing to help with tracking. If there are errors, you will typically receive a notification indicating what issues need to be resolved.

What are the data retention requirements for the information submitted with the 2010 940 schedule a?

It’s crucial to maintain records of your submitted 2010 940 schedule a for at least three years. This ensures compliance with IRS record retention requirements and provides ample time to address any questions or audits that may arise regarding your submitted information.

Are there any specific technical requirements for e-filing the 2010 940 schedule a?

When e-filing the 2010 940 schedule a, ensure you are using compatible software that meets IRS specifications. Additionally, check that your internet browser is updated to avoid any submission issues. Technical glitches can lead to rejections, so proper setup is essential.

What should I include if I receive a notice from the IRS regarding my 2010 940 schedule a?

If you receive a notice about your 2010 940 schedule a, it’s crucial to carefully read the notice and respond promptly. Gather any required documentation, such as previous submissions, and address the specific issues raised in the notice to facilitate a resolution.

See what our users say