Get the free loan or who have reason to know that such property has been abandoned

Show details

Attention:

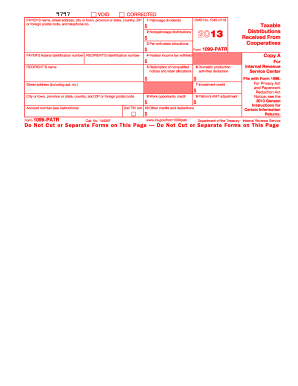

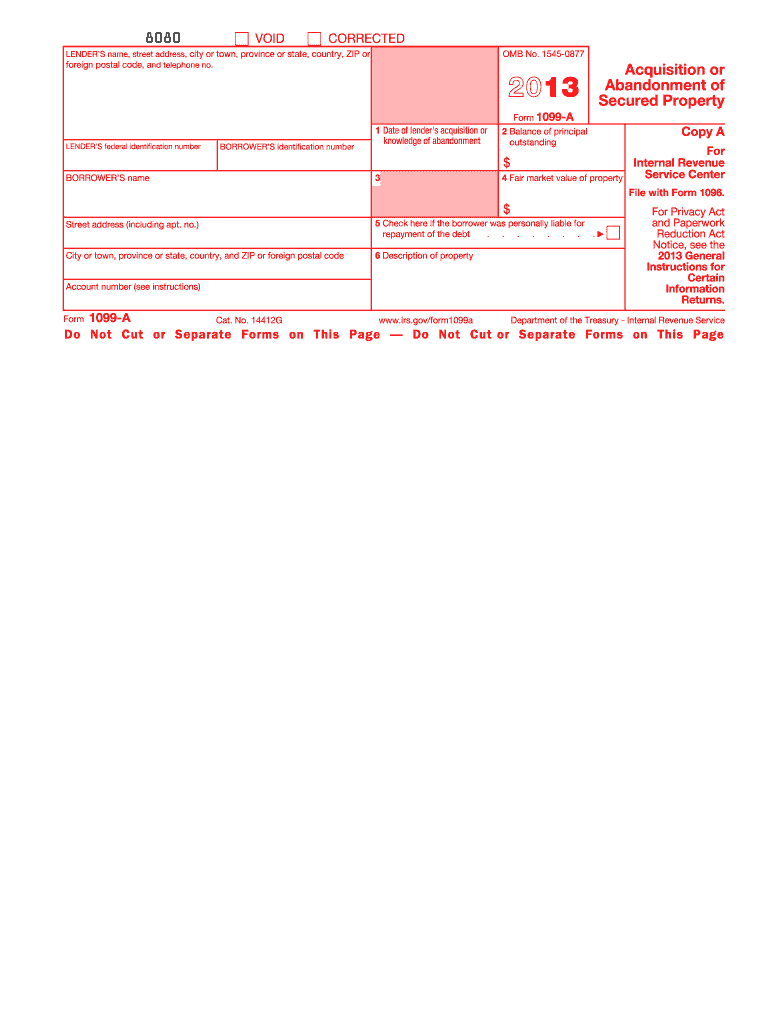

This form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. Do not file copy A downloaded from this website. The official printed version

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan or who have

Edit your loan or who have form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan or who have form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan or who have online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit loan or who have. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan or who have

To properly fill out a loan application or determine if you need a loan, it is important to follow these points:

01

Assess your financial situation: Before filling out a loan application, evaluate your current financial standing. Determine if you have any outstanding debts, calculate your income and expenses, and consider your credit score. This self-assessment will help you understand if you truly need a loan or if there are alternative solutions available.

02

Research loan options: If you have determined that a loan is necessary, research different loan options to find the one that best suits your needs. Consider factors such as interest rates, repayment terms, and any additional fees associated with the loan. Look for reputable lenders or financial institutions that offer favorable terms and conditions.

03

Gather necessary documentation: When applying for a loan, you will typically need to provide certain documents. This may include proof of income (pay stubs, employment contract), identification documents (ID, passport), bank statements, and proof of residence. Gather all required paperwork beforehand to streamline the application process.

04

Fill out the application form accurately: Pay close attention to the loan application form and provide all requested information accurately. Provide personal details, employment information, financial information, and any other required details. Double-check your inputs to ensure there are no errors or omissions.

05

Provide supporting documents: Along with the application form, include all the supporting documents requested by the lender. This may include the documentation mentioned in point 3. Make sure these documents are organized and easy to understand for the lender's evaluation.

06

Submit the application: Once you have completed the application and gathered all the necessary documents, submit your loan application to the lender. Some lenders may have online submission processes, while others may require physical submission. Follow the instructions provided by the lender to ensure a smooth application process.

Who needs a loan or who already has one?

01

Individuals with financial emergencies: A loan can be helpful for individuals facing unexpected financial emergencies such as medical expenses, car repairs, or urgent home repairs. These individuals may not have sufficient savings or immediate access to funds, making a loan a viable solution.

02

Small business owners: Entrepreneurs looking to start or expand their businesses often require financial assistance. Loans can provide the necessary capital to invest in equipment, inventory, or hiring employees. The loan can help maintain cash flow during the early stages of a business until it becomes profitable.

03

Students pursuing education: Many students rely on loans to finance their education. Higher education expenses, such as tuition fees, books, accommodation, and living costs, can be covered through student loans. These loans enable individuals to acquire the necessary education to enhance their career prospects.

Remember, the decision to take out a loan should be carefully considered, weighing the potential benefits against the long-term financial implications. It's advisable to consult with financial advisors or professionals to determine the most suitable loan options for your specific needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my loan or who have directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your loan or who have and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I fill out the loan or who have form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign loan or who have. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit loan or who have on an Android device?

You can make any changes to PDF files, such as loan or who have, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is loan or who have?

A loan is a sum of money that is borrowed and expected to be paid back with interest. It can be obtained from a financial institution, such as a bank, or from an individual.

Who is required to file loan or who have?

Anyone who borrows money or obtains a loan is required to file it.

How to fill out loan or who have?

To fill out a loan, one must provide personal information such as name, address, contact information, employment details, income, and documentation related to the loan.

What is the purpose of loan or who have?

The purpose of a loan is to provide individuals or businesses with financial assistance to meet their needs, whether it be for personal reasons or to fund a project or investment.

What information must be reported on loan or who have?

Information such as the amount borrowed, interest rate, repayment terms, and any collateral put up for the loan must be reported.

Fill out your loan or who have online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Or Who Have is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.