Canada T2033 E 2019 free printable template

Show details

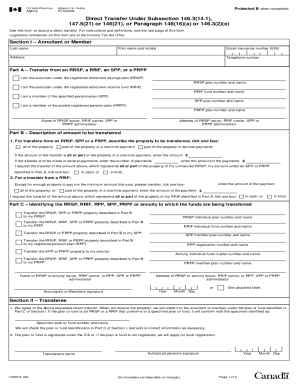

Clear DataProtected B when completedDirect Transfer Under Subsection 146.3(14.1),

147.5(21) or 146(21), or Paragraph 146(16)(a) or 146.3(2)(e)

Use this form to record a direct transfer. For instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada T2033 E

Edit your Canada T2033 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T2033 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada T2033 E online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada T2033 E. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T2033 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T2033 E

How to fill out Canada T2033 E

01

Obtain the Canada T2033 E form from the official Canada Revenue Agency (CRA) website or your tax professional.

02

Begin filling out your personal information in the designated sections, including your name, address, and Social Insurance Number (SIN).

03

Indicate the type of tax deferral request you are making by checking the appropriate boxes provided in the form.

04

Provide details about your income earned, including the sources of income and any relevant amounts.

05

Ensure all supporting documents are attached as required by the form instructions.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the bottom where indicated.

08

Submit the form to the CRA either by mail or through any specified electronic means.

Who needs Canada T2033 E?

01

Individuals who are planning to defer taxes on certain types of income or assets may need to fill out the Canada T2033 E form.

02

Taxpayers who are involved in specific tax scenarios that require approval or documentation for tax deferral.

03

Those who have received a letter from the CRA requesting the T2033 E form in connection with their tax filings.

Fill

form

: Try Risk Free

People Also Ask about

What is a T2033 used for?

What is a T2033 (CRA form T2033) ? This exciting number is the name of a transfer form you need to fill out to transfer RRSP funds between two institutions (say, you're changing stockbrokers, or you want to move your GIC to a mutual fund at a new company) without having to deregister the funds.

What is a transfer under section 60l?

Section 60(L) is a Transfer of refund of premiums under an RRSP. Taxcycle has a section called “RRSP Transfers” in the middle section of the “RRSP Contributions Worksheet”

What is a 146.16 transfer?

You can use this form to record a direct transfer, under paragraph 146(16)(a), of all or part of the property of the plan to: the issuer of another RRSP having the same annuitant; the carrier of a RRIF having the same annuitant; or the administrator of a registered pension plan (RPP), for credit to the account of the

What is a transfer under section 60L?

Section 60(L) is a Transfer of refund of premiums under an RRSP. Taxcycle has a section called “RRSP Transfers” in the middle section of the “RRSP Contributions Worksheet”

What is a T2151?

The Canada Revenue Agency Direct Transfer Form (T2151) records the transaction of moving funds from your public service pension plan to a locked-in registered retirement account of your choice.

How to fill out a T2033 form?

Learn How to Complete a T2033 Transfer Form 9 Step Process. Learn how to fill in a T2033 transfer form in 9 simple steps outlined below. Download a Copy of a T2033. Print the 5 pages of the T2033. Complete Page 1, Area 1 by the Annuitant. Complete, Area 1 - Annuitant. Complete Part A. Complete Part B. Sign and Date Part C.

What is subsection 147 19?

subsection 147(19) (a DPSP lump-sum transfer to an RPP, an RRSP, a RRIF, a PRPP, an SPP or another DPSP) one of the following subsections: 147.3(1) to (8) (an RPP lump-sum transfer to an RRSP, a RRIF, an SPP, a PRPP, or another RPP)

What is the difference between T2033 and T2151?

The T2151 and T2033 are CRA (Canada Revenue Agency) forms that are used when directly transferring funds from one registered investment account to another. The T2151 is used for transferring RPPs and DPSPs while the T2033 is used for transferring RRSPs, RRIFs, SPPs and PRPPs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Canada T2033 E from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your Canada T2033 E into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit Canada T2033 E online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your Canada T2033 E and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I complete Canada T2033 E on an Android device?

Use the pdfFiller Android app to finish your Canada T2033 E and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is Canada T2033 E?

Canada T2033 E is a form used by Canadians to authorize an individual to act on their behalf when dealing with the Canada Revenue Agency (CRA) regarding tax matters.

Who is required to file Canada T2033 E?

Individuals who want to appoint someone, such as a tax professional or a family member, to manage their tax affairs and receive information from the CRA are required to file Canada T2033 E.

How to fill out Canada T2033 E?

To fill out Canada T2033 E, you'll need to provide personal information such as the taxpayer's name, address, social insurance number, details of the authorized representative, and specify the tax matters for which the authorization applies.

What is the purpose of Canada T2033 E?

The purpose of Canada T2033 E is to formally grant permission for a representative to communicate with the CRA on behalf of a taxpayer, allowing them to receive tax information and act in the taxpayer's interest.

What information must be reported on Canada T2033 E?

On Canada T2033 E, the taxpayer must report their personal identification details, the representative's information, the specific tax years or periods affected, and the type of tax matters for which the authorization is given.

Fill out your Canada T2033 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t2033 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.