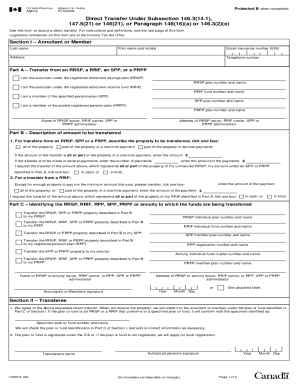

Canada T2033 E 2011 free printable template

Show details

Address. T2033 E (11). I am the annuitant under the RESP. I am the member under the SPP. Furthermore, I am the member under the RPP. Furthermore, I am the annuitant under the RIF.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T2033 E

Edit your Canada T2033 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T2033 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada T2033 E online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada T2033 E. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T2033 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T2033 E

How to fill out Canada T2033 E

01

Obtain the Canada T2033 E form from the Canada Revenue Agency (CRA) website or your local tax office.

02

Fill in your name, address, and social insurance number at the top of the form.

03

Provide the information regarding the type of transfer or election you are making in the appropriate sections.

04

Complete the section detailing the financial institution involved in the transfer.

05

Ensure the signed consent from the taxpayer (you) is included if required.

06

Review the completed form for any errors or omissions.

07

Submit the form according to the instructions provided by the CRA, either online or by mailing it to the appropriate address.

Who needs Canada T2033 E?

01

Individuals who are transferring their registered retirement savings plans (RRSPs) or registered pension plans (RPPs) to another financial institution.

02

Those electing to transfer funds between tax-sheltered accounts in Canada.

03

Taxpayers who need to report the transfer of registered funds for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a 146.16 transfer?

You can use this form to record a direct transfer, under paragraph 146(16)(a), of all or part of the property of the plan to: the issuer of another RRSP having the same annuitant; the carrier of a RRIF having the same annuitant; or the administrator of a registered pension plan (RPP), for credit to the account of the

What is a T2033 transfer?

What is a T2033 Form Direct Transfer Used For? This form covers almost all transfers between two registered savings or retirement accounts, including transfers made due to marriage breakdown or for non-residents. Here is a list of the situations where you may use a T2033 form. Direct Transfer Payments.

What is a T2151?

The Canada Revenue Agency Direct Transfer Form (T2151) records the transaction of moving funds from your public service pension plan to a locked-in registered retirement account of your choice.

What is the difference between T2033 and T2151?

The T2151 and T2033 are CRA (Canada Revenue Agency) forms that are used when directly transferring funds from one registered investment account to another. The T2151 is used for transferring RPPs and DPSPs while the T2033 is used for transferring RRSPs, RRIFs, SPPs and PRPPs.

What is TFSA transfer form T2033?

What is a T2033 (CRA form T2033) ? This exciting number is the name of a transfer form you need to fill out to transfer RRSP funds between two institutions (say, you're changing stockbrokers, or you want to move your GIC to a mutual fund at a new company) without having to deregister the funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada T2033 E to be eSigned by others?

To distribute your Canada T2033 E, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make edits in Canada T2033 E without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your Canada T2033 E, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit Canada T2033 E straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit Canada T2033 E.

What is Canada T2033 E?

Canada T2033 E is a form used by Canadian residents to report transfers of property from an RRSP, RRIF, or other tax-advantaged accounts to a registered charity or for other eligible purposes.

Who is required to file Canada T2033 E?

Individuals transferring property from their Registered Retirement Savings Plan (RRSP), Registered Retirement Income Fund (RRIF), or other specified accounts to a charity are required to file Canada T2033 E.

How to fill out Canada T2033 E?

To fill out Canada T2033 E, individuals must provide their personal information, details of the transfer, description of the property being transferred, and any relevant tax identification numbers. The form must be submitted to the Canada Revenue Agency (CRA) along with any supporting documentation.

What is the purpose of Canada T2033 E?

The purpose of Canada T2033 E is to facilitate the tax-deferred transfer of property to a charity, allowing individuals to make charitable donations while controlling tax implications related to capital gains and income.

What information must be reported on Canada T2033 E?

The information that must be reported on Canada T2033 E includes the donor's identification details, the type of property being transferred, its fair market value, the charity's information, and the purpose of the transfer.

Fill out your Canada T2033 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t2033 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.