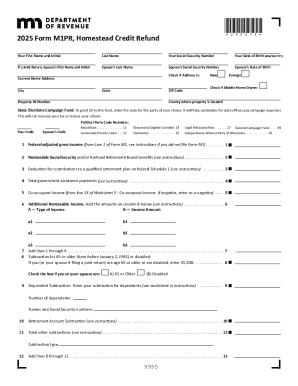

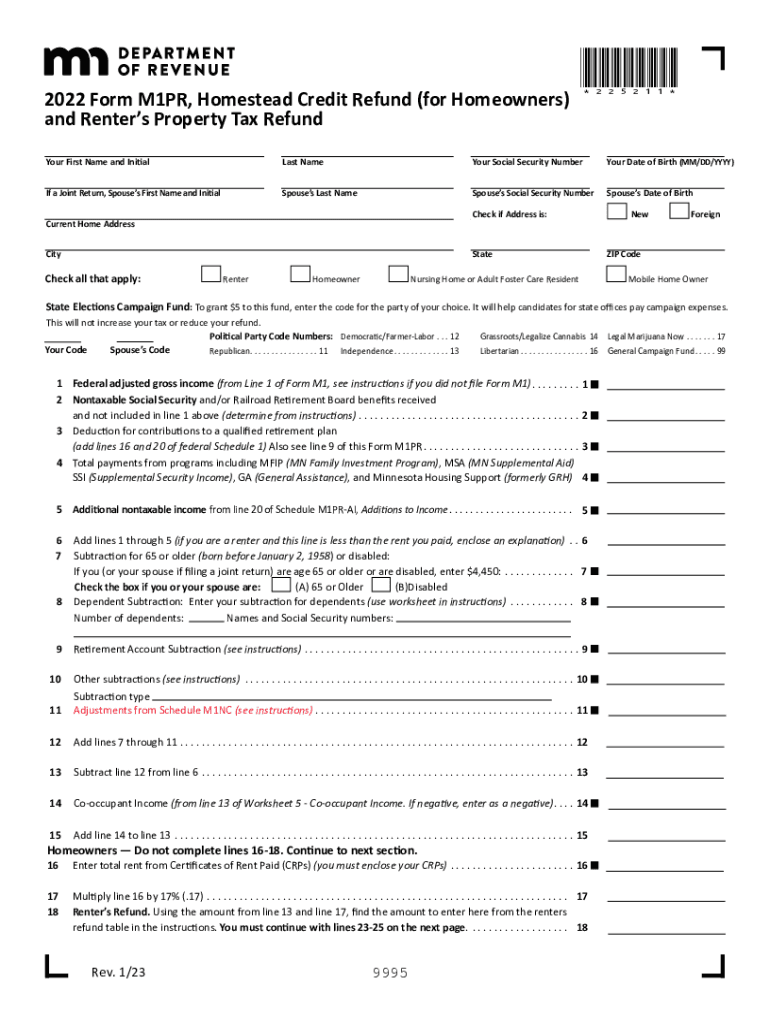

MN DoR M1PR 2022 free printable template

Show details

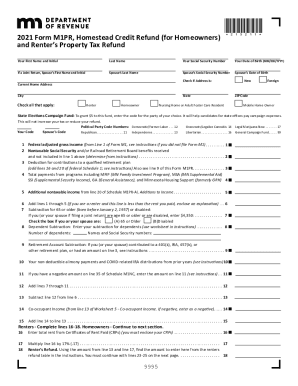

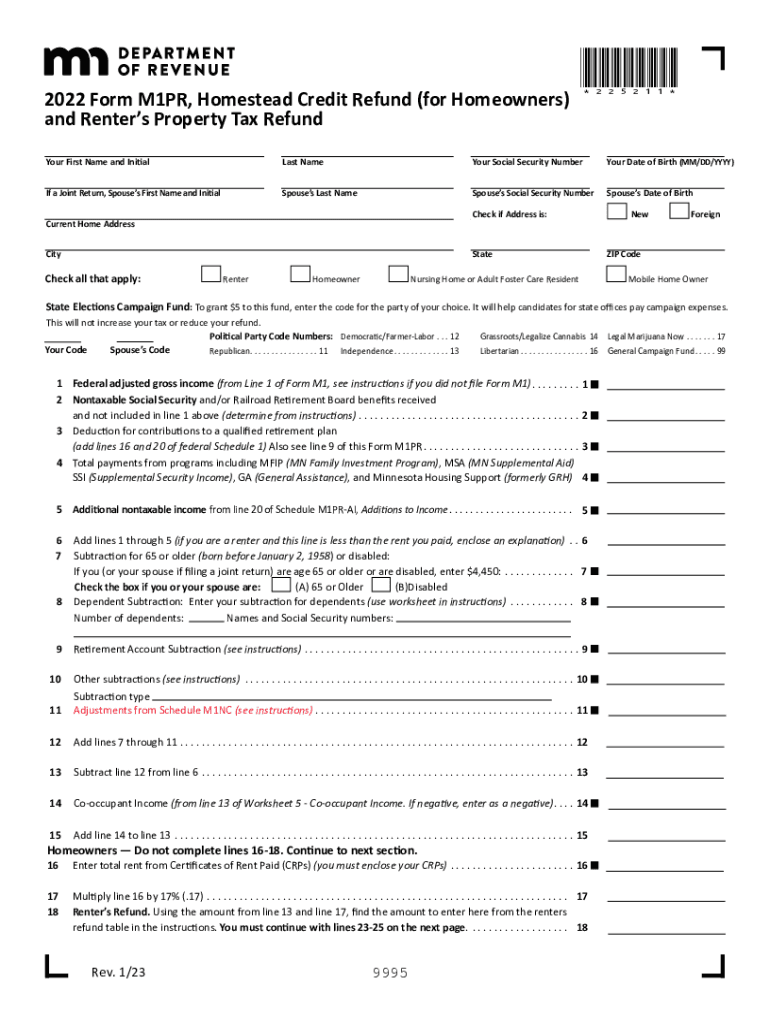

Disabled Veterans Homestead Exclusion see instructions Special refund not your regular refund from line 20 of your 2021 Form M1PR. 3 Deduction for contributions to a qualified retirement plan add lines 16 and 20 of federal Schedule 1 Also see line 9 of this Form M1PR. You must continue with lines 23-25 on the next page. 18 Homeowners Do not complete lines 16-18. Continue to next section. Rev. 1/23 2022 Form M1PR page 2 Property ID Number County where property is located Property tax from...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN DoR M1PR

Edit your MN DoR M1PR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN DoR M1PR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MN DoR M1PR online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MN DoR M1PR. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN DoR M1PR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN DoR M1PR

How to fill out MN DoR M1PR

01

Gather your personal information including your Social Security number and address.

02

