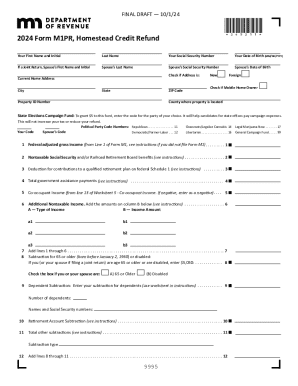

MN DoR M1PR 2011 free printable template

Show details

26 Amount from line 24 X 12. 12. 26 Enter the amount here and on line 12 of this Form M1PR. 30 Schedule 2 Residents of nursing homes adult foster care homes intermediate care facilities or group homes 32 Amount you received from Supplemental Security Income SSI Minnesota Supplemental Aid MSA or Group Residential Housing GRH that was included in line 31. 32 34 Total medical assistance or Medicaid and GAMC payments made directly to your landlord from line A of your 2011 CRP. 37. 38 Multiply...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN DoR M1PR

Edit your MN DoR M1PR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN DoR M1PR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MN DoR M1PR online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MN DoR M1PR. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN DoR M1PR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN DoR M1PR

How to fill out MN DoR M1PR

01

Gather your personal information including your name, address, and Social Security number.

02

Collect documentation of all income received during the year.

03

Determine your residency status in Minnesota for the tax year.

04

Fill out the 'Income' section by reporting your total income from all sources.

05

Complete the 'Deductions' section if applicable, including any deductions for dependents.

06

Fill out the 'Tax Calculation' section to determine your tax owed or refund.

07

Review the 'Sign and Date' section to ensure your form is properly signed.

08

Submit the completed M1PR form by the specified due date, either online or via mail.

Who needs MN DoR M1PR?

01

Residents of Minnesota who are eligible for a property tax refund.

02

Individuals who own property or pay rent in Minnesota.

03

Those who meet the income requirements set by the Minnesota Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

Am I exempt from Minnesota withholding?

You may claim exempt from Minnesota withholding if at least one of these apply: You meet the requirements and claim exempt from federal withholding. You had no Minnesota income tax liability last year, received a refund of all Minnesota income tax withheld, and do not expect to owe state income tax this year.

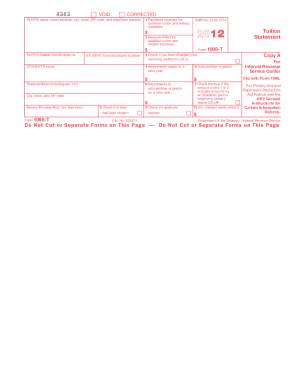

What is Minnesota Form M1W?

You can generally find Minnesota tax withheld on federal Forms W-2 and 1099. Use Schedule M1W to report your wages and income tax withheld. Only report your Minnesota income tax withheld.

Where can I find MN tax forms?

You can get Minnesota tax forms either by mail or in person. To get forms by mail, call 651-296-3781 or 1-800-652-9094 to have forms mailed to you. You can pick up forms at our St. Paul office.

What is Minnesota Form M8?

Corporations doing business in Minnesota that have elected to be taxed as S corporations under IRC section 1362 must file Form M8. Who Must File. The entire share of an entity's income is taxed to the shareholder, whether or not it is actually distributed.

Who must file Minnesota return?

If you are a full-year Minnesota resident, you must file a Minnesota income tax return if your income meets the state's minimum filing requirement. (See the table on this page.) If you are a part-year resident or nonresident, you must file if your Minnesota gross income meets the state's minimum filing requirement.

Is Minnesota a mandatory withholding state?

Effective January 1, 2022, IRA distributions to Minnesota residents are subject to mandatory state withholding. This includes one-time distributions as well as scheduled payments.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MN DoR M1PR online?

Completing and signing MN DoR M1PR online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make changes in MN DoR M1PR?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your MN DoR M1PR to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the MN DoR M1PR electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your MN DoR M1PR in seconds.

What is MN DoR M1PR?

MN DoR M1PR is the Minnesota Department of Revenue's Income Tax Refund for low-income residents, specifically designed to provide relief and assistance to those who qualify under certain income thresholds.

Who is required to file MN DoR M1PR?

Individuals who reside in Minnesota and meet the low-income requirements set by the Minnesota Department of Revenue are required to file the MN DoR M1PR form to claim their refund.

How to fill out MN DoR M1PR?

To fill out the MN DoR M1PR, individuals should gather their financial information including income details, complete the form according to the instructions provided, and submit it by the designated deadline.

What is the purpose of MN DoR M1PR?

The purpose of MN DoR M1PR is to provide financial assistance and tax refunds to qualified low-income residents of Minnesota, helping to alleviate financial burdens.

What information must be reported on MN DoR M1PR?

On the MN DoR M1PR, individuals must report their total income, any qualifying dependents, and other relevant financial data as required by the form's guidelines.

Fill out your MN DoR M1PR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN DoR m1pr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.