Authorization for Direct Deposit 2008 free printable template

Show details

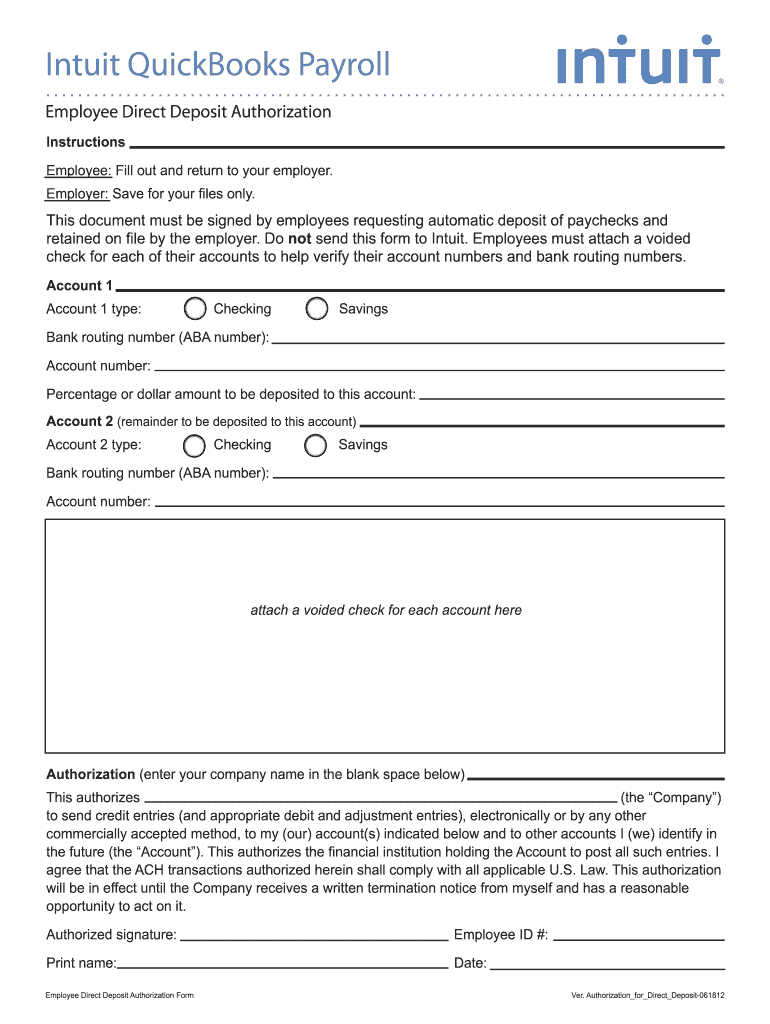

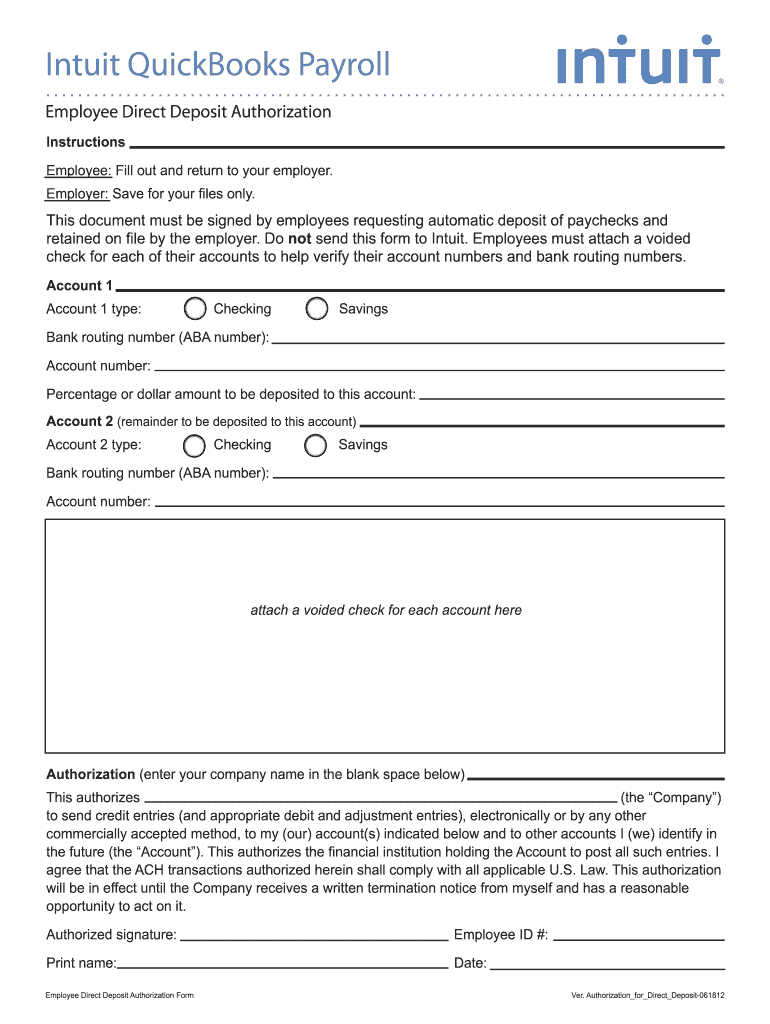

Intuit QuickBooks Payroll. Employee Direct Deposit Authorization Instructions Employee Fill out and return to your employer. Employer Save for your files only. This document must be signed by employees requesting automatic deposit of paychecks and retained on file by the employer. Do not send this form to Intuit. Employees must attach a voided check for each of their accounts to help verify their account numbers and bank routing numbers. Employer Save for your files only. This document must...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Authorization for Direct Deposit

Edit your Authorization for Direct Deposit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Authorization for Direct Deposit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Authorization for Direct Deposit online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Authorization for Direct Deposit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Authorization for Direct Deposit Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Authorization for Direct Deposit

How to fill out Authorization for Direct Deposit

01

Obtain the Authorization for Direct Deposit form from your employer or bank.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate the type of account (checking or savings) you wish to deposit your funds into.