Obtain your income information from all sources, including W-2s and 1099s.

03

Determine your eligibility for credits or deductions.

04

Start filling out the form by entering your personal details in the designated sections.

05

Report your income on the appropriate lines, ensuring to include all necessary documents.

06

Calculate your allowable credits and deductions.

07

Complete the tax calculation section to determine your refund or amount due.

08

Review the entire form for accuracy.

09

Sign and date the form.

10

Submit the completed form by mail or electronically to the Minnesota Department of Revenue.

Who needs MN DoR M1PR?

01

Individuals who have lived in Minnesota for part of the year and are filing a tax return.

02

Residents who want to claim a property tax refund.

03

People who received Social Security, unemployment benefits, or other income during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim my Minnesota property tax refund?

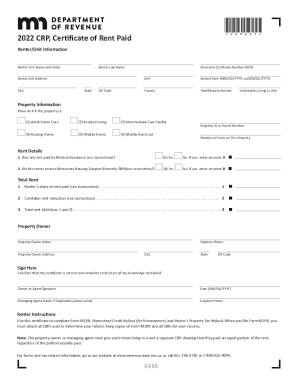

Complete and send us Form M1PR, Homestead Credit Refund (for Homeowners) and Renter's Property Tax Refund. If you are filing as a renter, include any Certificates of Rent Paid (CRPs) you received. See the Form M1PR instructions for filing details. Use our Where's My Refund?

How do I eFile a renters rebate in MN?

e-File your 2021 Minnesota Homestead Credit and Renter's Property Tax Refund return (Form M1PR) using eFile Express! Most calculations are automatically performed for you. Eliminate errors before submitting your return. Receive confirmation that your return was accepted. Get your refund as fast as Minnesota law allows*.

Who qualifies for MN property tax credit?

Your total household income (including a subtraction for dependents or if you are age 65 or older) for 2022 must be less than $69,520. The maximum refund is $2,440. You must have lived in a building in which property taxes were assessed or you made payments to a local government instead of property taxes.

What makes me eligible for a tax refund?

You will get a refund if you overpaid your taxes the year before. This can happen if your employer withholds too much from your paychecks (based on the information you provided on your W-4). If you're self-employed, you may get a refund if you overpaid your estimated quarterly taxes.

What is the income limit for MN property tax refund?

What are the maximums? For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund.

Can you file M1PR separately?

Yes, after completing the M1PR within the account, you can go to the E-file section of the account and electronically file the M1PR separately or with your other forms.

Can I efile form M1PR?

Your 2020 Form M1PR should be mailed, delivered, or electronically filed with the department by August 13, 2021.

Can I eFile MN property tax refund?

There are different ways to file your Property Tax Refund. The due date is August 15. You may file up to one year after the due date. You may be able to file for free using our Property Tax Refund Online Filing System.

Does everyone get a property tax refund in MN?

The Minnesota Homestead Credit Refund can provide relief to homeowners paying property taxes. To qualify, you must: Have a valid Social Security Number.Homeowner's Homestead Credit Refund. Type of refundRegularRequirements to claim the refundYou owned and lived in your home on January 2, 2022 Your household income for 2021 was less than $119,790 May 20, 2022

Where do I send my M1PR in MN?

Mail to: Minnesota Property Tax Refund St. Paul, MN 55145-0020 Renters — Include your 2020 CRP(s).

Is it too late to file renters rebate MN?

You can file up to 1 year late. To claim your 2021 refund, you have until August 15, 2023 to file.

What is IRS Form M1PR?

Complete and send us Form M1PR, Homestead Credit Refund (for Homeowners) and Renter's Property Tax Refund. If you are filing as a renter, include any Certificates of Rent Paid (CRPs) you received. See the Form M1PR instructions for filing details.

What is MN property tax refund based on?

For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund.

How do I qualify for MN property tax refund?

To qualify, all of these must be true: You spent at least 183 days in Minnesota during the year. You cannot be claimed as a dependent on someone else's tax return. Your property was assessed property taxes or the owner made payments in lieu of property taxes.

What is the deadline for filing M1PR?

Your 2021 return should be electronically filed, postmarked, or dropped off by August 15, 2022. The final deadline to claim the 2021 refund is August 15, 2023.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MN DoR M1PR online?

Completing and signing MN DoR M1PR online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make changes in MN DoR M1PR?

With pdfFiller, the editing process is straightforward. Open your MN DoR M1PR in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit MN DoR M1PR on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share MN DoR M1PR on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is MN DoR M1PR?

MN DoR M1PR is a tax form used by residents of Minnesota to claim a property tax refund based on income and property taxes paid.

Who is required to file MN DoR M1PR?

Residents of Minnesota who meet certain income eligibility requirements and have paid property taxes on their homestead are required to file MN DoR M1PR.

How to fill out MN DoR M1PR?

To fill out MN DoR M1PR, you need to gather your income information, property tax statements, and follow the instructions provided on the form, detailing your qualifying income and the property taxes paid.

What is the purpose of MN DoR M1PR?

The purpose of MN DoR M1PR is to allow eligible property owners to claim a refund for property taxes based on their income level, thereby providing financial relief.

What information must be reported on MN DoR M1PR?

The MN DoR M1PR requires reporting your total income, property taxes paid, the property address, and any qualifying dependents.

Fill out your MN DoR M1PR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN DoR m1pr is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.