04

Provide your bank's routing number and your account number accurately.

05

Sign and date the form to authorize the direct deposit.

06

Submit the completed form to your employer or designated bank representative.

Who needs Authorization for Direct Deposit?

01

Employees who receive salary or wages via direct deposit.

02

Individuals receiving government benefits or pensions who want their payments deposited directly.

03

Freelancers or contractors who have agreed to be paid via direct deposit.

Fill

form

: Try Risk Free

People Also Ask about

What is a direct deposit authorization form?

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account.

How long does direct deposit authorization take?

Setting up direct deposit can take anywhere from one day to a few weeks, depending on the provider. This wait period applies every time new employees are added to the system.

Can I set up direct deposit online?

Setting up direct deposit is easy. Check with your employer's payroll office, you may be able to set up your direct deposit through an online portal. If not: Complete a direct deposit form.

How do I authorize a direct deposit?

How to set up direct deposit for your paycheck Ask for a copy of your employer's direct deposit signup form, or download the U.S. Bank Direct Deposit Authorization Form (PDF). Provide your U.S. Bank deposit account type (checking or savings), account number and routing number, and other required information.

Is it hard to set up direct deposit?

Direct deposit isn't difficult. If you use payroll software to run payroll, you can deposit wages into employee bank accounts in a few simple steps. Enter and approve payroll before sending it to their financial institution. Then, you're done.

Is Zelle considered a direct deposit?

Is Zelle considered a direct deposit? In most cases, Zelle is not considered a direct deposit. Zelle is mainly used to transfer money between friends and family. Banks and credit unions are usually after a monthly income source such as paycheck, benefits, and pension.

Can someone else direct deposit into my account?

no. To set up direct deposit, you need to give your employer your bank account and routing number—and typically, you don't have the right to give out somebody else's bank account information.

What do you need to give employers for direct deposit?

Each employee needs to provide the following information: bank name, account type, account number and routing number. Some states also require employees to sign a consent form before their employer can switch them to direct deposit.

What is an authorization form for direct deposit?

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account.

What documents are required for direct deposit?

Just have your bank account information (routing and bank account numbers) handy. The second step in direct deposit enrollment is to ask your employer for direct deposit forms. These are generally very basic. It helps to have your Social Security number handy, and a blank check or account and routing numbers.

Are direct deposit authorization forms required?

Yes. Collecting and using personal bank information in any way without the individual's written consent is illegal. If you want to use direct deposit, you will need your employees to sign an authorization form.

Can I create my own direct deposit form?

Most banks offer a link on their website that says “Set up Direct Deposit” where you are able to create a customized direct deposit form. By clicking on the pre-filled form, you will add the needed information electronically and save it to start the deposit process.

How long does it take to authorize a deposit?

This is the result of a temporary hold the bank places on your credit or debit card at the time of your deposit, and will clear itself in 1-3 business days.

Is a direct deposit form required?

It's critical to get proper authorization to use an employee's bank details for payroll before sending money. Otherwise, your business could find itself in legal trouble. A direct deposit authorization form also covers all the bank account details that you need to know where to send a payment.

Do I need a direct deposit authorization form?

It's critical to get proper authorization to use an employee's bank details for payroll before sending money. Otherwise, your business could find itself in legal trouble. A direct deposit authorization form also covers all the bank account details that you need to know where to send a payment.

How long does it take to authorize a bank account?

Filling out an application may take minutes and receiving all the documents you need could take up to 10 business days, but your account will be open and operational either the same day or within two business days If you're in a rush, it's best to prepare for the application process by pulling out all the documents you

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Authorization for Direct Deposit from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like Authorization for Direct Deposit, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit Authorization for Direct Deposit straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing Authorization for Direct Deposit, you can start right away.

How do I edit Authorization for Direct Deposit on an Android device?

You can make any changes to PDF files, like Authorization for Direct Deposit, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is Authorization for Direct Deposit?

Authorization for Direct Deposit is a form that allows an individual to authorize a financial institution to deposit funds directly into their bank account.

Who is required to file Authorization for Direct Deposit?

Anyone who wants to receive payments via direct deposit, including employees, retirees, and beneficiaries of certain government programs, is required to file an Authorization for Direct Deposit.

How to fill out Authorization for Direct Deposit?

To fill out the Authorization for Direct Deposit, you need to provide personal information such as your name, bank account number, routing number, and any other required details specified on the form.

What is the purpose of Authorization for Direct Deposit?

The purpose of Authorization for Direct Deposit is to streamline the payment process, ensuring that funds are deposited directly into the designated bank account, which can enhance security and speed up access to funds.

What information must be reported on Authorization for Direct Deposit?

The information that must be reported on Authorization for Direct Deposit includes the account holder's name, financial institution's name, account number, routing number, and any relevant identification numbers specific to the payment being processed.

Fill out your Authorization for Direct Deposit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Authorization For Direct Deposit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.